Key Takeaways

Why is ZEC gaining again?

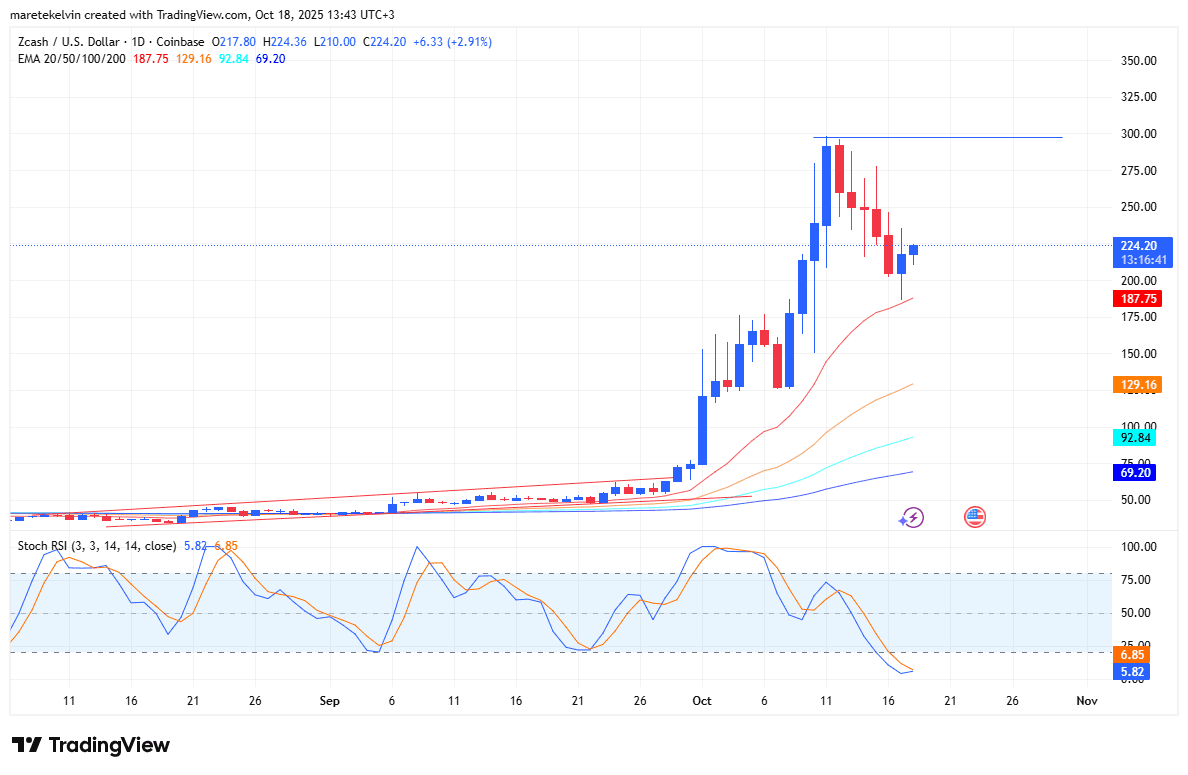

Price rebounded 15% to $224 after holding above its 20-day EMA, signaling renewed buyer strength.

What do Zcash’s derivatives show now?

Open Interest hit $170 million and Long/Short Ratio 1.213, supporting a continued move toward $300 liquidity clusters.

Zcash [ZEC] rebounded sharply after days of selling pressure, rising 15% in 24 hours as buyers reclaimed control.

The recovery began when prices bounced off the 20-day EMA at $187.75, marking the start of a short-term uptrend.

ZEC traded at $224.20 on the 18th of October, extending its two-day rally while momentum strengthened.

The Stochastic RSI hovered near 5.82 / 6.85, rebounding from oversold levels. This indicated that selling momentum was fading and positioned ZEC for a possible retest of the $300 resistance zone.

Buyers dominate the derivatives market

Derivatives metrics reinforced the same outlook.

AMBCrypto’s analysis of Coinalyze data showed that the Aggregated Long/Short Ratio stood at 1.3, signaling a strong bias toward long positions.

That shift reflected improving sentiment after a prolonged bearish stretch.

Go to Source to See Full Article

Author: Kelvin Murithi