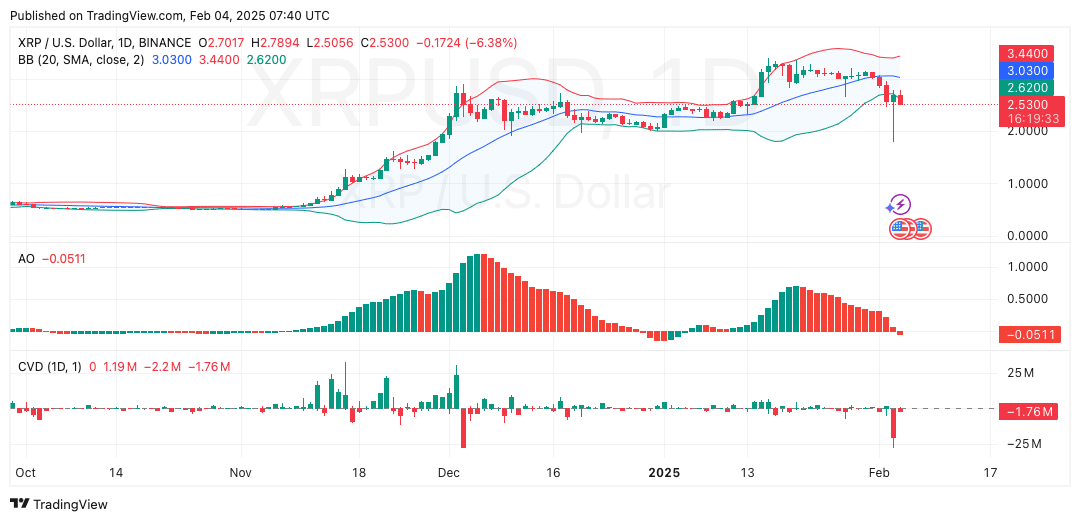

- XRP rebounded 20% but faces resistance at $2.62, with whale sell-offs driving market volatility.

- Bitcoin’s rejection at $99,500 and trade tariff uncertainties influenced XRP’s attempt to reach $3.

Ripple [XRP] experienced a notable recovery, surging 20% in the last 24 hours, and was trading at $2.57, at press time. This was supported by a daily trading volume of $18.8 billion.

Despite this rebound, XRP had a seven-day decline of 18.57% due to market uncertainties and whale sell-offs. XRP’s market cap currently stands at $146.4 billion, with a circulating supply of 58 billion tokens.

This recovery comes as tech stocks and cryptocurrencies faced significant pressure due to trade tariff uncertainties between the U.S., Canada, and Mexico.

Although tariffs on Canada and Mexico were postponed, the continuation of tariffs on China kept markets on edge.

Whale sell-offs contribute to market volatility

Recent sell-offs by whales have played a crucial role in XRP’s price fluctuations. Reports indicate over 130 million XRP were dumped in a single day, flooding the market and intensifying bearish sentiment.

These large-scale sales have created a cascading effect, causing smaller investors to sell as well, amplifying price drops.

Decentralized Exchange (DEX) data confirms widespread selling pressure, with CryptoQuant reporting a persistently low Buy-Sell Ratio for XRP over the last 16 hours.

A lack of buying activity on both DEXs and centralized exchanges has reflected the bearish market outlook in recent days.

XRP technical analysis: Resistance and support levels

XRP has broken below the middle Bollinger Band at $3.03, signaling bearish momen

Go to Source to See Full Article

Author: Olivia Stephanie