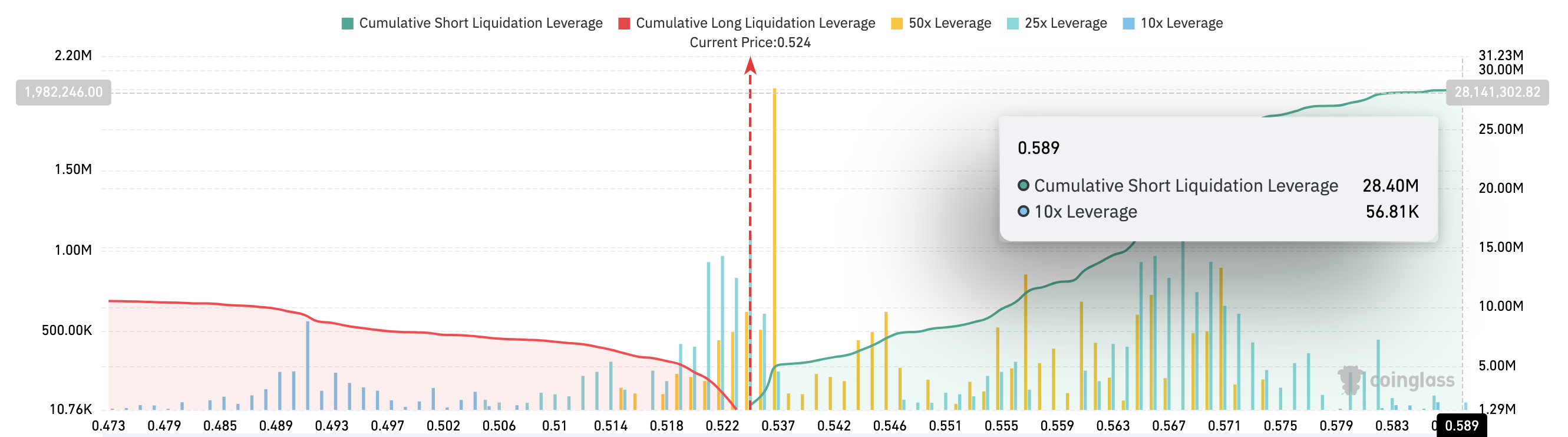

According to Coinglass, if Ripple’s (XRP) price hits $0.60, it will wipe out millions of dollars in open contracts. The derivatives information portal indicates that this level represents the highest XRP liquidation price.

Currently, XRP trades at $0.52, having dropped from $0.60 at the beginning of October. Besides revealing the possible liquidation levels, this analysis checks if the altcoin has the potential to rebound.

Ripple Short Traders Expose Millions to Liquidation

As of this writing, the liquidation map reveals that XRP’s price action has prompted many traders to open short contracts valued at $28.40 million. A liquidation map helps traders identify potential levels where significant positions may be forced to close due to margin calls.

For context, a short contract indicates a market position anticipating that a cryptocurrency’s value will decline.

Conversely, long contracts, which reflect positions predicting price increases, are valued at $10.50 million. Therefore, this significant disparity suggests a bearish sentiment among traders. Further, this highlights the potential for massive liquidation if XRP’s price rebounds significantly.

Read more: XRP ETF Explained: What It Is and How It Works

Go to Source to See Full Article

Author: Victor Olanrewaju