Peter Schiff has admitted that he underestimated the extent people would FOMO in Bitcoin. According to the exec, his “biggest mistake” was downplaying people’s “foolishness” jumping on something that won’t work.

The long-time BTC critic has been doomposting and predicting a BTC collapse for a while now. And yet, his overblown projections have never materialized. Back in 2018, for example, he warned that BTC would fall to $750, calling the $3800 price level at that time “overvalued.”

BTC has since surged to over $120k before retreating to $90k, marking a nearly 23-fold increase. Even at its press time levels, Schiff still believes BTC will collapse and calls those who don’t see a zero-sum end-game “fools.”

According to him, BTC is backed by “nothing” and is worth nothing – A belief he has held for over a decade.

In fact, after BTC erased its 2025 gains, Schiff intensified attacks against the top BTC treasury Strategy, labelling it as “fraud.” Despite his position, however, BTC and overall crypto adoption have increased.

Surge in global adoption

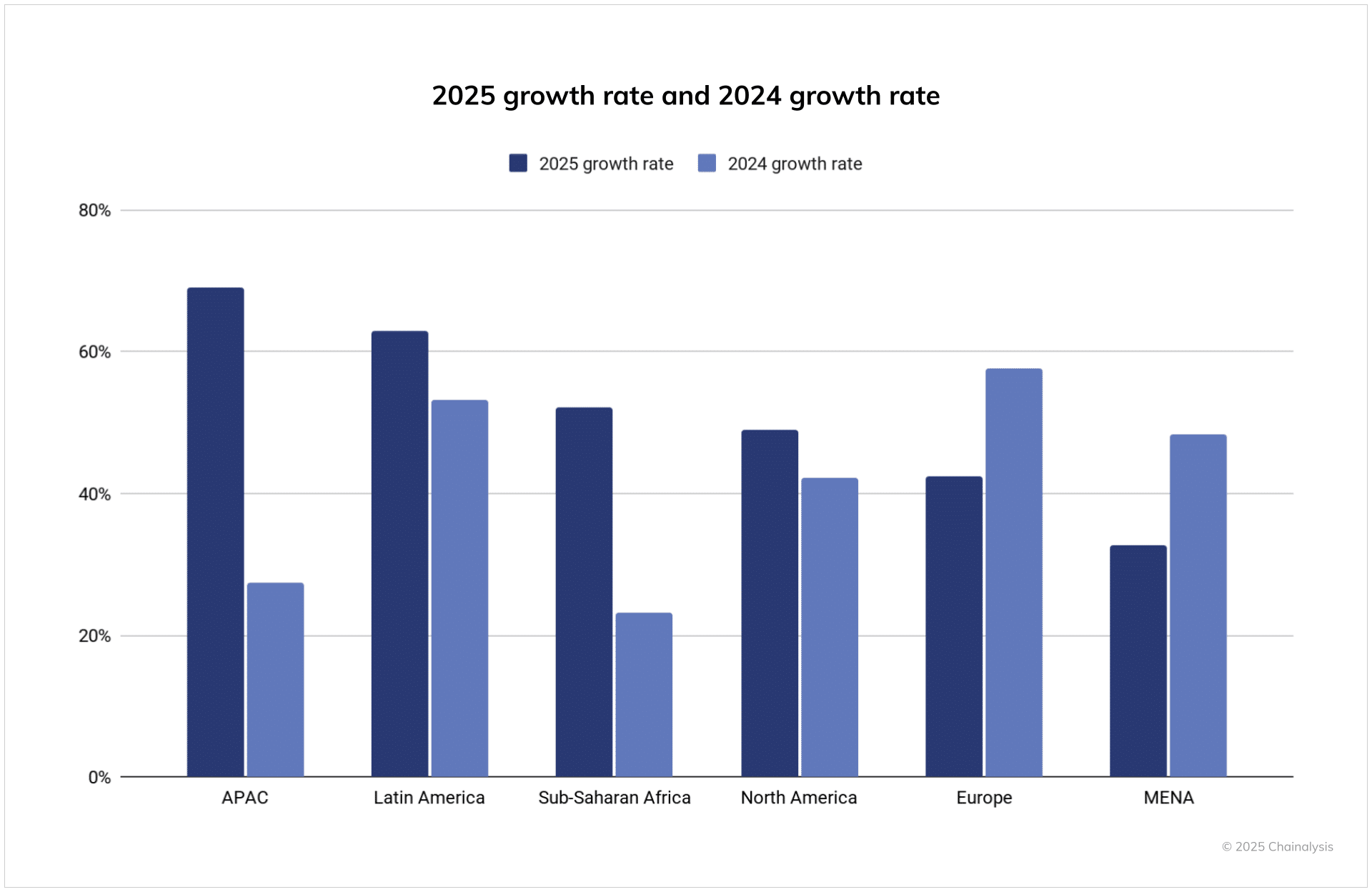

In 2025, the APAC region led global crypto adoption, with India, Pakistan, and Vietnam being the dominant countries. As per Chainalysis, APAC saw a 69% YoY in received on-chain value from $1.4 trillion to $2.36 trillion.

Latin America and Sub-Saharan Africa followed closely as the second and third regions with the highest adoption rate. According to Chainalysis, the rising interest in the Global South has been driven by utilities such as remittances and everyday payments.

At the asset level, BTC emerged as the most purchased cryptocurrency, followed by Ethereum. The report added,

“Bitcoin leads by a wide margin, accounting for over $1.2 trillion in fiat inflows during the period. That’s slightly over 70% more than ETH, which saw roughly $724B in volume during this period.”

That being said, the U.S approval of Spot BTC ETFs in 2024 has been a bellwether for the maturing asset class.

Overall, the products have attracted $58 billion in cumulative inflows since launch, led by BlackRock, the world’s largest asset manager. In fact, BTC ETFs have become BlackRock’s top revenue source too.

Now, JPMorgan and others want a piece of it in one way or another. For them, BTC acts as digital gold and a long-term safe haven against fiscal policy, a trend they call “debasement trade.”

With institutional interest, global adoption, and a $1.8 trillion market cap, it’s hard to dismiss BTC as “nothing,” as Schiff tries to portray it.

Final Thoughts

- For Schiff, BTC doesn’t work as ‘digital gold,’ and those jumping on it are ‘fools.’

- BTC and overall crypto adoption have increased globally, across institutions and the retail market.

Go to Source to See Full Article

Author: Benjamin Njiri