AMBCrypto reported that the institutional interest in Ripple [XRP] remained extremely high. It was the second-most inquired asset among advisory assets, revealed Grayscale’s Head of Product and Research, Rayhaneh Sharif-Askary.

At the same time, the high long-term selling pressure in the crypto market was evident in XRP’s price action. Since rallying to $2.41 in the first week of January, XRP has shed 41.35% in 45 days.

The exchange reserve on Upbit was building, and the $0.8 price level was the XRP target later this year. However, compressed liquidity and a rising taker buy volume argued for a short-term bullish bias.

The XRP’s potential for a rally

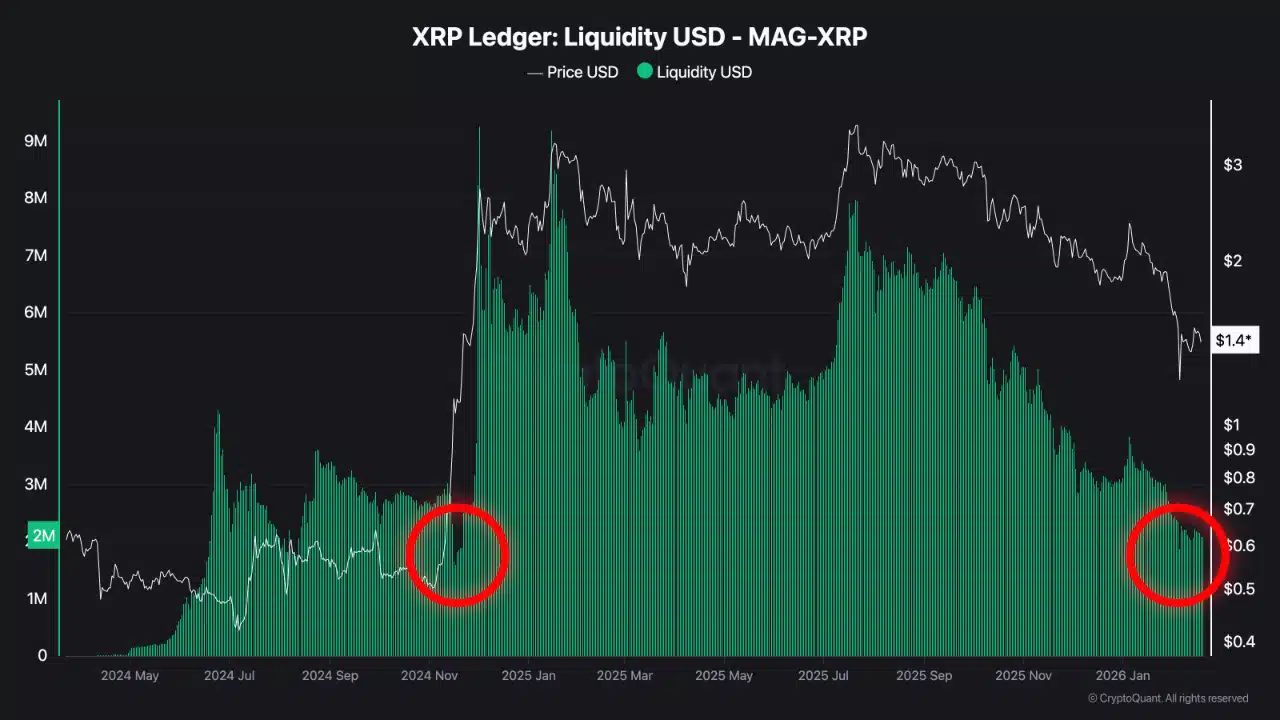

In a post on CryptoQuant Insights, on-chain analyst The Alchemist noted that liquidity conditions can help explain the market trends.

Source: CryptoQuant

The liquidity USD measures the depth of capital supporting XRP markets. The rally phase in November 2024 saw a significant expansion in USD liquidity, supporting the altcoin’s expansion even higher.

It should be noted that liquidity in the AMM pool is not the cause of the rally, but helps sustain the move. It reflects market conviction. Conversely, the low liquidity conditions in recent weeks have increased the volatility sensitivity, noted the analyst.

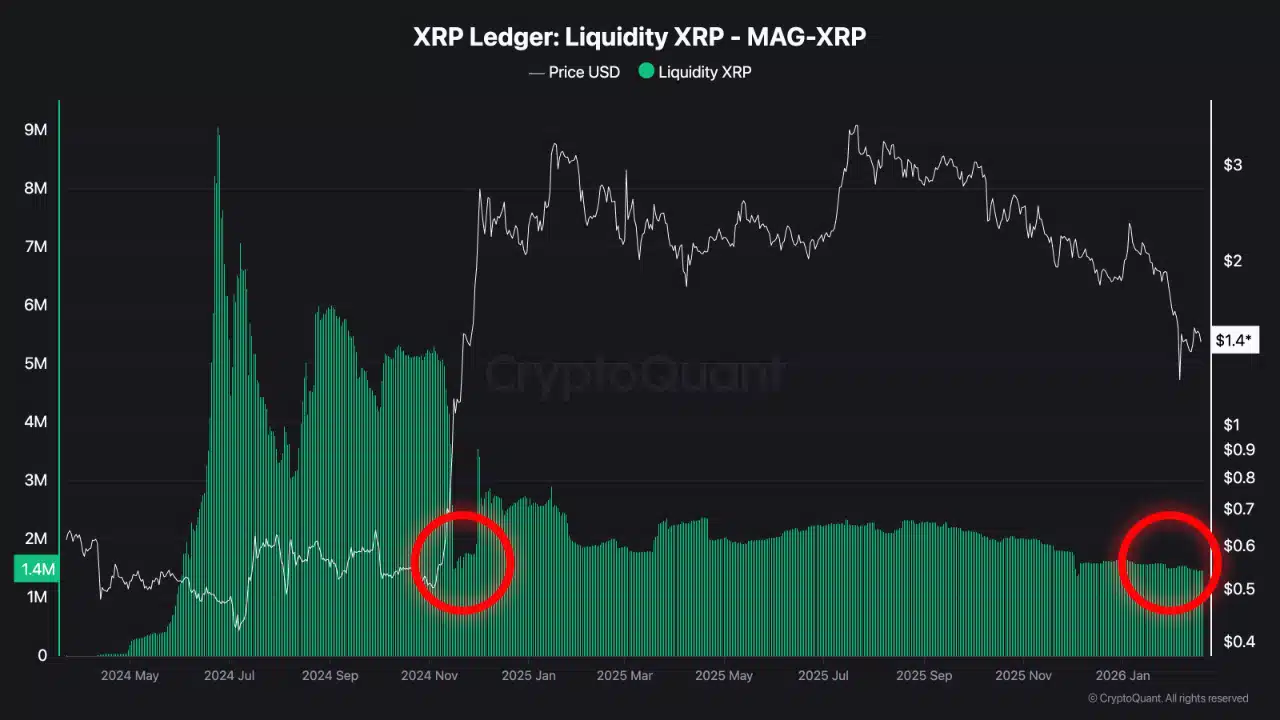

Source: CryptoQuant

The analyst used the reduced token-side availability during the late 2024 rally to demonstrate “reduced active supply”. Yet, it could be that the reduced liquidity was due to the AMM being forced to sell XRP for stablecoins due to the aggressive rally.

The reduced XRP liquidity can make it easier for large buy orders to move prices higher. This indicated that the compression merely reflects the effects of an aggressive rally and the impact seen on the AMM, but might not be a warning of another imminent upward price expansion.

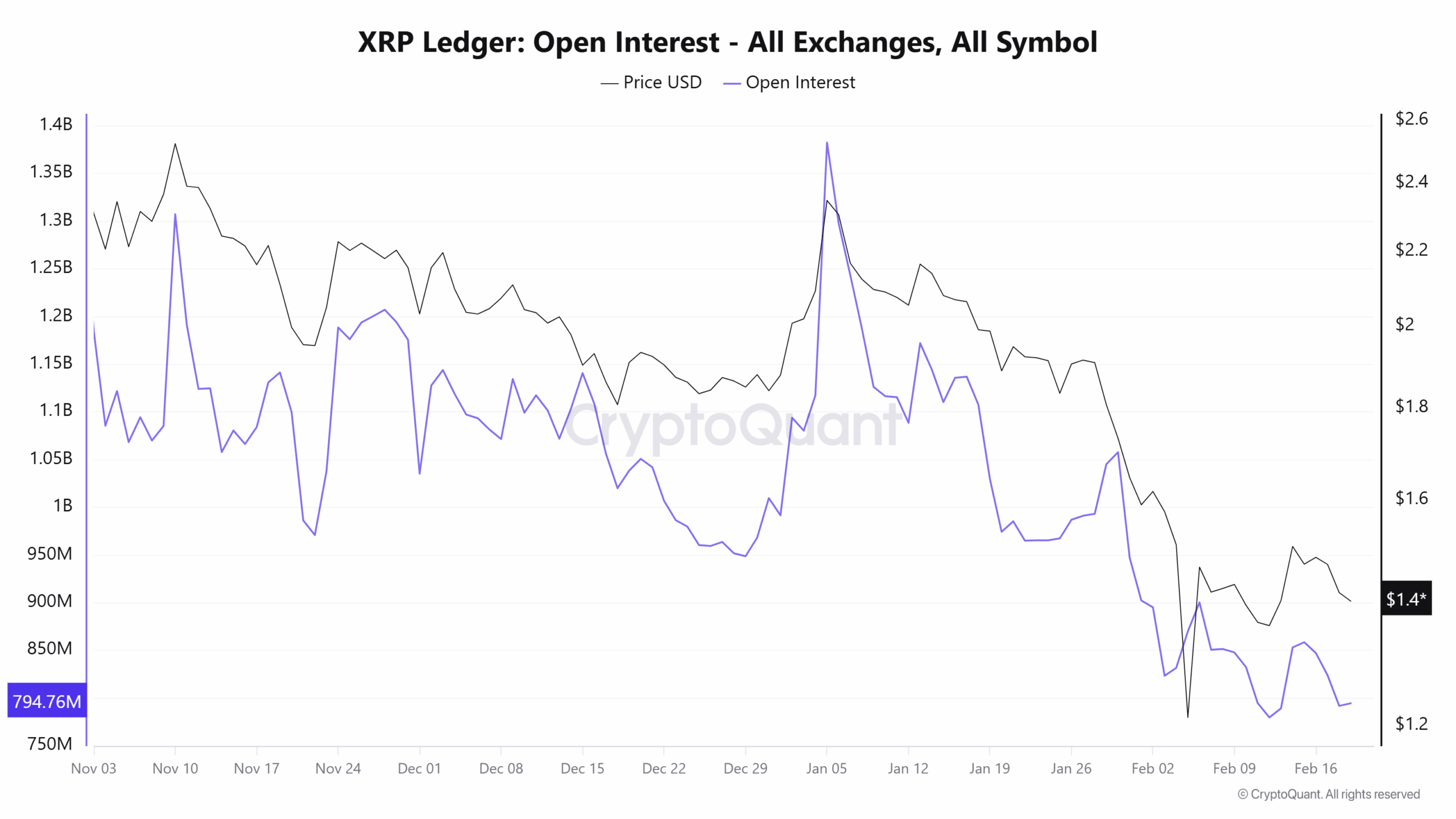

Source: CryptoQuant

The Open Interest continued its downward spiral. The lack of speculative interest suggested that the bearish XRP trend has not begun to reverse. Swing traders and investors can watch out for increased Open Interest to signal a bullish sentiment shift.

Interestingly, the 7-day moving average of the Taker Buy-Sell Ratio climbed to 1.01 on the 17th of February. The 7SMA going above 1 is a rare occurrence for the token and previously occurred during the early January rally.

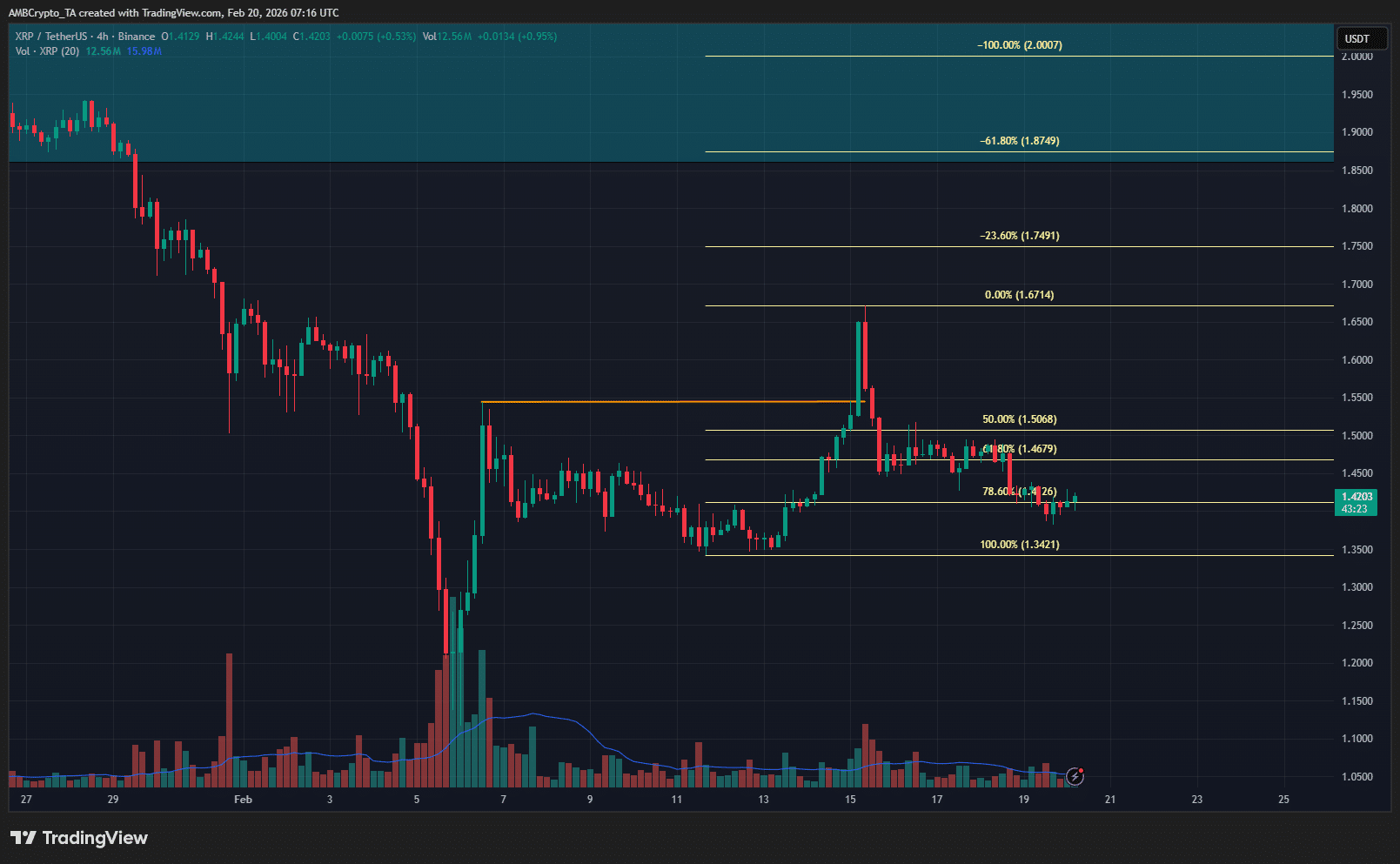

The H4 swing structure has shifted bullishly, and the $1.41 retracement level has been tested as support. There is potential for a relief rally beyond $1.55. Traders can keep an eye on the upward momentum, but remember that the longer-term trend remains bearish.

Final Summary

- The XRP AMM liquidity conditions during the late 2024 rally had some similarities to current conditions, but an upward price expansion is not guaranteed.

- The Open Interest trends showed an unenthusiastic speculative trader base, while the price action underlined the potential for a short-term rally.

Go to Source to See Full Article

Author: Akashnath S