Savvy investors keenly monitor market indicators to gauge potential shifts preemptively. One such metric, the MVRV (market-value-to-realized-value) ratio, has recently highlighted a curious trend among five altcoins.

Currently showing high MVRV values, these digital assets may be poised for a price adjustment due to a spike in profit-taking activities.

The Most Overbought Altcoins

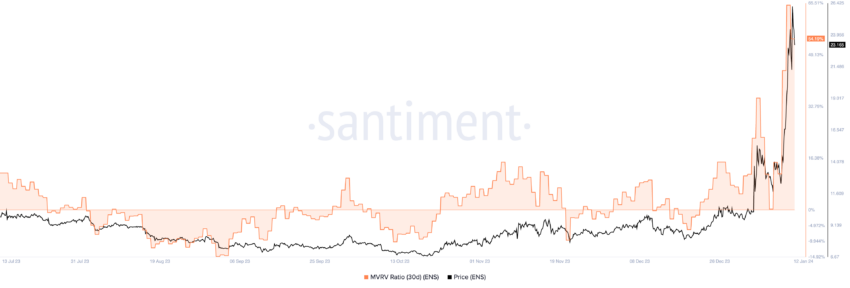

The MVRV ratio, comparing an asset’s market capitalization to its realized capitalization, offers a window into whether an altcoin’s price aligns with its “fair value.”

When the market cap overtakes the realized cap, it signals that unrealized profits are peaking. This scenario typically suggests an impending sell-off as investors look to capitalize on gains. Conversely, a lower market cap relative to the realized cap might signal undervaluation or tepid demand.

Read more: Top 10 Cheapest Cryptocurrencies to Invest in January 2024

At present, these five altcoins exhibit elevated 30-day MVRV values, which suggests they trade at overbought territory:

- Ethereum Name Service (ENS) presents a 30-day MVRV of 54.19%

Go to Source to See Full Article

Author: Bary Rahma