If you’re weighing which crypto to buy today for long-term growth, two very different paths are on the table. Pepecoin (PEPE) commands a giant following and deep liquidity, but its upside is tied to meme momentum. Mutuum Finance (MUTM), priced at $0.035, is building a lending stack where on-chain activity links directly to token demand. For investors focused on asymmetric returns—not just brand recognition—the setup favors Mutuum Finance as the best cryptocurrency to invest in among these two.

Pepecoin (PEPE)

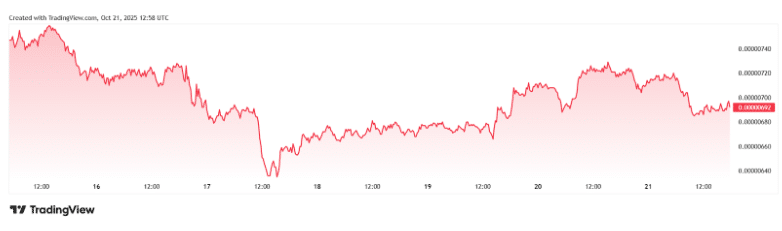

PEPE is trading in the micro-penny band, with live pricing near $0.000007 and a market cap around $2.9B, per top trackers. Circulating supply sits near 420.69 trillion tokens, which is a core part of its math and narrative. The 24-hour flow fluctuates, but the bigger picture is clear: this is a high-liquidity meme asset already priced into the large-cap bracket of its category.

Technically, several resistance areas have been flagged this week. One desk marks $0.00000796 as a level that needs to be cleared and held to avoid another fade toward $0.00000631 support. Another snapshot of machine-driven TA keeps resistance clustered near $0.000007–$0.000008, with a bearish bias into late October. In other words, buyers have work to do before upside trend confirmation.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is an Ethereum-based lending protocol with two tracks: Peer-to-Contract pools for core assets (depositors earn mtTokens that accrue yield) and a Peer-to-Peer marketplace for custom, isolated deals. Borrow rates respond to pool usage to keep liquidity balanced, and positions are overcollateralized.

On the token side, a portion of protocol fees and platform revenue is used to buy MUTM on the open market; MUTM purchased on the open market is redistributed to users who stake mtTokens in the safety module.

The current MUTM price is $0.035 in Phase 6, which is already over 71% allocated. The raise sits around $17.7M with roughly 17.4K holders, and every new purchase chips away at the remaining Phase 6 supply. Because the sale uses a fixed-price, fixed-allocation model, strong demand can close a stage quickly and automatically move the price to $0.04 for the next phase, with guidance near $0.06 around listing.

Go to Source to See Full Article

Author: AMBCrypto Team