The US Bureau of Labor Statistics will release its December nonfarm payrolls report on Jan. 5, 2024. The US Federal Reserve was optimistic about the economy at its last meeting of 2024, but it will face a conundrum if the jobs market didn’t cool in December, making the future of Bitcoin slightly uncertain.

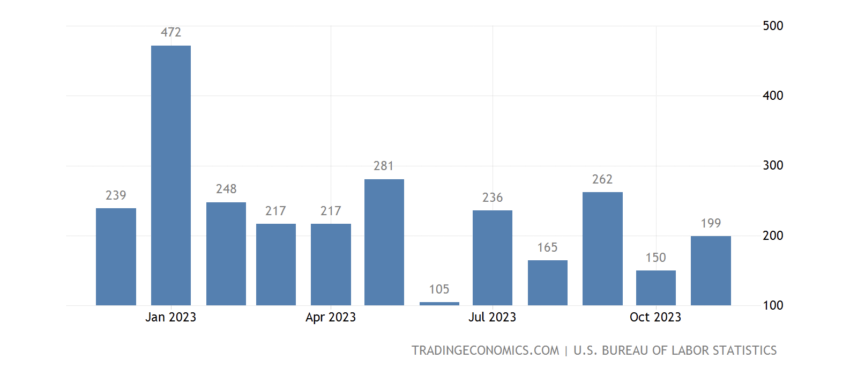

In November, the nonfarm payrolls report reported that US jobs grew from 150,000 in October to 199,000 in November, stoking hopes that the US economy had finally reached the Goldilocks moment. Inflation has been getting closer to 2% recently, while wage growth has moderated.

US Nonfarm Payrolls Could Delay Soft Landing

But some economists warn that it’s not all a bed of roses. Former New York Fed president Bill Dudley believes that markets may have overreacted to the Fed’s implied pivot away from tightening.

“[One] thing that could go wrong is that the Fed could ease policy prematurely, or the market itself could ease financial conditions prematurely, which will stimulate the economy and make it so that the Fed can’t cut rates as quickly as the market expects. I think the market is getting a little bit ahead of itself here by taking the Fed’s optimism and translating [it] into very large reductions in short-term rates in 2024,” Dudley told Bloomberg last week.

Former World Bank Treasury Secretary Lawrence Summer said a soft landing could occur in 6-8 months. Higher neutral rates have meant that interest rates have less impact, he argues. The neutral, or R-star rate, is the rate at which the economy is not growing or shrinking.

Go to Source to See Full Article

Author: David Thomas