Vanguard is preparing to loosen restrictions on crypto exchange-traded funds (ETFs).

The move, first reported on Sept. 26 by Crypto in America, would represent a sharp departure for a firm that has consistently distanced itself from digital assets.

The $10 trillion asset manager has historically taken a cautious approach, barring clients from buying Bitcoin ETFs on its brokerage platform while competitors such as Fidelity have embraced them.

That strategy reflected Vanguard’s preference for stability and long-term returns over exposure to what it once considered speculative products.

According to the report, Vanguard has begun exploratory talks with external partners about granting brokerage customers access to select third-party crypto ETFs.

However, the asset management firm is not expected to develop in-house products like its rivals.

Why Vanguard is changing stance on crypto

Vanguard’s new approach to crypto can be linked to several factors, including the improved regulatory environment and the success of crypto ETFs.

Over the past year, the Trump administration has reshaped the US regulatory landscape, steering it toward a more pro-crypto direction.

This shift is reflected in the growing coordination between key financial watchdogs, including the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), as they work to establish clearer rules for digital assets.

Their collaborative approach has transformed what was once an unregulated frontier into a more structured market, drawing substantial institutional interest and accelerating growth across the crypto sector.

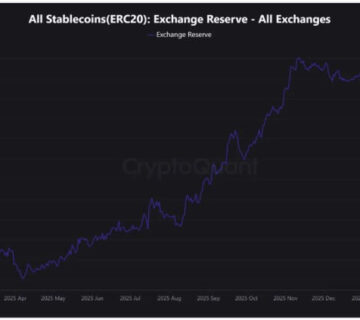

Apart from that, the significant success of th

Go to Source to See Full Article

Author: Oluwapelumi Adejumo