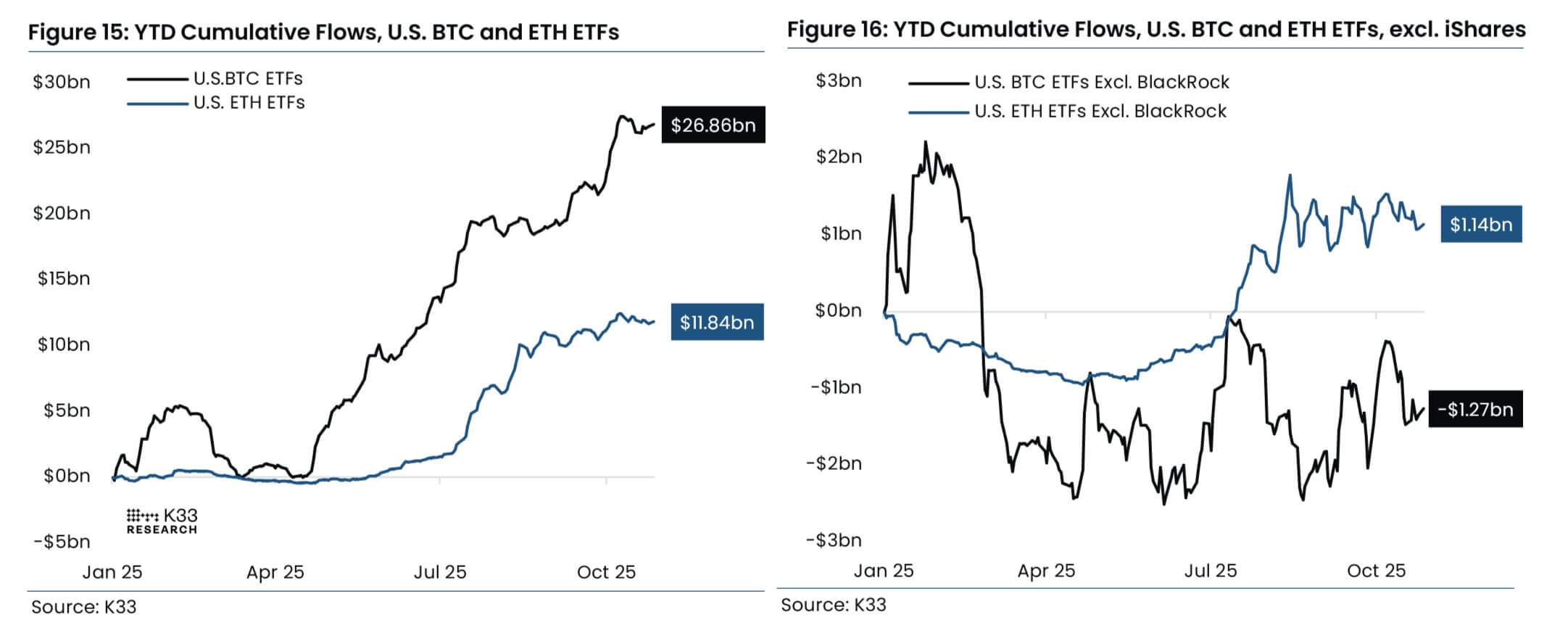

Over the past year, Bitcoin’s exchange-traded fund (ETF) boom has been celebrated as proof that Wall Street has finally embraced crypto. Yet the numbers reveal something far more fragile.

On Oct. 28, Vetle Lunde, head of research at K33 Research, noted that US-traded Bitcoin ETFs have attracted about $26.9 billion in inflows year-to-date.

However, that headline figure hides a stark imbalance that BlackRock’s iShares Bitcoin Trust (IBIT) alone accounts for roughly $28.1 billion of those flows.

In other words, Bitcoin ETFs would be in net outflows this year without IBIT. The product’s relentless accumulation has single-handedly offset redemptions across competitors, keeping aggregate inflows positive and sustaining Bitcoin’s narrative of institutional adoption.

A market held by one fund

Since launching in early 2024, IBIT has dominated every major performance metric in the ETF ecosystem.

According to SoSo Value data, it has seen about $65.3 billion in lifetime inflows, compared to $21.3 billion across all other Bitcoin funds combined.

Go to Source to See Full Article

Author: Oluwapelumi Adejumo