The core US Personal Consumption Expenditure (PCE) index rose 2.3% year-on-year. The US economy grew 5.2% in Q3, beating estimates of 5%, and is the highest level of growth since Q4 2021, signaling US Federal Reserve policy has not yet put the economy into a recession.

According to the Bureau for Economic Analysis, the initial gross domestic product (GDP) estimate of around 4.9% was revised after considering revisions to nonresidential fixed investment and state and local government spending. The GDP increase is a symptom of strong private sector demand, according to Gregory Daco, a chief economist at EY News.

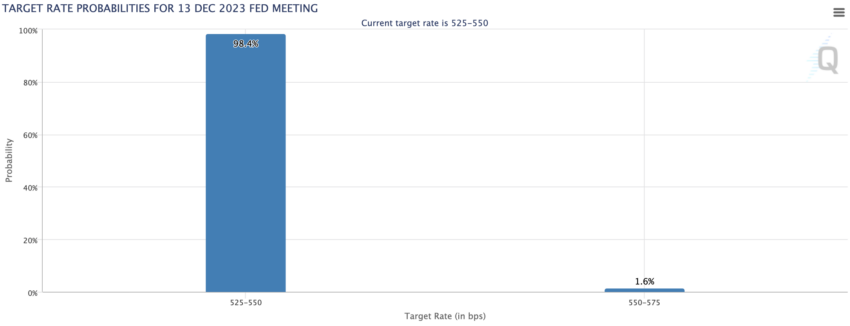

Fed Looks Set to Keep Rates Elevated

So-called headline PCE rose 2.8% quarterly, undercutting an advance estimate of 2.9%. Core PCE also came in 0.1% lower than expected. The PCE is the US Federal Reserve’s preferred inflation gauge, as it tracks changes in consumer spending habits and is a more accurate gauge of how prices are affecting households.

Experts predict the central bank is unlikely to raise rates at its next meeting after declines in the Consumer Price Index and the

Go to Source to See Full Article

Author: David Thomas