- TRON had 50% more circulating stablecoins than Ethereum

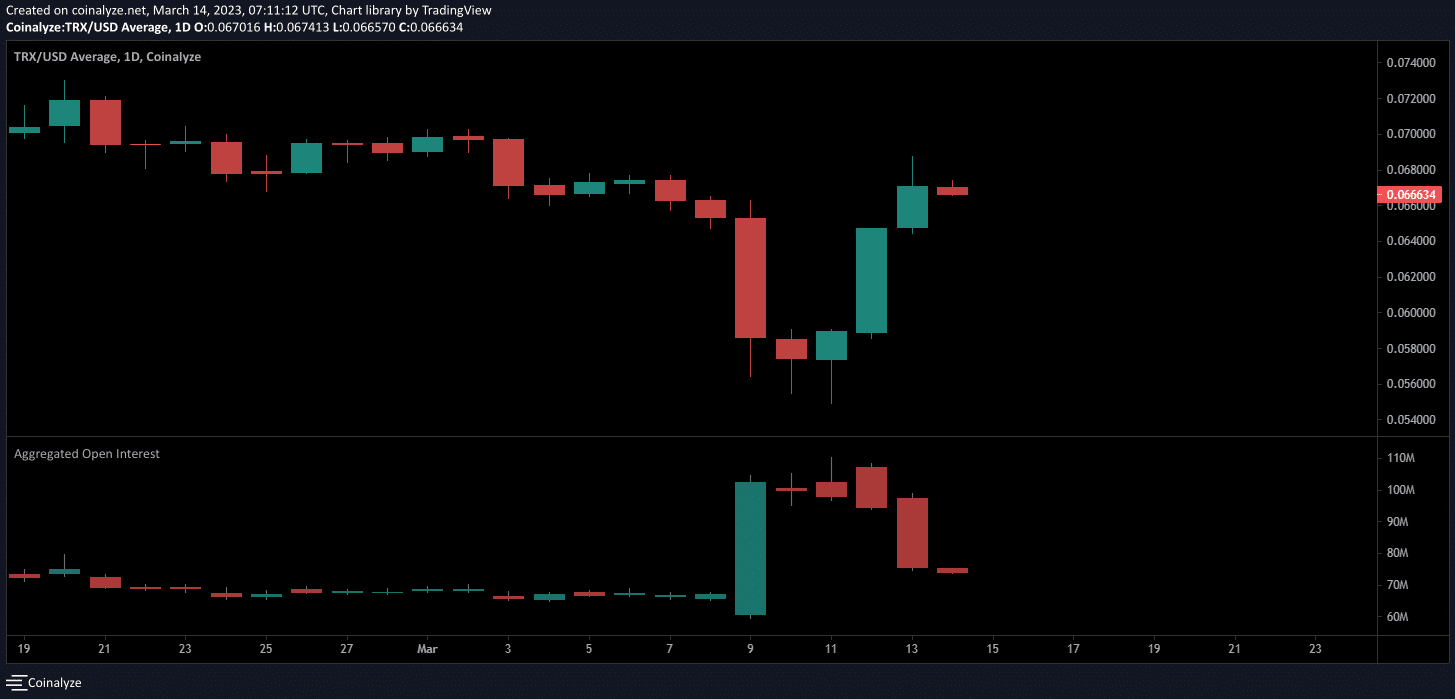

- TRX’s Open Interest formed a bearish divergence which could lead to a pullback

Amidst all the chaos in the crypto-markets following the collapse of crypto-friendly banks, Tron [TRX]‘s ecosystem shared its latest weekly report. In doing so, it provided updates on some of its key performance indicators (KPIs).

The report highlighted that the total number of transactions recorded over the past week hit 46.6 million. This, while the number of new accounts added to the network went past 1 million.

On the other hand, the total value locked on the chain’s smart contracts regained its $11 billion-mark after dipping to $9.3 billion. This was when news of USDC’s de-pegging first broke out.

Read TRON’s [TRX] Price Prediction 2023-24

USDT transfers helped Tron?

The uptick in trading activity could have been powered by stablecoin transfers as Tron registered a significant jump in its stablecoin circulating supply. In fact, a tweet shared by an analyst revealed that due to the market shake-up, TRON had 50% more stablecoins than Ethereum [ETH]. While ETH’s marketcap declined, TRON recorded the highest weekly growth, more than 6% among top blockchains.

Here, it’s worth noting that the supply of Tether [USDT] went past 40 billion and enjoyed a dominance of 93.69% in the overall Tron’s stablecoin market cap.

Trend that I haven’t seen many people talk about.

The flight from USDC to USDT this week pushed the total Tron stablecoin market cap higher, even as the Ethere

Go to Source to See Full Article

Author: Suzuki Shillsalot