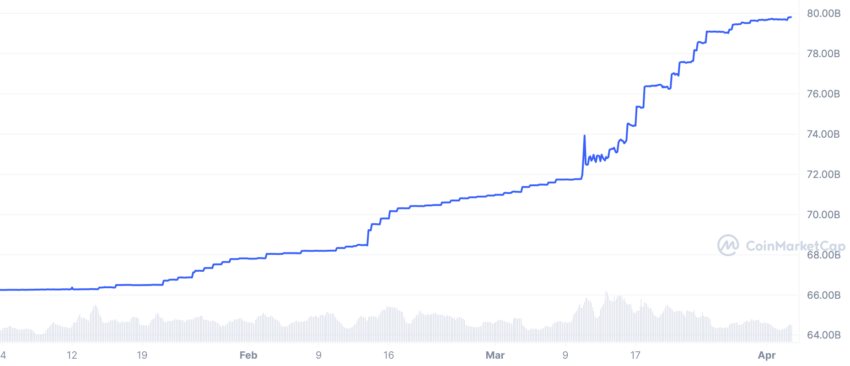

Tether, the company behind the most-used stablecoin in the crypto market, minted 9.7 billion USDT in March. This figure is quite impressive when considering the U.S. Federal Reserve printed $400 billion during the same period.

The output of Tether’s stablecoin is a sign of surging investor demand amid the banking crisis enveloping Silicon Valley Bank, Silvergate, Signature Bank, and First Republic Bank. Not to mention the fall of Swiss-based Credit Suisse and its bailout by rival UBS.

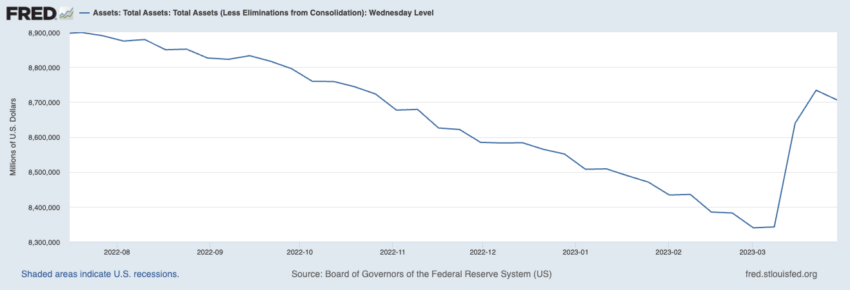

These developments have shaken confidence in banks while driving the Federal Reserve to pump out $400 billion of liquidity in two weeks.

This perfect storm has proven to be a boon for stablecoins and other digital currencies. The stablecoin issued by Hong Kong-based Tether has met increasing demand in the face of attacks in the legacy media.

Go to Source to See Full Article

Author: Michael Washburn