- Stablecoin supply surged by 17% in Q4, with more investors jumping into Bitcoin despite the high risk

- BTC soared by over 50% as a result – Is another rally on the charts?

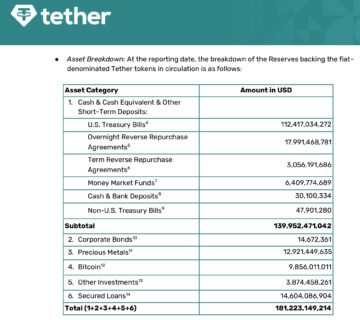

Stablecoin supply and Bitcoin’s price are tightly linked – When stablecoins flow, Bitcoin often follows. Take the ‘Trump Pump’ in Q4 last year, for instance – Stablecoin supply soared by 16.9%, hitting $188.82 billion, and Bitcoin [BTC] climbed from $67.8k to $106.1k. It was a textbook case of liquidity driving momentum.

But now, the tides are turning. Liquidity inflows are slowing, signaling that investors are starting to hesitate. With another Trump Pump just days away, is the ‘high-risk, high-reward’ allure of crypto starting to lose its appeal?

Market shifts towards caution

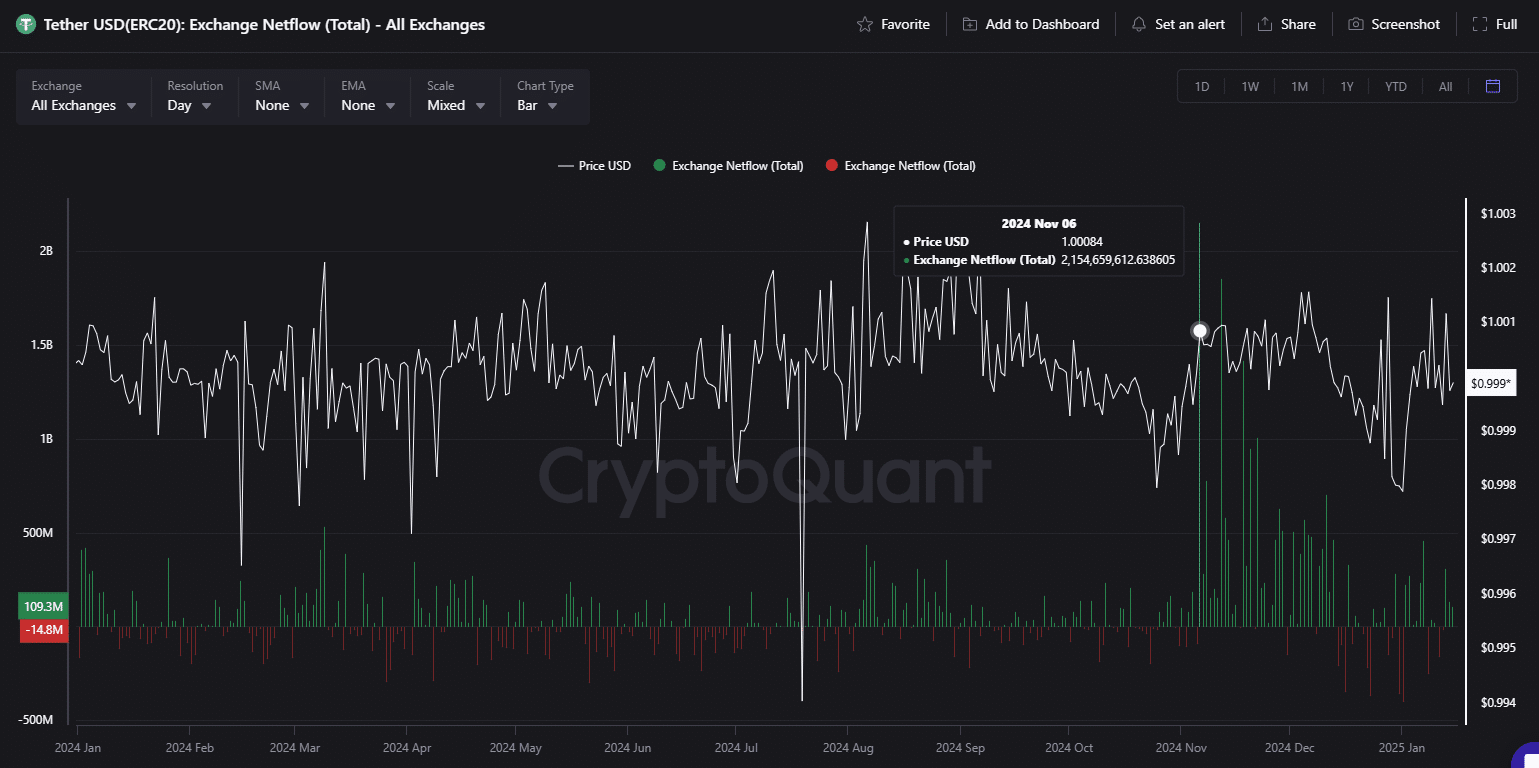

Bitcoin’s impressive recovery from $91k to $97k (At the time of writing) – a 6.6% jump in just a week – shows that traders are bracing for the next big rally. And, it’s no coincidence that Tether USD (ERC20) stablecoins saw $311.5 million in inflows during the same period.

This backs up AMBCrypto’s theory – When liquidity rises, investors aren’t hesitating. They’re doubling down, loading up their portfolios.

However, this is just the beginning. It’s still nothing compared to last year’s Election Day, when a massive $2.15 billion in stablecoins flooded the market, marking the highest influx of the year. The result? BTC surged by 8.24% in one day, breaking through $70k for the first time in eight months.

And, it didn’t stop there. In the two months following the Trump pump, $27.35 billion in stablecoins flowed across exchanges, fueling BTC’s 56.5% surge to $106.5k. Q4 truly shattered stablecoin’s ‘safe haven’ image.

Go to Source to See Full Article

Author: Ripley G