- Stablecoin reserves and SSR trends suggested strong buying power and imminent Bitcoin rally potential.

- Technical indicators and liquidations confirmed bullish sentiment, with $110,000 as a realistic target.

Bitcoin’s [BTC] latest price surge has sparked discussions, fueled by Binance’s enormous stablecoin reserves and positive market trends. These reserves reached $44.5 billion on the 31st of December, showcasing immense buying power poised to drive BTC higher.

Bitcoin was trading at $93,592.03, at press time, up 1.20% in the past 24 hours. This combination of liquidity and momentum makes the cryptocurrency market’s outlook increasingly bullish.

How stablecoin reserves ignite Bitcoin rallies

Stablecoins provide instant liquidity, often acting as a catalyst for Bitcoin price increases. Historically, significant inflows of stablecoins to exchanges have led to BTC rallies by increasing demand.

For instance, during the rally on the 11th of December, a surge in stablecoin activity helped Bitcoin gain 4.7% in one day. Therefore, the current reserve levels suggest a similar rally could soon occur, reinforcing investor optimism.

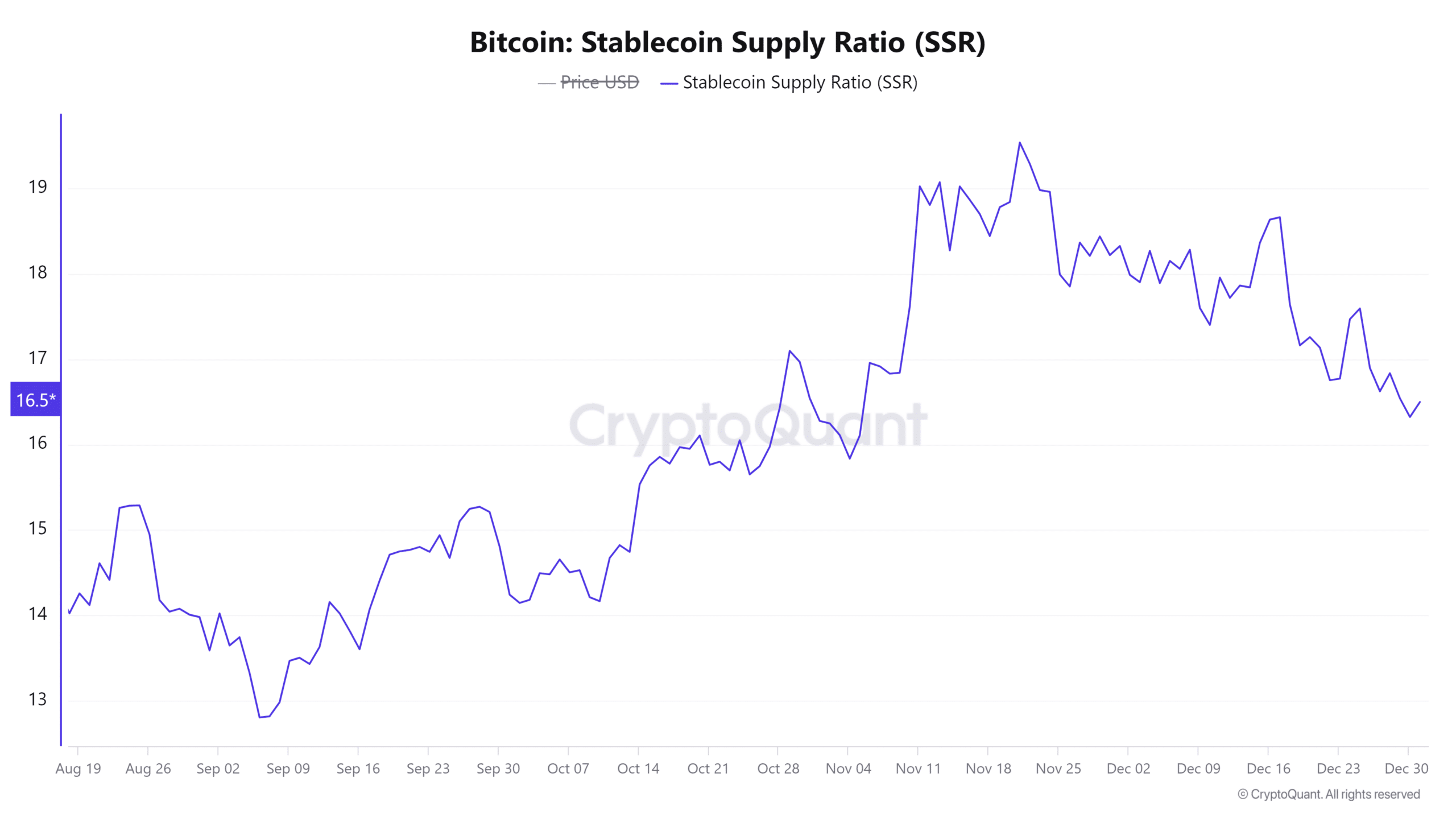

Does the SSR hint at more upward potential?

The Stablecoin Supply Ratio (SSR) is a key metric that indicates Bitcoin’s growth potential. Currently at 16.55, with a 1.01% daily increase, the SSR reflects ample liquidity compared to Bitcoin’s market cap.

This suggests a favorable environment for Bitcoin’s price to rise, as there is more stablecoin liquidity available to fuel demand. Consequently, SSR trends strongly support the possibility of continued upward momentum.

Source: CryptoQuant

BTC price action: Is a breakout imminent?

Bitcoin’s price has rebounded from the demand zone at $92,198.11 and is now approaching a potential breakout from a descending wedge. Historically, such patterns indicate bullish reversals, and Bitcoin’s movement suggests a similar outcome.

Key resistance at $100,3

Go to Source to See Full Article

Author: Erastus Chami