- Whale deposits of $22.9M have impacted SOL’s liquidity, signaling potential price fluctuations.

- Social metrics decline, but long liquidations suggest bullish pressure on SOL’s price.

Whale activity continued to influence Solana’s [SOL] market dynamics, as a large deposit of 132,573 SOL, valued at $22.9 million, was made into Kraken recently.

The sender? PumpFun—already responsible for over 2 million SOL worth nearly $340 million in transfers this year.

At press time, SOL traded at $173.80, up 0.60% in 24 hours. Naturally, such large transfers hinted at potential volatility.

However, the broader market sentiment and key technical indicators also play a pivotal role in shaping the coin’s price trajectory.

SOL shifting sentiment: Declining social dominance and emerging bullish funding rates

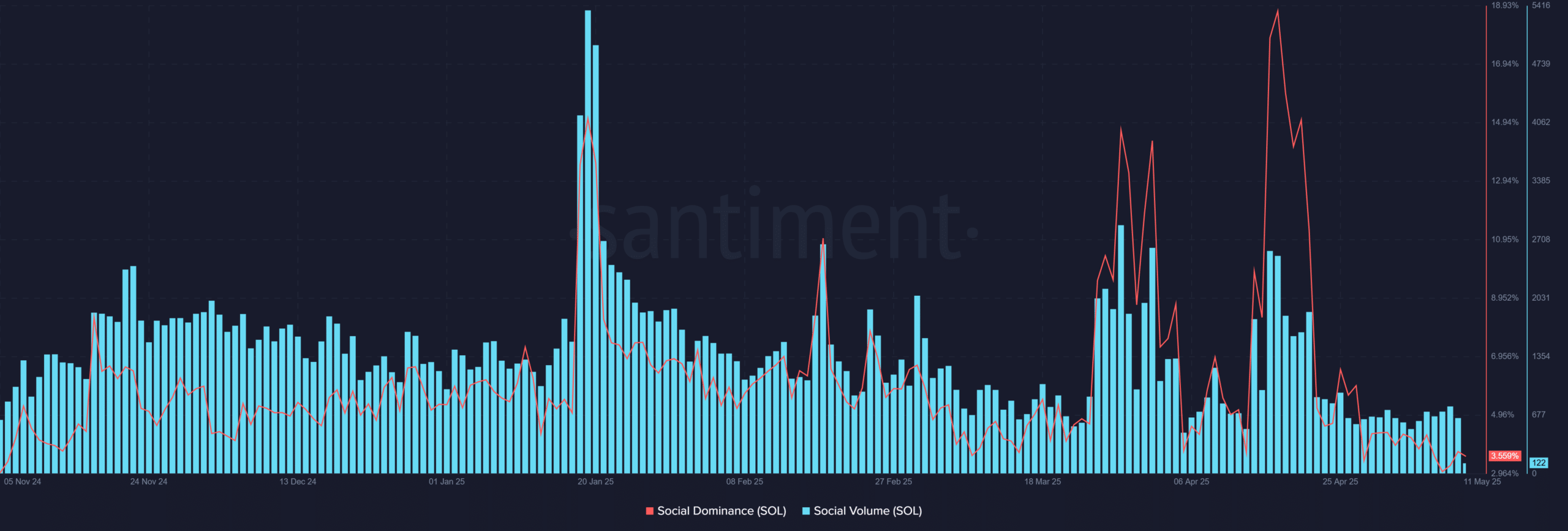

Interestingly, Social Dominance for Solana has seen a significant decline, dropping to 3.56% on the 11th of May, from its peak of 18.93% in January 2025.

Alongside this, Social Volume has decreased, as it stood at 122, a stark drop from the highs earlier this year.

In late January, Social Volume surged to over 5,400, signaling a period of heightened market activity and attention.

The OI-Weighted Funding Rate for SOL recently flipped positive, to +0.0130%, suggesting traders leaned slightly bullish with increasing long positions.

In past trends, these Funding Rate changes have often coincided with upward price movements, though caution is required.

Price squeeze potential: Liquidation heatmap and long vs short trends

The Liquidation Heatmap for Solana (SOL) indicated significant risks around key price levels. Notably, near $175, the heatmap shows concentrated long liquidation levels.

This suggested that any upward momentum might trigger a price sque

Go to Source to See Full Article

Author: Erastus Chami