The United States equity markets have witnessed a solid year so far. The Nasdaq Composite has soared 31.7%, its best first-half performance since 1983. Similarly, the S&P 500 Index’s (SPX) 15.9% gain is its best first half since 2019. This suggests that risky assets remain in demand.

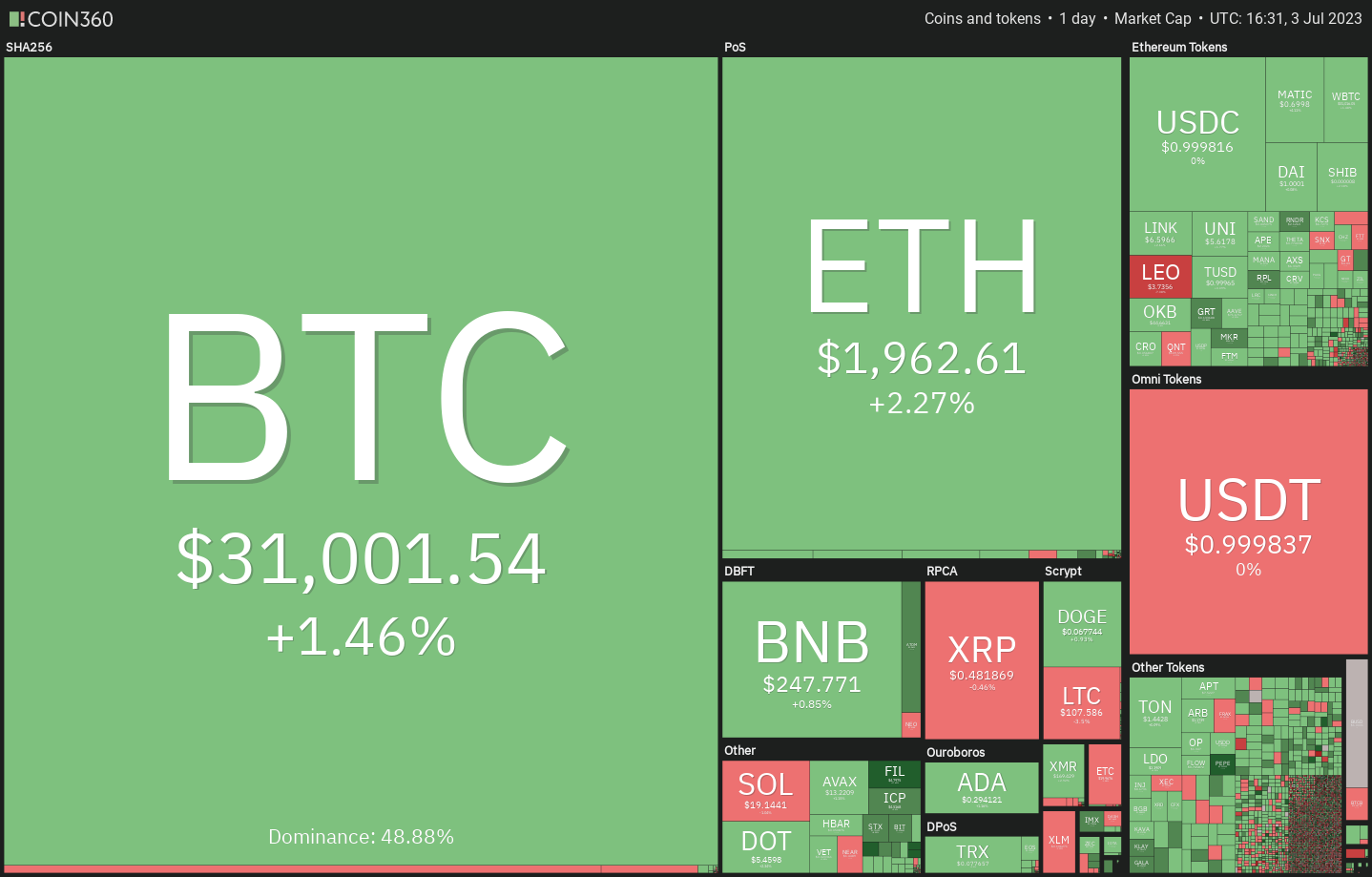

In the cryptocurrency markets, Bitcoin (BTC) has led the recovery from the front, rising 20% in Q2 2023. An encouraging sign is that the rise has not tempted the Bitcoin hodlers to book profits. Glassnode’s illiquid supply change metric is near cycle highs, indicating hodler conviction.

Usually, the leader is the first to emerge from a bear market. If the rally sustains, the sentiment among the traders improves and they start looking at other buying opportunities. After Bitcoin’s rally, the altcoins have started to show signs of life. If the trend continues, several altcoins may rally over the next few weeks.

Will the U.S. equities markets continue their march higher? Could Bitcoin and the major altcoins continue their recovery? Let’s analyze the charts to find out.

S&P 500 Index price analysis

The S&P 500 Index bounced off the breakout level of 4,325 on June 26, indicating that the bulls have flipped the level into support.

Buyers continued their purchases at higher levels, which pushed the index above the immediate resistance at 4,448. This indicates the resumption of the uptrend. The bears are likely to pose a st

Go to Source to See Full Article

Author: Rakesh Upadhyay