Key Takeaways

Why are Bitcoin short-term holders under pressure?

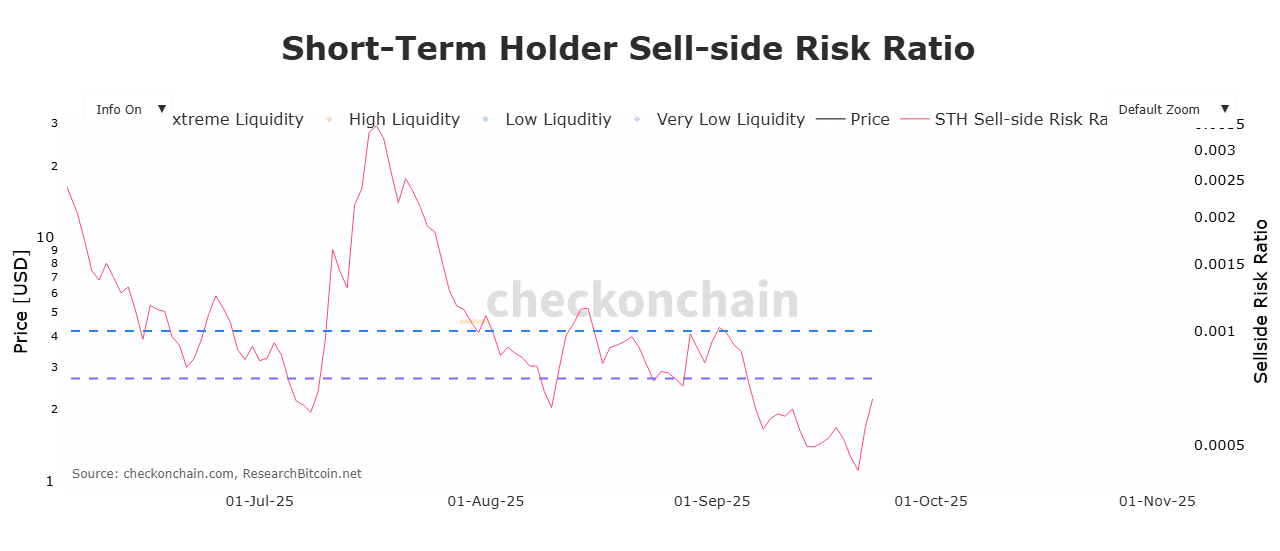

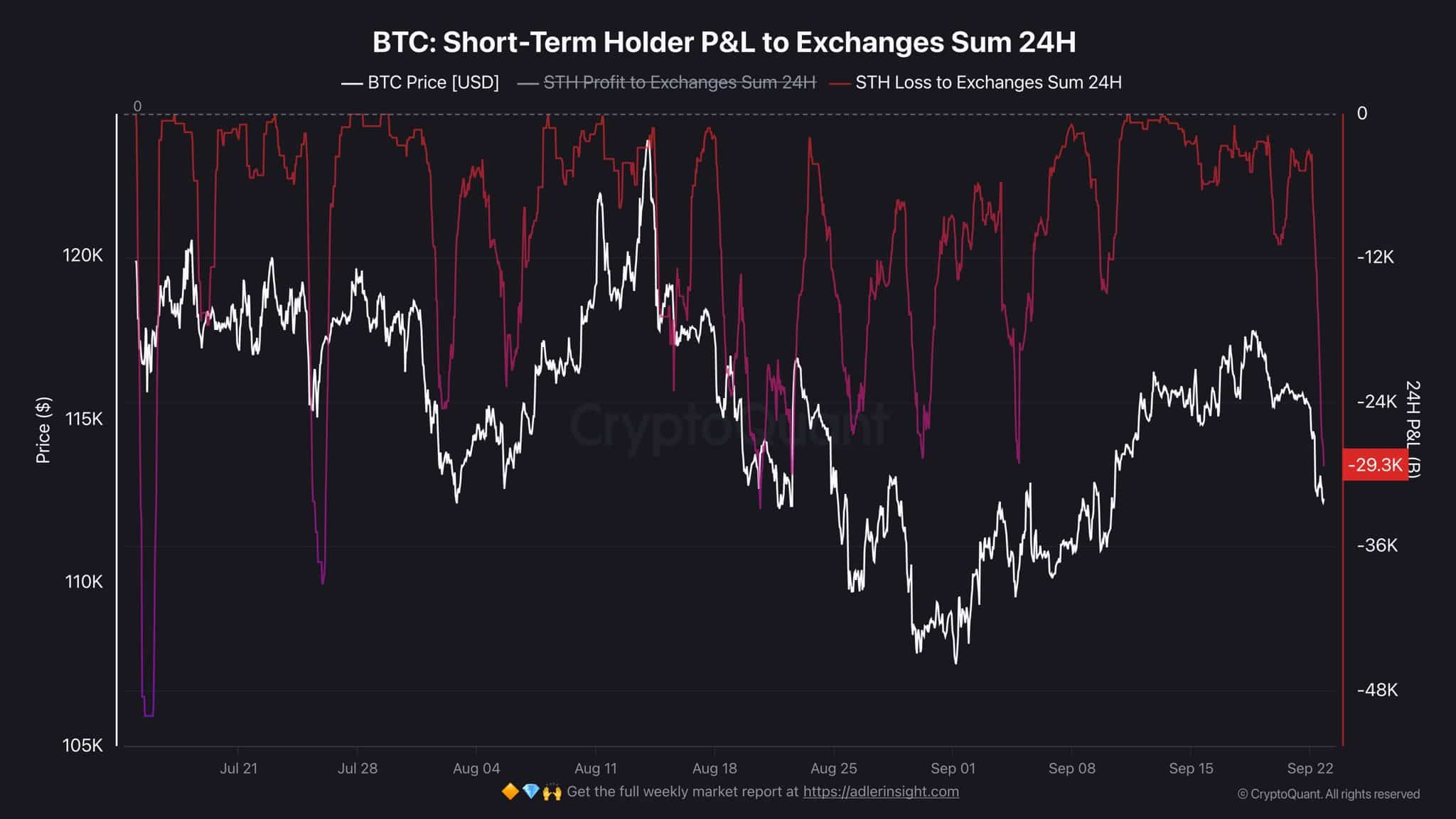

They realized losses on 30,000 BTC, Sell-side Risk hit 0.00055, and unrealized profits nearly vanished.

What signals could shift Bitcoin’s trend?

Seller Exhaustion Constant declined, suggesting reduced supply. BTC may rebound if buyers defend $112,000 and push toward $115,896.

Bitcoin [BTC] broke below its consolidation band and touched a 12-day low of $111,000 before recovering. At press time, BTC traded at $113,213 after a 0.41% daily uptick, though it remained down 2.24% on the week.

Amid this increased market volatility, investors, especially Short-Term Holders (STHs), have suffered a massive hit.

Bitcoin short-term holders face heavy losses

As Bitcoin declined sharply, STHs panicked and started exiting the market. Inasmuch as so, STH’s Sell-Side Risk spiked, reaching a two-week high of 0.00055, indicating panic selling from the cohort.

CryptoQuant analyst Darkfost noted that STHs realized losses on nearly 30,000 BTC in a single day.

With BTC still below $114,000, unrealized profits for this cohort were nearly erased, while September buyers recorded heavier losses.

Go to Source to See Full Article

Author: Gladys Makena