While most small investors are focused on daily price changes, one of Bitcoin’s oldest and most famous wallets has made a major move.

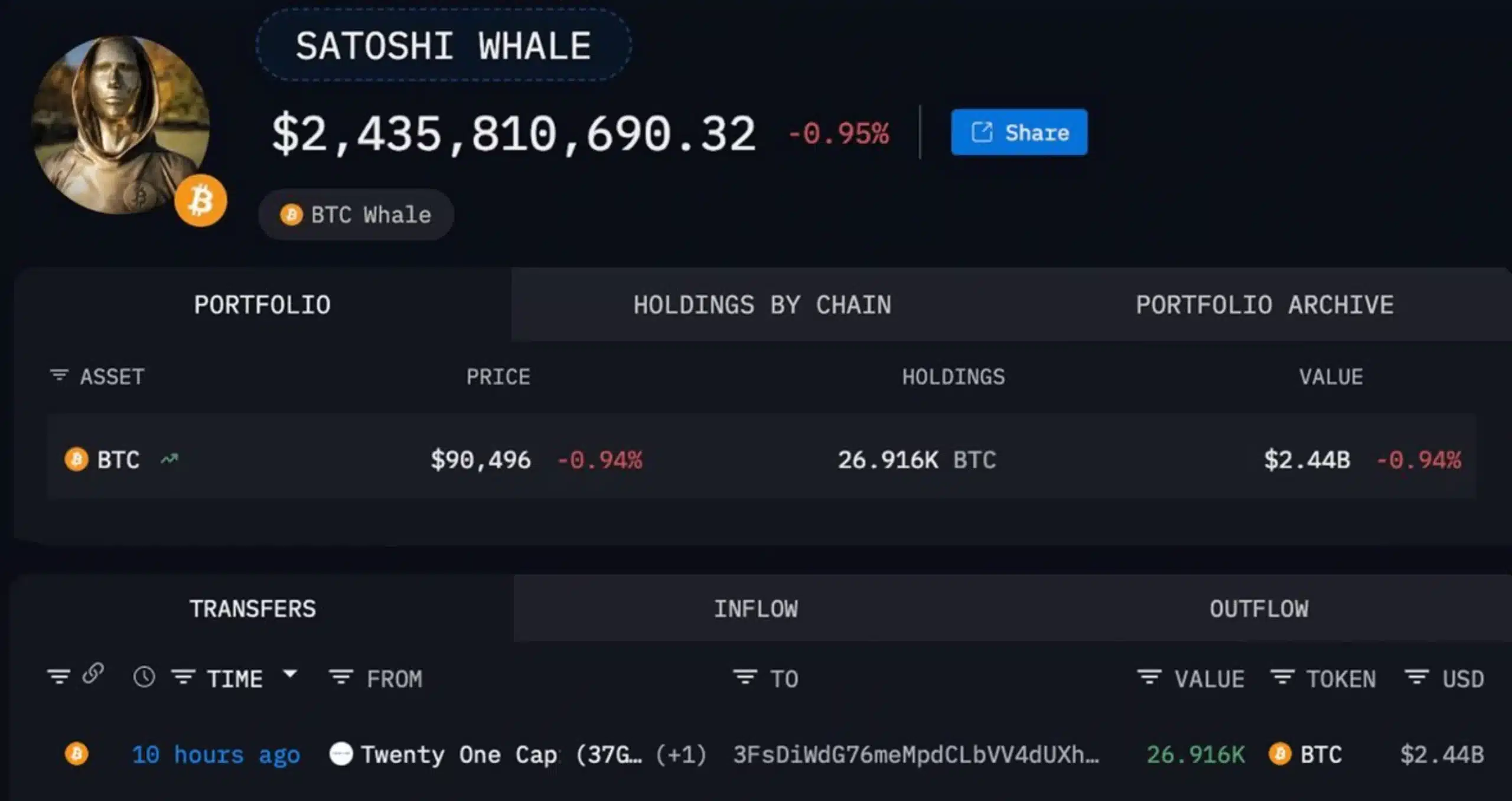

A wallet from the early “Satoshi era,” when Bitcoin [BTC] was still an experiment, has become active again and bought around 26,000 BTC.

With a value of more than $2 billion, this is not just a normal trade. It sends a strong signal to the market.

This wallet is well known among analysts because it has correctly bought during major market dips since 2015, earning over $800 million in profits.

When such an experienced and successful investor chooses to buy more at current levels, it suggests strong confidence in Bitcoin’s future.

It also shows that short-term price drops may not matter as much as many people think.

Strategic buying after Bitcoin failed at $70,000

The timing of this $2 billion purchase was not random.

Just a day earlier, Bitcoin tried to break above the important $70,000 level but failed. Heavy selling pushed the price down by about 3%, sending it to nearly $68,500.

This made many small investors nervous, with some expecting prices to fall even further.

While most people saw this drop as a bad sign, the Satoshi-era whale saw it as a buying opportunity. By purchasing 26,000 BTC at these levels, the whale turned a weak price zone into a strong support area.

How does this create a supply shock?

This move matters for two main reasons.

First, large investors move their Bitcoin off exchanges and into private wallets, reducing the number of coins available for selling. With fewer BTC on exchanges, sellers find it harder to push prices lower.

Second, this wallet has a strong record of buying at market lows. When such an experienced investor buys heavily, it boosts confidence among other major institutions.

Together, their buying creates a strong price floor and helps prevent panic during short-term drops.

Previous such moves and their impact

This recent $2 billion Bitcoin purchase is part of a bigger trend seen over the past year.

From the 150 BTC movement in October 2025, when Bitcoin was near $111,000, to the 2,000 BTC transfer in December, early Bitcoin holders are clearly reorganizing their holdings.

Both moves happened during market downturns, reinforcing the “buy the dip” strategy followed by experienced long-term investors.

After more than 14 years of ups and downs, they still see long-term growth as the best strategy. All in all, this shows that the most experienced investors are not leaving; instead, they are quietly preparing for what comes next.

Final Summary

- Short-term price drops are being seen as buying opportunities, not warning signs.

- Large accumulations during weakness often mark important turning points.

Go to Source to See Full Article

Author: Ishika Kumari