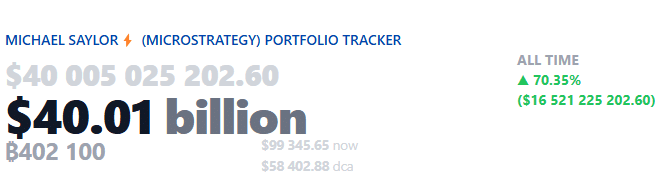

A prominent investment expert has raised concerns about MicroStrategy’s aggressive Bitcoin accumulation strategy, even as the company’s holdings reach $40.01 billion.

The warning comes as the company’s portfolio shows unrealized gains of 70.35% ($16.52 billion) on its total investment.

Gavin Baker, managing partner and chief investment officer of Atreides Management LP, highlighted potential risks in MicroStrategy’s debt-fueled Bitcoin (BTC) acquisition strategy during a recent All-In Podcast appearance.

The company, under Michael Saylor’s leadership, has accumulated 402,100 BTC. Baker specifically warned about the growing disparity between MicroStrategy’s annual revenue of $400 million and its increasing interest expenses from Bitcoin-backed debt.

“No trees grow to the sky,” Baker cautioned. He suggested that the strategy of continually issuing debt to purchase Bitcoin could become unsustainable if debt investors lose confidence in the approach.

Baker’s concerns center on the potential breakdown of what he terms the “magic money creation machine.” If Saylor’s strategy grows too large relative to MicroStrategy’s core business capacity, over-collateralization could lead to major risks for the company’s financial stability.

Saylor keeps accumulating Bitcoin

Despite these warnings, Saylor maintains his commitment to Bitcoin accumulation. In a recent Yahoo Finance interview, he reaffirmed his consistent four-year message: “Every day for the past four years, I’ve said buy bitcoin, don’t sell the Bitcoin. I’m going to be buying more Bitcoin. I’m going to be buying Bitcoin at the top forever.”

Saylor advocates for a long-term investment appro

Go to Source to See Full Article

Author: Vignesh Karunanidhi