Bitcoin (BTC) mining heavyweights Marathon Digital and Riot Platforms are among the most overvalued crypto mining companies relative to their competitors, says MinerMetrics founder and analyst Jaran Mellerud.

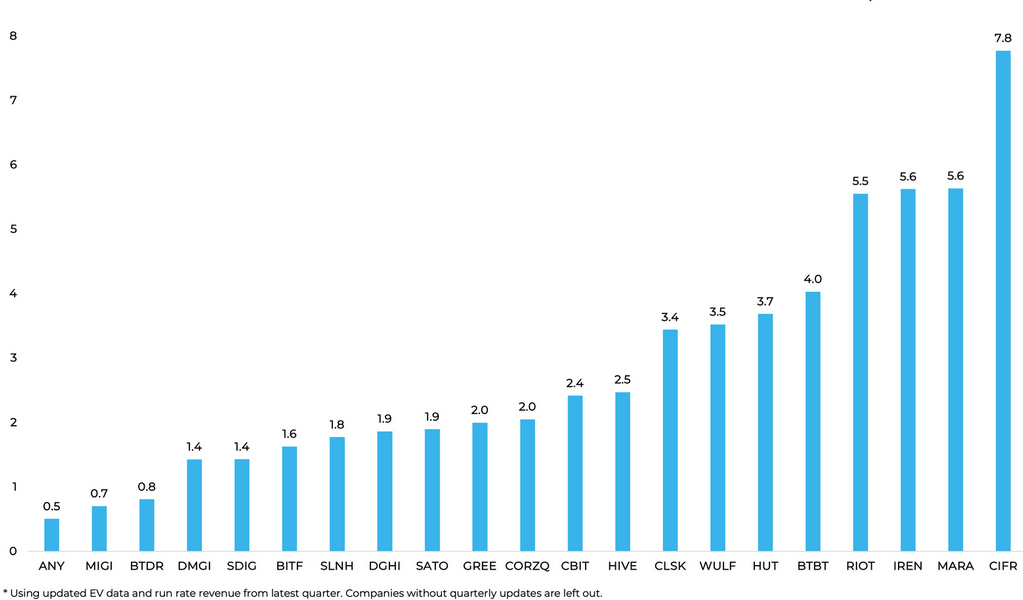

The key metric backing Mellerud’s claim is enterprise value-to-sales ratio — measuring a company’s value to its sales revenue. The higher the ratio, the more overvalued a company is.

The miners with the highest EV/S ratios are Cipher at 7.8, Marathon and Iris Energy each at 5.6 and Riot at 5.5, according to a Nov. 3 report by Mellerud.

Mellerud attributed the heavyweight’s high EV/S ratios to receiving more institutional attention from the likes of BlackRock.

“These companies have historically been favored among institutional investors like Blackrock and Vanguard, giving them superior access to capital and higher valuations like the rest of the industry.”

Mellerud told Cointelegraph in the coming months he expects investors to start allocating to other players “which could even out the valuation discrepancies between these stocks,” he said.

He suggested there are better-priced opportunities with lower EV/S ratios that could be capitalized on.

“There exist immense valuation discrepancies in the Bitcoin mining sector that value investors can take advantage of.”

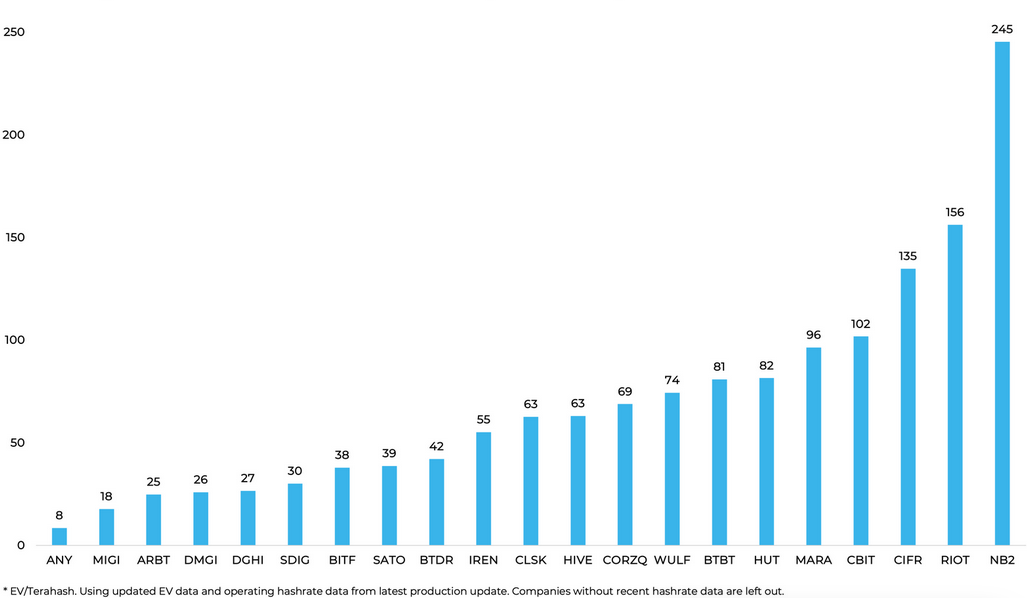

Riot’s high EV-to-Hashrate ratio at 156 is another indicator pointing toward its overvaluation, says Mellerud.

Mellerud, previously an analyst at Bitcoin miner Luxor Technology, noted Riot has “massive growth” priced in as it’s constructing its a gigawatt site and awaits the

Go to Source to See Full Article

Author: Brayden Lindrea