Jupiter’s native token, JUP, drew heightened attention on the 28th of January as its airdrop approached.

The focus centered on distribution mechanics rather than price gains alone.

Jupiter [JUP] confirmed plans to distribute 200 million JUP tokens on the 30th of January. Of that total, 175 million tokens targeted fee-paying active users, while 25 million were allocated to stakers.

That update coincided with a sharp rise in market participation. Price gains aligned with rising activity across spot and derivatives markets.

At press time, JUP traded at $0.2217, up roughly 15% over 24 hours. Spot Volume climbed 210% to $63.64 million, reflecting elevated trader engagement.

However, another catalyst shaped sentiment. Coinbase completed its Solana [SOL] chain integration during the same period.

That move enabled users to trade Solana-based tokens directly on Coinbase through Jupiter’s aggregation layer. The integration expanded Jupiter’s reach beyond native Solana users.

Can JUP clear resistance?

On the daily chart, JUP formed a double-bottom structure near the $0.20 region. Price moved toward the neckline near $0.233 after the recent rally.

A decisive break above that level could have opened room toward $0.32. That target implied roughly 35% upside from current levels.

However, previous attempts near $0.233 triggered reversals. The bullish setup required a sustained close above that resistance.

JUP also traded above the 50-day Exponential Moving Average, signaling short-term trend strength.

Leverage clusters shape risk

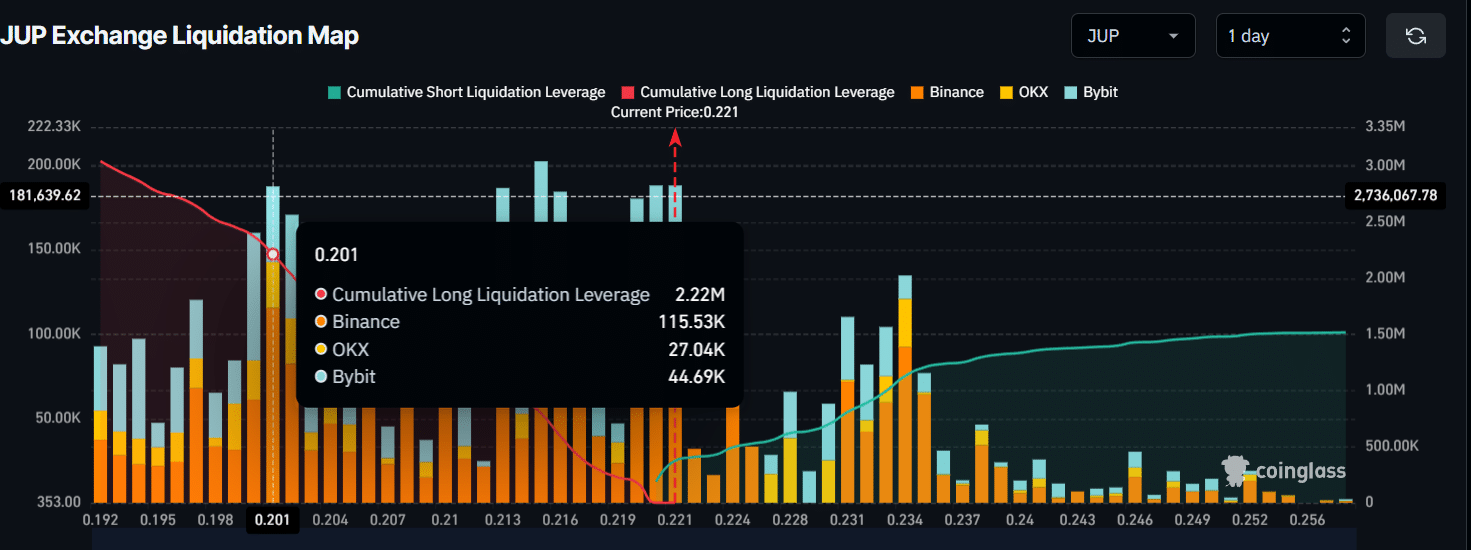

Data from CoinGlass showed concentrated leverage on both sides of JUP’s range.

According to the latest data, traders were heavily overleveraged at $0.201 on the downside, where strong interest is recorded, and at $0.234 on the upside, where comparatively lower interest is observed.

At these levels, traders had built approximately $2.22 million worth of long-leveraged positions and $1.13 million worth of short-leveraged positions.

This positioning suggests that intraday and short-term market sentiment remains bullish.

During 2025, JUP dropped over 75%, falling from $0.943 to near $0.215. That history kept long-term sentiment cautious.

Reacting to the recent breakout attempt, a market commentator wrote,

“JUP is officially out of the cage.”

The remark captured improving momentum but stopped short of confirming a trend reversal.

Final Thoughts

- Jupiter [JUP] faces resistance near $0.233, while liquidation exposure around $0.201 could magnify volatility quickly.

- A 200 million token airdrop and Coinbase’s Solana integration boosted Spot Volume and short-term speculative demand.

Go to Source to See Full Article

Author: Vivaan Acharya