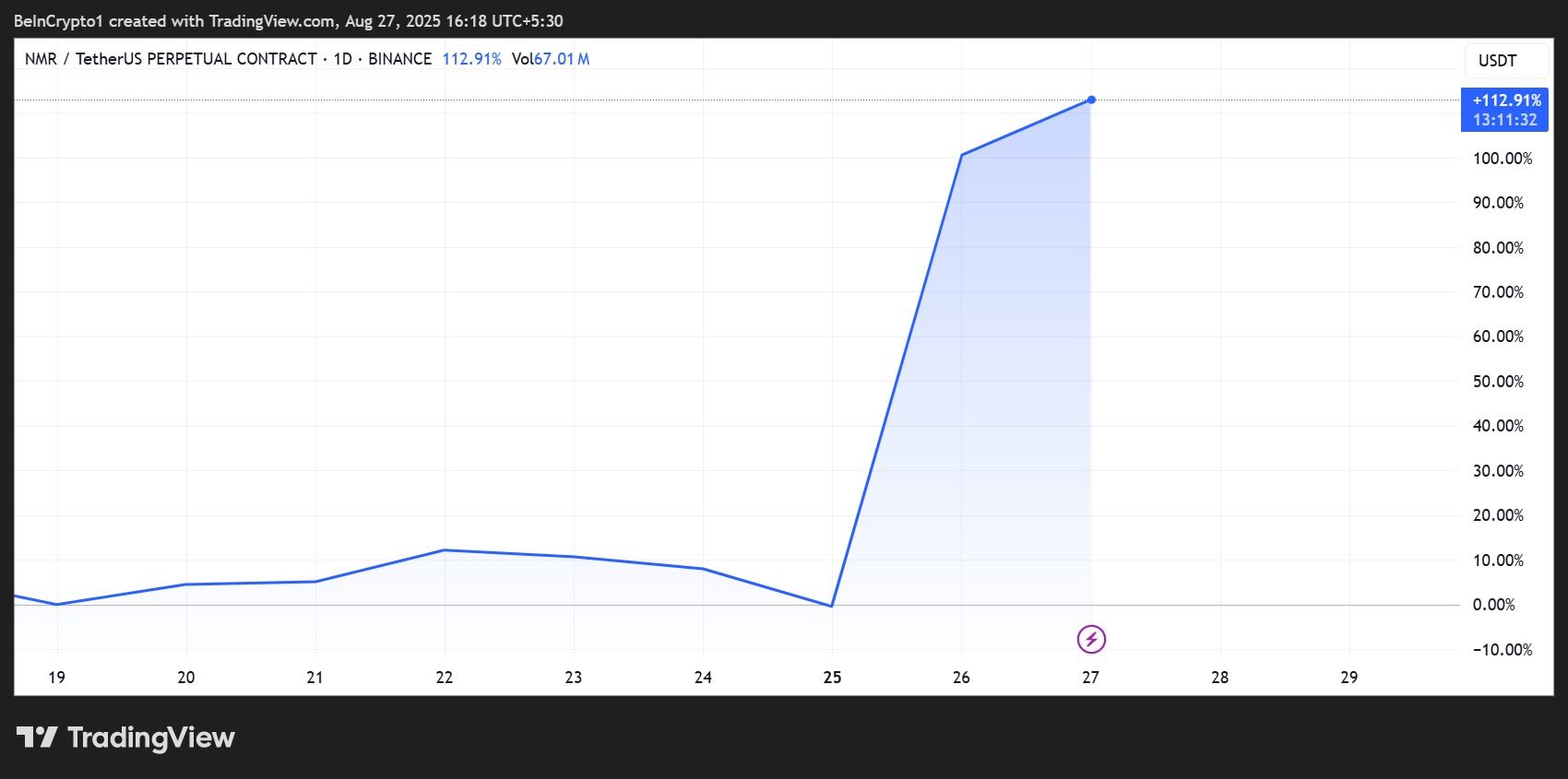

Numeraire (NMR), the native token of decentralized hedge fund platform Numerai, rallied more than 130% in the past week.

Experts associate the surge with JPMorgan, after the asset manager secured a $500 million capacity for the firm’s flagship hedge fund.

JPMorgan Partnership Marks a Turning Point for Numerai

Numerai announced that JPMorgan, one of the world’s largest allocators to quantitative strategies, committed to invest and locked in $500 million of fund capacity.

The deal is significant, coming a decade after Numerai’s inception in 2015. It was initiated as an experimental hedge fund powered by crowdsourced AI signals.

“The point of Numerai has always been to create a hedge fund for the AI age…Our open platform lets any data scientist or AI submit stock market signals through a simple API. That openness is our edge,” the team said in its announcement.

Over the past three years, Numerai’s assets under management (AUM) have grown from $60 million to $450 million.

In 2024, its global equity hedge fund posted a 25.45% net return with a Sharpe ratio of 2.75, outperforming many established quant competitors. It was the firm’s strongest year on record, with just one down month.

The news triggered a frenzy in NMR markets. The token surged 125% in just seven days, pushing trading volume close to $500 million in 24 hours.

“NMR is absolutely LIT right now, shooting skyward after the JPMorgan bombshell…many are betting it could blaze past $20–$25 in no

Go to Source to See Full Article

Author: Lockridge Okoth