Key Takeaways

How is Ripple positioning XRP in the DAT landscape?

By acquiring GTreasury, Ripple is providing corporates with a real-time liquidity engine and a utility-driven alternative to legacy treasury systems.

Why does this move stand out amid market turbulence?

Even as other DATs struggle, Ripple’s strategic acquisitions demonstrate its push into the $120 trillion corporate treasury market.

With major developments underway, it’s clear that Ripple [XRP] is stepping into the growing Digital Asset Treasury (DAT) landscape. However, rather than relying on external catalysts, Ripple is taking a proactive stance.

A recent report revealed that Ripple Labs Inc. is planning to raise $1 billion through a Special Purpose Acquisition Company (SPAC), with the funds set to be used for accumulating XRP and housing it within a DAT framework.

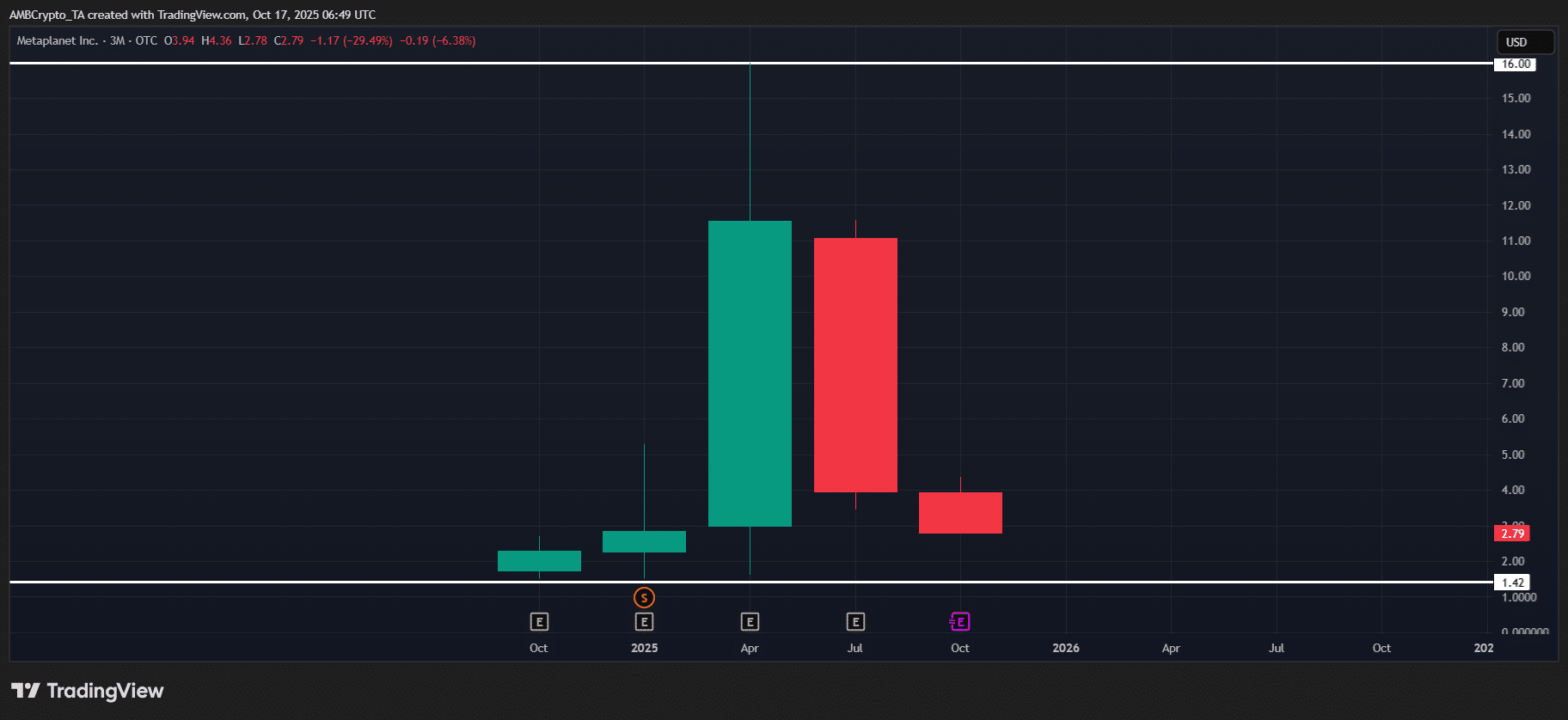

However, the timing is key. DATs haven’t been immune to market turbulence, with MicroStrategy [MSTR] posting two consecutive down quarters. In this context, what strategic approach is Ripple leaning on?

Ripple targets $120 trillion corporate treasury market

Ripple’s latest move has significantly scaled its institutional network.

In an official announcement, the L1 blockchain confirmed its $1 billion acquisition of GTreasury, a SaaS platform that provides corporate treasuries with tools to streamline financial operations like cash management.

By integrating GTreasury into its ecosystem, Ripple gains direct access to a vast network of businesses, tapping into what CEO

Go to Source to See Full Article

Author: Ritika Gupta