Peter Thiel-backed ETHZilla appears to be shifting away from the Ethereum corporate treasury, just four months after entering the trend.

In a statement, the firm said it has offloaded $74.5 million of its ETH (24,291 coins) to pay down debt.

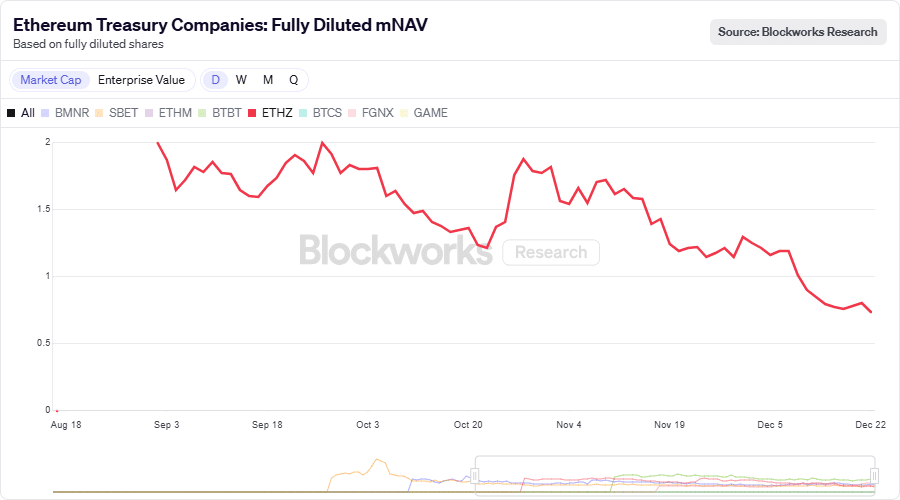

ETHZilla added that it will discontinue mNAV (a multiple that tracks the value of its crypto holdings relative to its enterprise value) and focus on tokenization.

Community reactions

However, the swift shift from its ETH strategy elicited mixed reactions from market watchers. One analyst castigated the firm for “destruction of shareholder value” within months, calling the shift “embarrassing”.

“NAV was 30/share 2 months ago…this is embarrassing. I haven’t seen such a quick destruction of value and poor management decision-making in 25 years outside of SPACs.”

ETHZilla’s (Nasdaq: ETHZ) mNAV fell below 1 in early December after threatening a similar move in late October.

The firm attempted to boost the mNAV via share buybacks in late October by selling $40M of its ETH holdings.

With the debt obligations also piling in, further market contraction in 2026 could complicate its ETH strategy and operations.

With mNAVs below 1, it becomes difficult to raise additional capital or sell shares to fund ETH buys.

In fact, this is exactly why Strategy has scaled its USD reserve fund to cover immediate obligations, thereby avoiding the need to liquidate its BTC holdings in the event of a prolonged crypto winter and compressed mNAV.

ETH struggles amid outflows

ETHZilla rebranded from 80 Life Sciences Corp, a biotech firm focused on therapeutic drugs.

The firm shifted its focus to the ETH strategy in August and sought to scale its holdings and generate yield via staking and diversified on-chain strategies.

It became the ninth-largest ETH treasury firm, holding 93.8K ETH, worth $280 million at current prices.

However, amid the Q4 crypto rout, the plans have completely changed to tokenization. Reacting to the U-turn, Mike Dudas, crypto investor at VC firm 6thMan Ventures, said,

“First DAT I’ve seen explicitly shift from mNAV (discontinued) to operating business model. RWA tokenization is occurring on many chains, interesting to see if they keep “ETH” as the core name or shift to something more reflective of how the segment is developing.”

That said, in the past seven days, ETH treasury firms recorded 107.7K ETH outflows. The ETF complex also recorded 116K ETH outflows, translating to nearly $670 million in outflows.

ETH struggled below $3k amid ongoing outflows.

Final Thoughts

- ETHZilla dumped more ETH to clear debt and signalled a shift from the ETH treasury to tokenized assets.

- ETH ETF and treasury firms saw nearly $670 million in outflows in the past seven days.

Go to Source to See Full Article

Author: Benjamin Njiri