Ethereum (ETH), the leading altcoin, has seen a significant surge over the past week, climbing 29% to a current three-month high of $3,184.

This rally has fueled speculation that ETH could soon reach its year-to-date high of $4,095. As market sentiment improves and investor confidence builds, several factors may drive Ethereum to new highs in the coming weeks.

Ethereum Holders Refrain From Selling

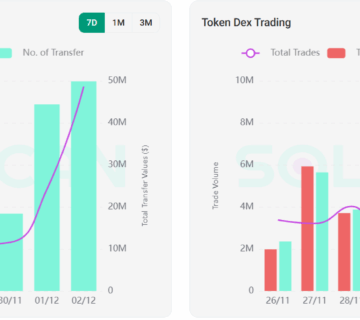

Ethereum’s coin holding time has increased by 40% in the past seven days. This metric measures how long a coin stays in an address before being transferred or sold.

A rising hold time indicates growing long-term confidence among investors. When holders choose not to sell, it suggests faith in Ethereum’s future value and reduces the impact of short-term price volatility. This often results in price stability and can boost demand since fewer coins are available for trading.

In addition to long-term investors, Ethereum’s short-term holders (STHs) have also shown a notable shift in behavior, choosing to hold onto their assets rather than sell. Over the past month, STHs — those who have held their coins for less than 30 days — have increased their holding period by 9%, a sign of growing confidence in the asset.

This trend is particularly significant, as short-term holders control a sizable portion of Ethereum’s circulating supply. When they choose to hold onto their coins, it reduces the selling pressure in the market. This shift in sentiment further reinforces the bullish outlook for ETH, as fewer coins are available for immediate sale.

Moreover,

Go to Source to See Full Article

Author: Abiodun Oladokun