Key Takeaways

Why is Ethereum attracting whale interest?

Whales accumulated over $417 million worth of ETH despite the market downturn, signaling strong long-term confidence.

How do reserves and sentiment shape Ethereum’s outlook?

Falling Exchange Reserves and improving Weighted Sentiment signal rising accumulation pressure.

Since mid-October, Ethereum [ETH] has shown renewed investor interest after whales accumulated 104,336 ETH worth $417 million from Kraken and BitGo wallets.

This massive inflow, led by Bitmine, coincided with Tom Lee’s forecast that Ethereum could reach $10,000 by year-end.

On top of that, the timing of this accumulation signaled that high-net-worth investors remained confident in Ethereum’s long-term potential.

Consequently, the whale-driven optimism could serve as a key catalyst for a major recovery if technical conditions align favorably.

Can Ethereum break out of its descending channel soon?

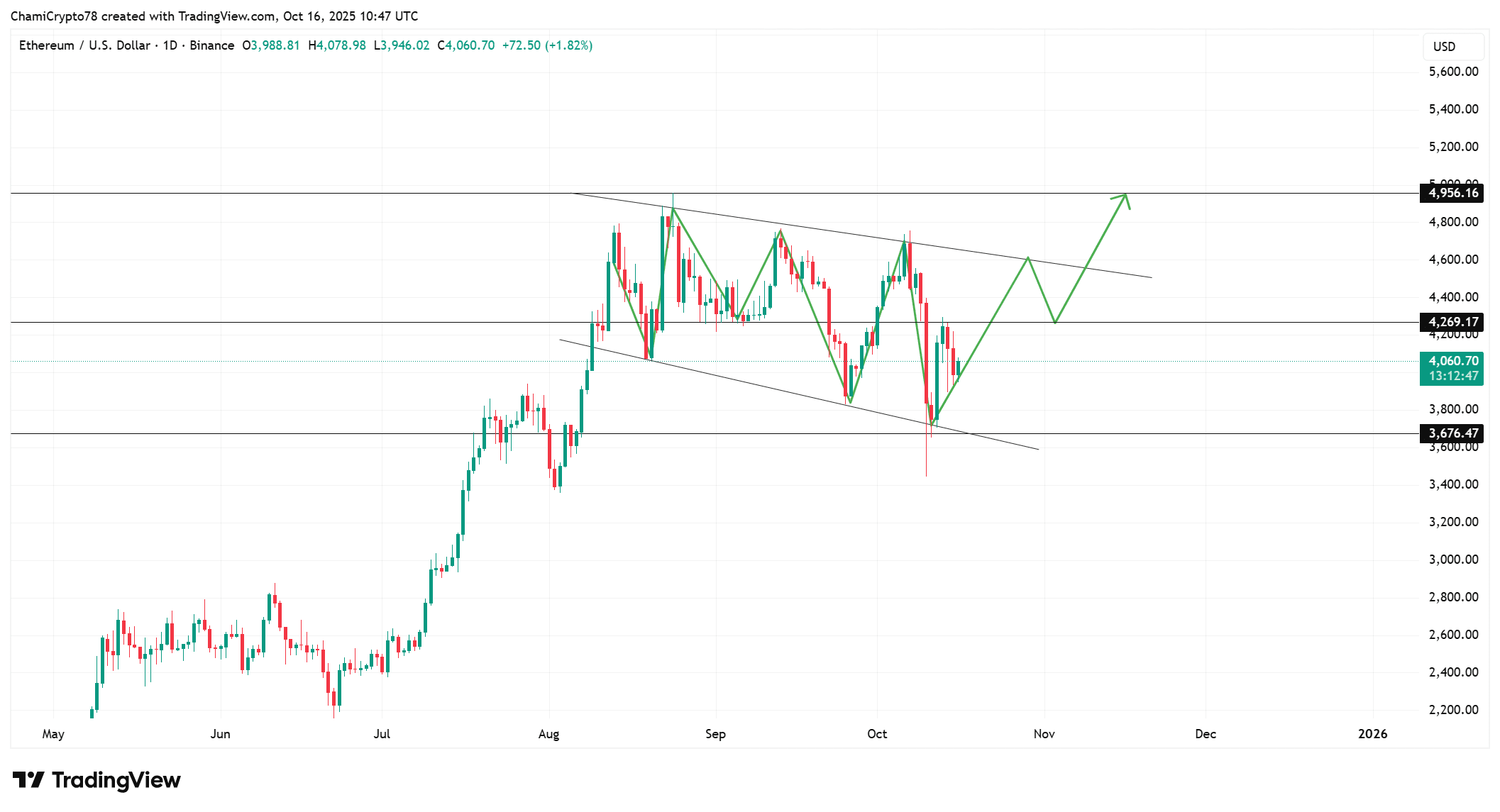

Ethereum’s daily chart revealed a well-defined descending channel, with price rebounding from the lower trendline near $3,676 at press time.

The recent upswing toward $4,060 suggested that bullish momentum is gradually returning.

A sustained move above $4,269 could trigger a breakout toward $4,950, marking the end of the multi-week correction phase.

However, if rejection occurs at the midline resistance, Ethereum may briefly retest the $3,800 demand zone before resuming upward movement.

Shrinking reserves = mounting accumulation pressure

Ethereum’s Exchange Reserves dropped 4.26% to $62.44 billion at press time. It meant that more t

Go to Source to See Full Article

Author: Erastus Chami