World Liberty Financial (WLFI), a DeFi initiative linked to US President-elect Donald Trump, has addressed concerns about recent Ethereum transactions worth $60 million.

On Jan. 15, the project clarified that the movements are part of its routine treasury management, dispelling speculations of asset sales.

It stated:

“To be clear, we are not selling tokens—we are simply reallocating assets for ordinary business purposes. These actions are intended to be part of maintaining a strong, secure, and efficient treasury. No need to speculate—this is all standard practice for managing operations at WLFI.”

These comments come from the blockchain analysis platform Lookonchain, which revealed a series of high-value transfers by WLFI.

According to the platform, the DeFi project converted 103 Wrapped Bitcoin (WBTC), valued at $9.89 million, into 3,075 Ethereum (ETH). It then deposited 18,536 ETH, worth nearly $59.8 million, into Coinbase. Afterward, WLFI spent $1.7 million in Tether (USDT) to acquire 17.62 WBTC at $96,491 per token.

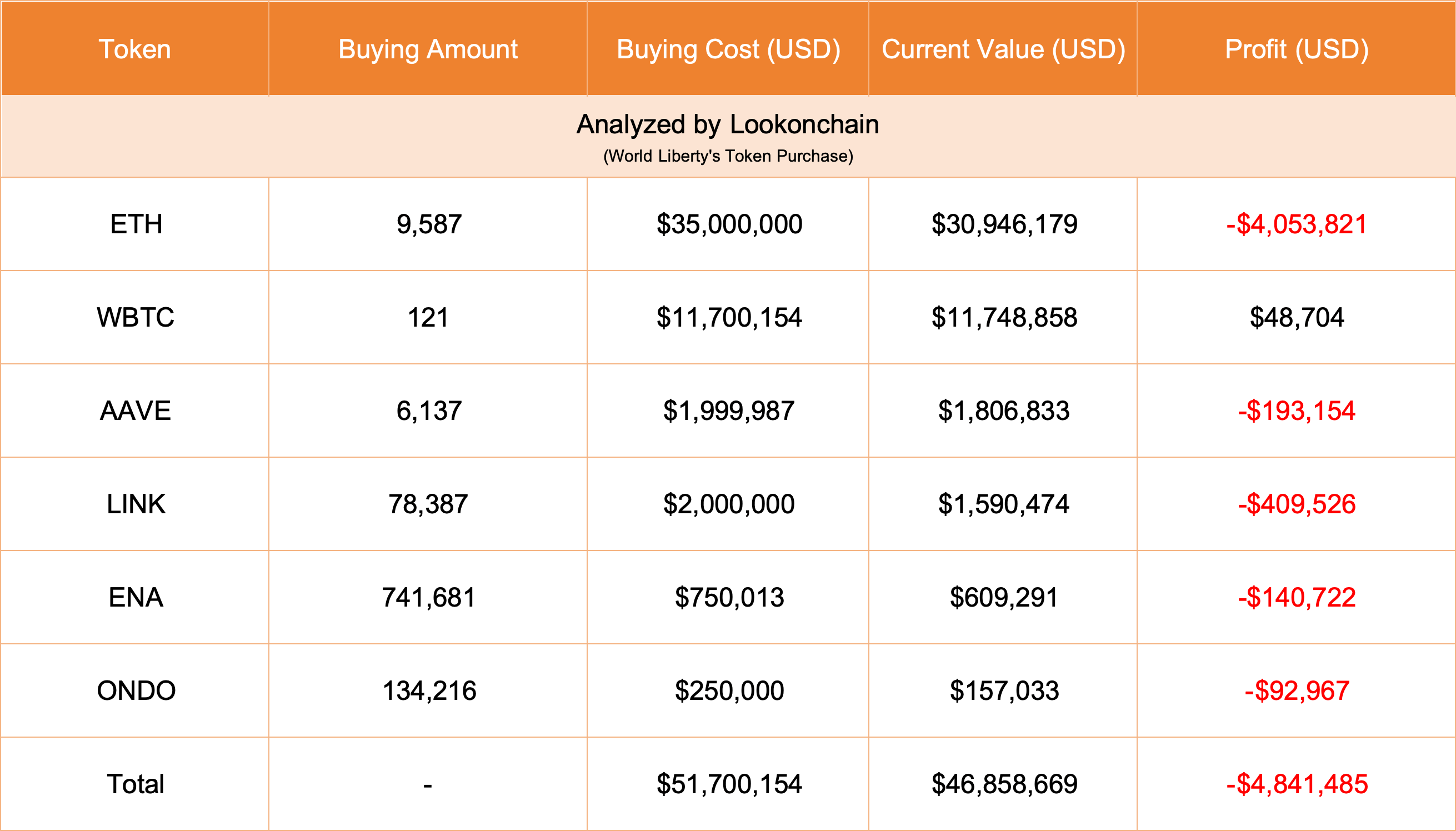

These transactions followed the project’s recent accumulation of several DeFi tokens, including Aave, Chainlink, and Ondo. However, Lookonchain noted that WLFI has incurred a $5 million loss from its recent asset allocations.

Meanwhile, data from Arkham Intelligence shows that WLFI’s wallet holds approximately $16.7 million in various assets at press time.

What next for WLFI?

This activity marks WLFI’s first significant transaction since December when it expanded its portfolio with a range of De

Go to Source to See Full Article

Author: Oluwapelumi Adejumo