Key Takeaways

What triggered Pi Network’s 21% surge and breakout above $0.27?

A combination of whale accumulation, surging trading volume, and bullish futures positioning fueled Pi’s strong breakout.

Can PI maintain its momentum and extend the rally toward $0.36?

Sustaining a price above $0.27 is crucial; continued buy-side dominance could drive a push toward the $0.36 resistance zone.

Since early October, Pi Network [PI] has witnessed a dramatic reversal, soaring over 21% in the past 24 hours to trade at $0.25.

Its market capitalization climbed to $2.08 billion, while trading volume spiked 535% to $61.7 million, signaling a revival in trader activity.

After weeks of consolidation between $0.20 and $0.23, Pi finally broke out of its range, supported by whale accumulation and bullish derivatives flows.

Pi finally breaks the chains as buyers return

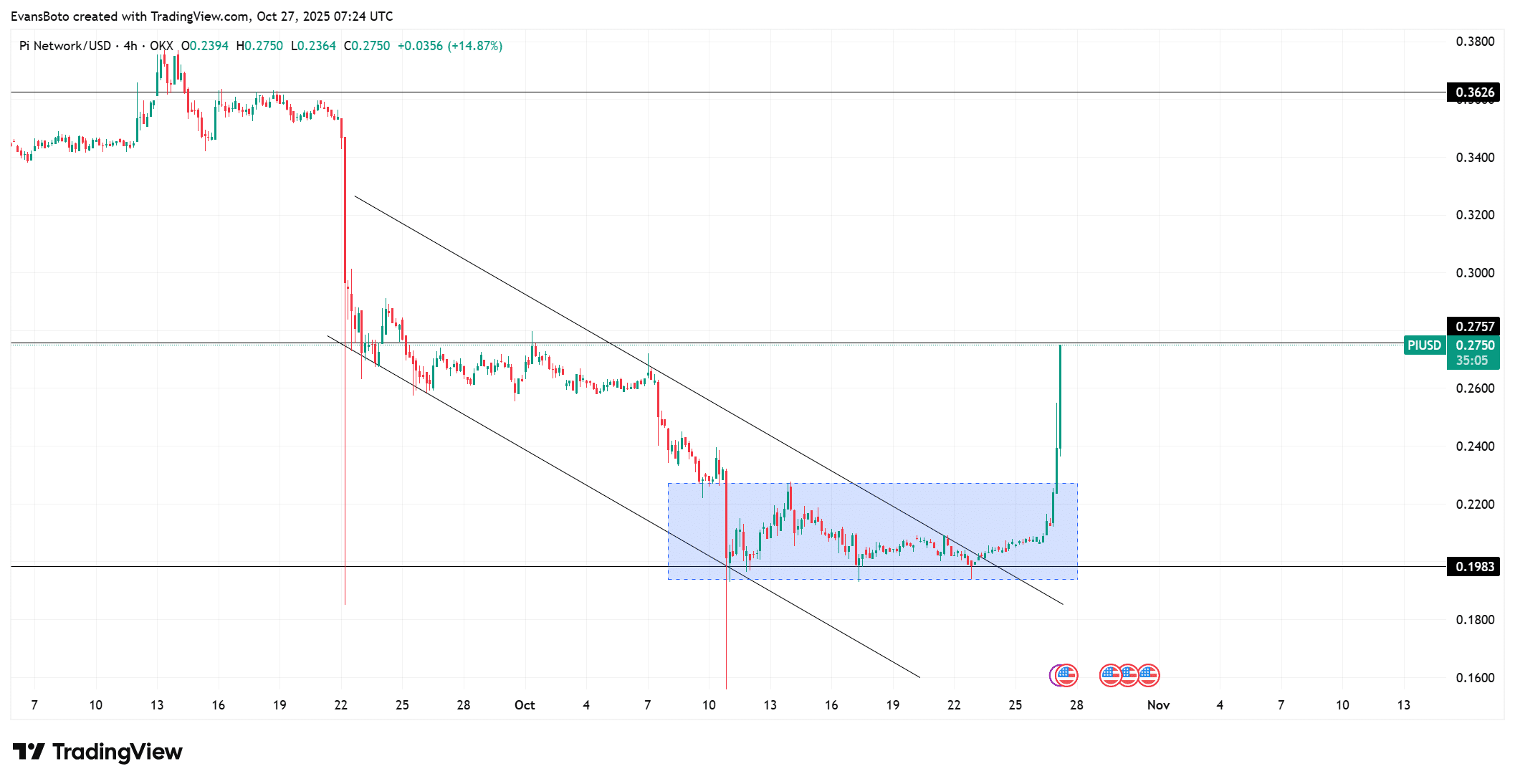

Pi’s breakout from a descending channel confirmed a shift in short-term market structure. The altcoin crossed its key resistance at $0.2757, reinforcing bullish sentiment after multiple failed retests of the $0.23 level.

That move aligned with buyers defending higher levels for the first time since September. The next major target sits near $0.3626, matching a prior supply zone.

However, a rejection around this level could pull Pi back toward the $0.23 support range.

Derivatives data reveal bullish conviction

Data from Futures Taker CVD showed a strong “taker buy dominant” trend, confirming aggressive long positioning in the Derivatives market. This pattern suggested that traders expected continued upside, supported by a parallel surge in leveraged participation.

The rally also combined expanding Spot Volume with long dominance, implying that conviction—rather than short liquidations—was be

Go to Source to See Full Article

Author: Evans Boto