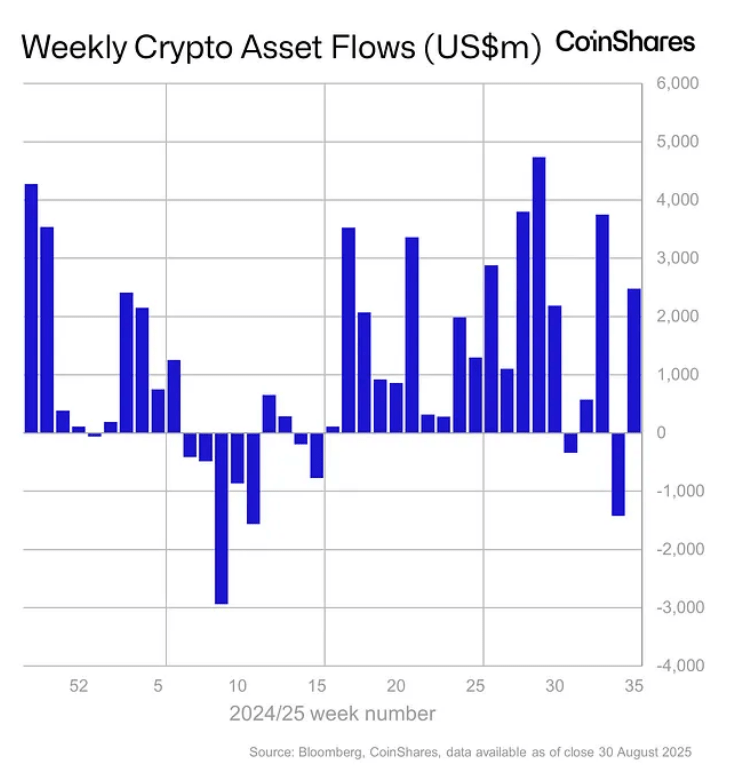

In CoinShares latest report net inflows for digital asset products reached $2.48 billion last week, more than doubling the monthly inflows for August.

Summary

- CoinShares’ recorded $2.48 billion of inflows last week, bringing the monthly total to $4.37 billion.

- Ethereum continues to outperform Bitcoin, accumulating inflows that have reached $1.4 billion last week.

According to the latest report by European investment firm CoinShares, last week’s net inflows reached as high as $2.48 billion. This boost in capital has raised August’s monthly net inflows to a total of $4.37 billion from just $1.89 billion.

In addition, the total year-to-date inflows have soared to around $35.5 billion.

It appears that digital asset investment products were able to recover from the large outpouring of capital from just a week prior. On the week of August 18, the firm recorded outflows of $1.43 billion; the largest it has seen since March.

Meanwhile, this month’s inflows signal strong investment sentiment, with positive signals all week except for Friday. This downturn was due to the release of the Core Personal Consumption Expenditures Price Index.

The Core PCE data measures inflation in the U.S. economy by tracking consumer prices for goods and services. According to CoinShares, the results from the data “failed to support expectations of a Federal Reserve rate cut in September, disappointing digital asset investors.”

The underwhelming Core PCE data combined with the recent negative price momentum led to a drop in the value of Assets Under Man

Go to Source to See Full Article

Author: Trisha Husada