- Whale withdrawals and resistance tests highlighted Chainlink’s pivotal position at $24–$25.

- Mixed on-chain metrics and declining exchange reserves suggested reduced selling pressure but uncertain momentum.

Over the past week, whale activity has stirred the Chainlink [LINK] market, as a whale withdrew 594,998 LINK, valued at $17.31M, from Binance, including a recent 65,000 LINK withdrawal worth $1.81M.

This development has left traders speculating—are these moves indicative of long-term confidence or preparation for significant market activity? At press time, LINK trades at $24.63, reflecting a 9.11% decline in the past 24 hours.

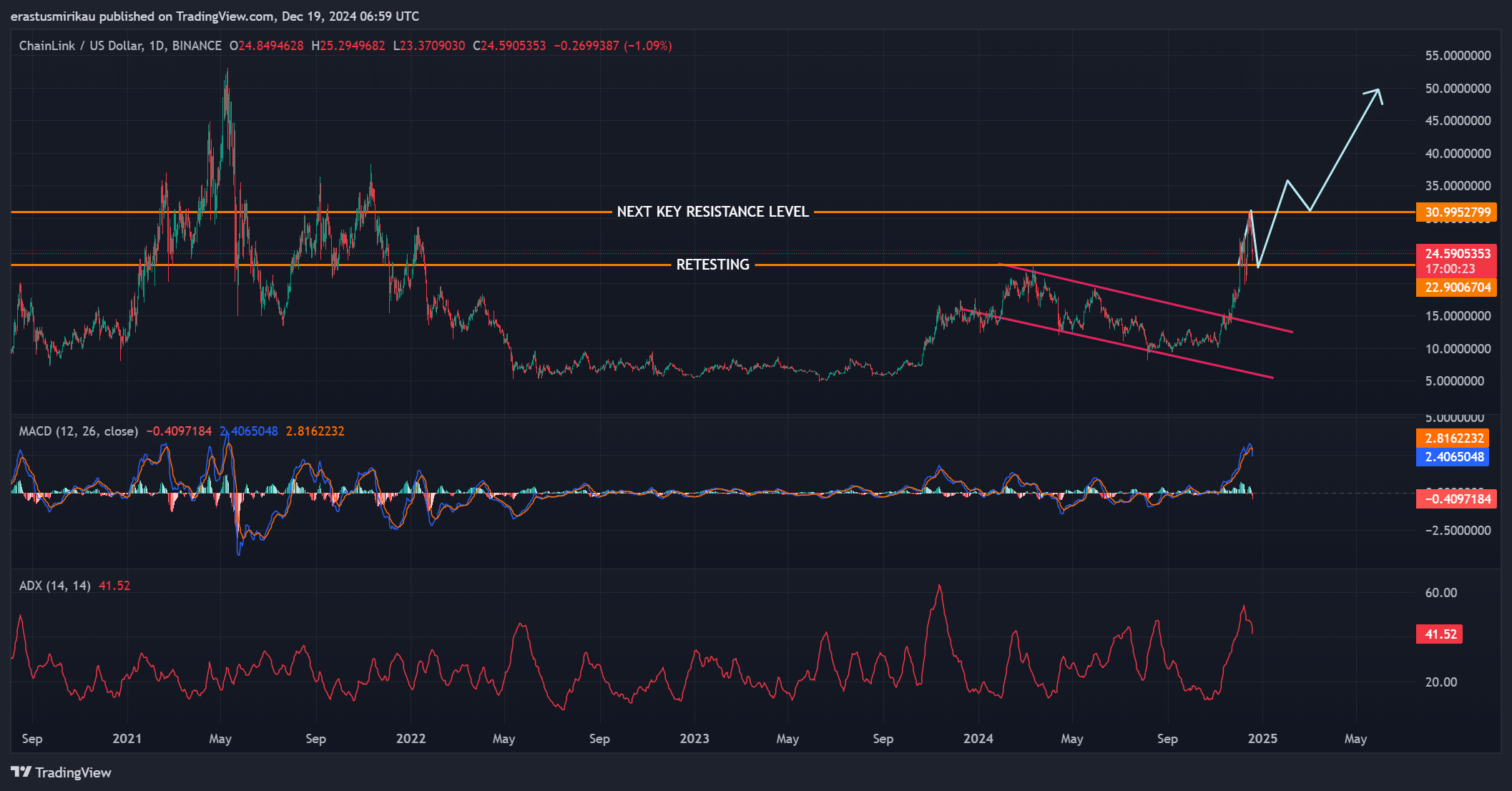

Analyzing price momentum and resistance levels

At the time of writing, Chainlink was testing a crucial resistance zone between $24–$25, a level that has acted as a significant barrier in previous rallies. The MACD suggests that bullish momentum persists, though it appears to be losing strength.

Additionally, the ADX value of 41.52 highlights the strength of the current trend. If LINK can decisively break through this resistance, the next target is $30.99, a key psychological and technical level.

However, failure to maintain this momentum could result in a pullback toward $22, a zone of strong support.

Source: TradingView

LINK address activity reveals mixed trends

On-chain metrics show contrasting trends in LINK’s address activity. New addresses have increased by 1.94%, indicating fresh interest. However, active addresses have fallen by 1.39%, suggesting slightly reduced engagement.

Additionally, zero-balance addresses have dropped significantly by 13.87%. This shift of LINK holdings to wallets indicates confidence among long-term holders. These mixed signals reveal growing interest but also highlight uncertainties about the asset’s short-term trajectory.

Author: Erastus Chami