There is no good news from the real estate market in the United States. Rising interest rates, inflation, and the specter of a recession are pushing home purchase and rental housing prices to unprecedented levels.

Buying a house in the US today is extremely expensive, as rising demand is not keeping up with the supply of properties available on the market. This has led to an absurd phenomenon where there are currently more real estate agents in the US than single-family homes available for sale.

Buying a House Getting Further Out of Reach for Many

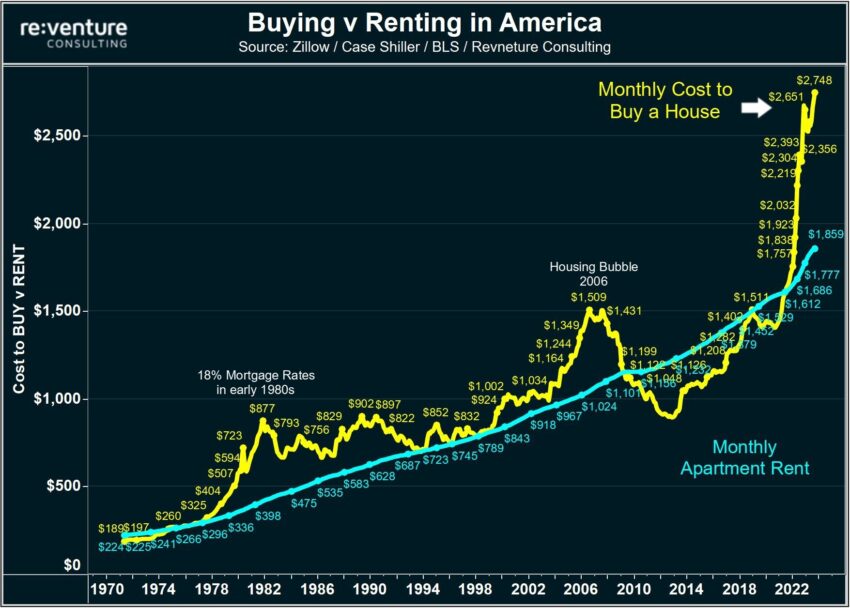

The official account of The Kobeissi Letter, an industry-leading analyst of global capital markets, recently published the latest data on the US real estate market. The exponentially rising costs of renting and buying a house in the United States show the extent of the real estate market’s crisis.

The data shows that the average cost of buying a house has reached a new all-time high of $2,748 per month. Since 2020, this represents a 90% increase. This alarming spike is illustrated by the parabolic yellow line in the chart below.

If translated to an annual scale, an American today needs to spend nearly $33,000 to pay for the house he or she buys.

These numbers are extremely high when compared to average incomes in the US. This is because it turns out that $33,000 represents 46% of the median annual pre-tax income in the US. However, post-tax US house buyers spend almost 70% of their income on household fees.

Go to Source to See Full Article

Author: Jakub Dziadkowiec