- Bitcoin traders de-risk as FOMC uncertainty looms.

- With a 9% January gain, can Trump’s policies fuel fresh momentum for BTC?

January has historically been a slow month for Bitcoin [BTC], but 2025 is bucking the trend with a 9% gain. Yet, a record drop in Open Interest and negative CME premiums signal that traders are cutting their BTC exposure.

With the U.S. economy as the key trigger, is this just caution—or the beginning of a larger shift?

What’s happening in the U.S.?

U.S. investors are the ones to watch right now. The Coinbase Premium Index (CPI) has been in the red for seven days straight, aligning with BTC’s dip from $104K to $102K.

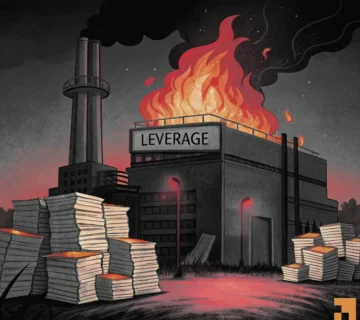

As de-risking continues, with over $3 billion in Futures positions closed, buying pressure remains tepid.

With the FOMC meeting looming large, traders are stepping back from high-risk leverage trades, keeping any major surge in open positions off the table – for now.

Although inflation seems under control and Trump is pushing for lower oil prices, it’s the execution of these policies that has the market in a holding pattern. Until clarity comes, traders are staying on the sidelines.

Bitcoin often performs well when oil prices fall. If oil helps cool inflation, the Fed may cut rates. Watch this closely—it could be a key factor in the coming days.

Bitcoin in January

Between Trump’s inauguration, MicroStrategy’s ongoing major Bitcoin accumulation, and a 10-month high in ETF vo

Go to Source to See Full Article

Author: Ripley G