Bitcoin climbed above $117,000 during the early trading hours today, its strongest level since early August, as traders positioned around the Federal Reserve’s interest rate decision.

The outcome of the Federal Open Market Committee (FOMC) meeting, due later today, will define the risk landscape for the rest of the year.

Market expectations of an easier monetary policy have fueled the latest momentum.

According to a Bitwise report, softer US inflation readings have pushed futures markets to fully price in a quarter-point rate cut, with odds near 93% that cumulative cuts will reach 75 basis points before year-end.

As a result, the prospect of looser conditions has energized crypto markets, with Bitwise highlighting “a return to slightly bullish sentiment” as risk appetite in the market becomes more evident.

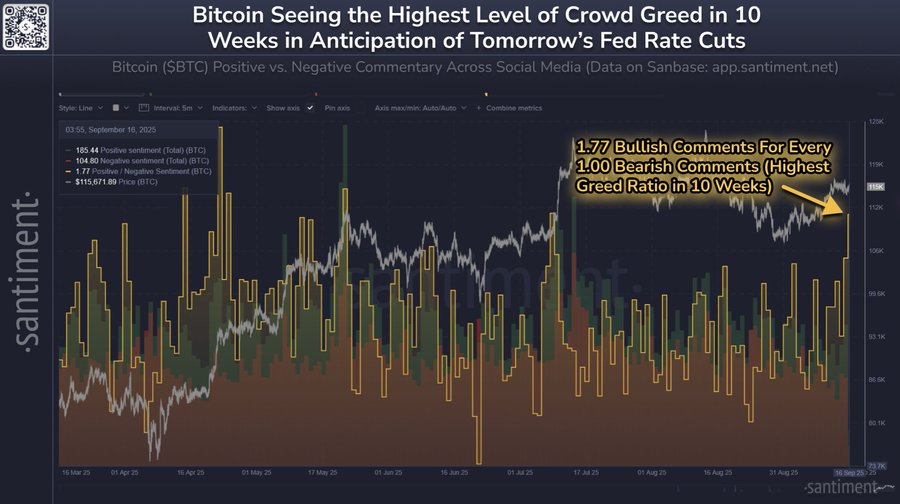

This position corroborates that of blockchain analysis platform Santiment, which noted that bullish optimism has surged on social channels like X.

Santiment noted that bullish commentary now makes up 64% of all crypto discussions, its highest “crowd greed” reading since July.

Moreover, stablecoin flows into exchanges also signal that real capital i

Go to Source to See Full Article

Author: Oluwapelumi Adejumo