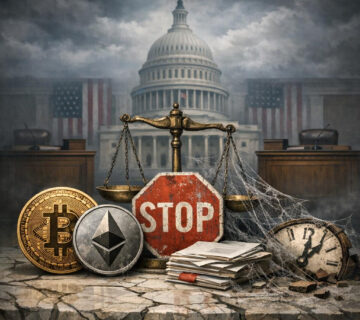

As Bitcoin continues to trade sideways, gold has quietly stolen the spotlight, surging to new all-time highs as investors flock to safety amid global economic uncertainty. The move underscores a widening divergence between traditional and digital stores of value, raising questions about BTC’s role as digital gold in a macro environment that should favor both.

Momentum Gap: Bitcoin Stagnation And Gold Surge

In a compelling and sobering perspective, the current state of the crypto market, particularly Bitcoin, is contrasting sharply with the performance of gold. As analyst Exy pointed out on X, Gold is breaking all-time highs week by week, and yet BTC hasn’t moved an inch. EXY also revealed that social risk is at zero, and Google Trends remains stagnant for BTC searches.

Exy describes the current crypto environment as an internal struggle, where participants are pvping, liquidating, scamming, pumping, and dumping against each other. However, the market tops are in euphoria and not in a stagnant period, as observed in the ongoing movement of Gold. Interestingly, when gold starts to consolidate, other risk assets such as BTC could finally catch their bounce.

Furthermore, the social risk will start improving once we see a consistent rate cut by the Federal Reserve (FED), which allows the normies to have extra cash monthly, and also quantitative easing (QE) to pump our assets. “Regardless, this isn’t over yet,” Exy noted.<

Go to Source to See Full Article

Author: Godspower Owie