Bitcoin [BTC] sits at a macro-on-chain inflection point; seller exhaustion is visible, yet demand has not decisively reasserted itself.

Until exhaustion translates into sustained buyer conviction, apparent stability risks concealing deeper structural fragility beneath the surface.

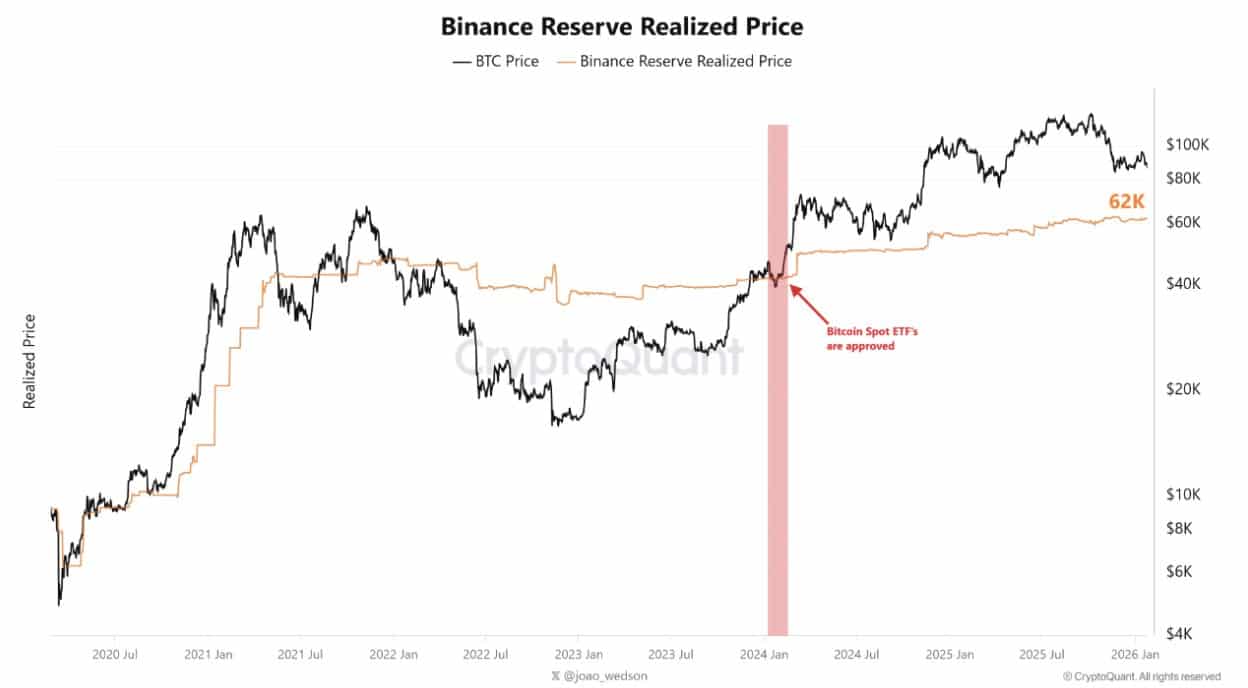

Bitcoin continues to hold above Binance’s $62,000 reserve realized cost, a level untested since spot ETF approval, signaling that marginal sellers are largely exhausted.

Historically, this metric marked cycle bottoms, as seen near $42,000 pre-2024, reinforcing its structural relevance.

Moreover, realized losses have flattened, indicating forced distribution has mostly cleared rather than accelerating further.

Consequently, downside pressure weakens as reactive selling fades.

But accumulation is not implied by exhaustion alone. Without a clear expansion in realized profits or fresh capital absorption, the market remains in equilibrium.

At this stage, this signifies stabilization rather than renewed demand leadership.

Bitcoin enters a wait-and-see risk regime

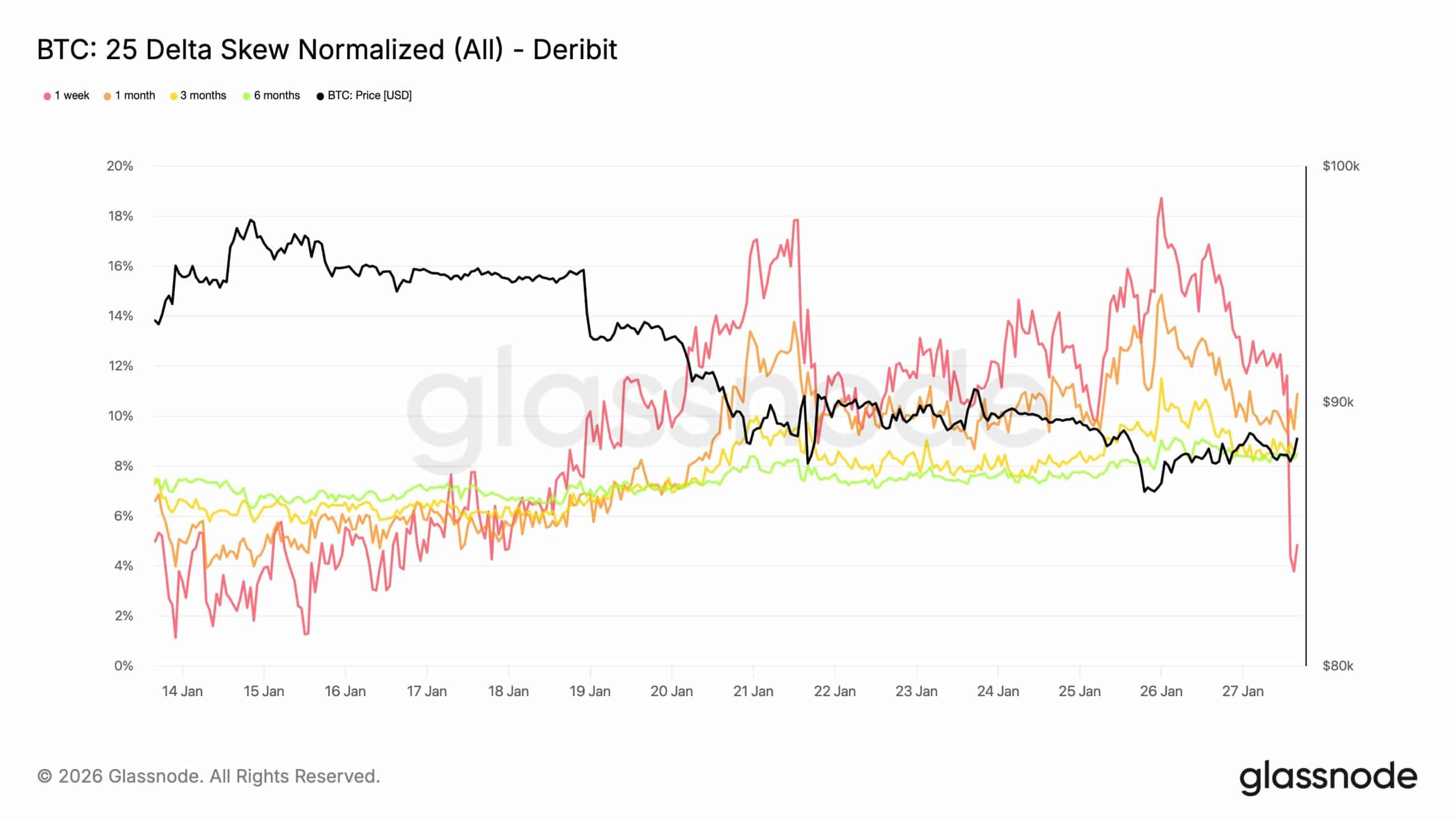

Bitcoin’s Options structure highlights a shift in how risk is priced, not a shift toward optimism.

Earlier on, a short-dated 25-delta skew pushed above 15%, indicating urgency to hedge the near-term downside.

However, as expected, catalysts failed to materialize, and realized volatility stayed muted while demand faded.

As a result, short-term skew compressed sharply toward 4–5%, signaling that immediate fear has been repriced lower.

Crucially, longer-dated skews remain anchored near 7–9%. This persistence matters because it shows traders are not rotating bullish.

Instead, they are reducing expensive near-term insurance while keeping protection further out the curve.

As a result, caution eases into neutrality rather than confidence, reinforcing consolidation instead of trend continuation.

Decoding the absence of a sustained spot bid

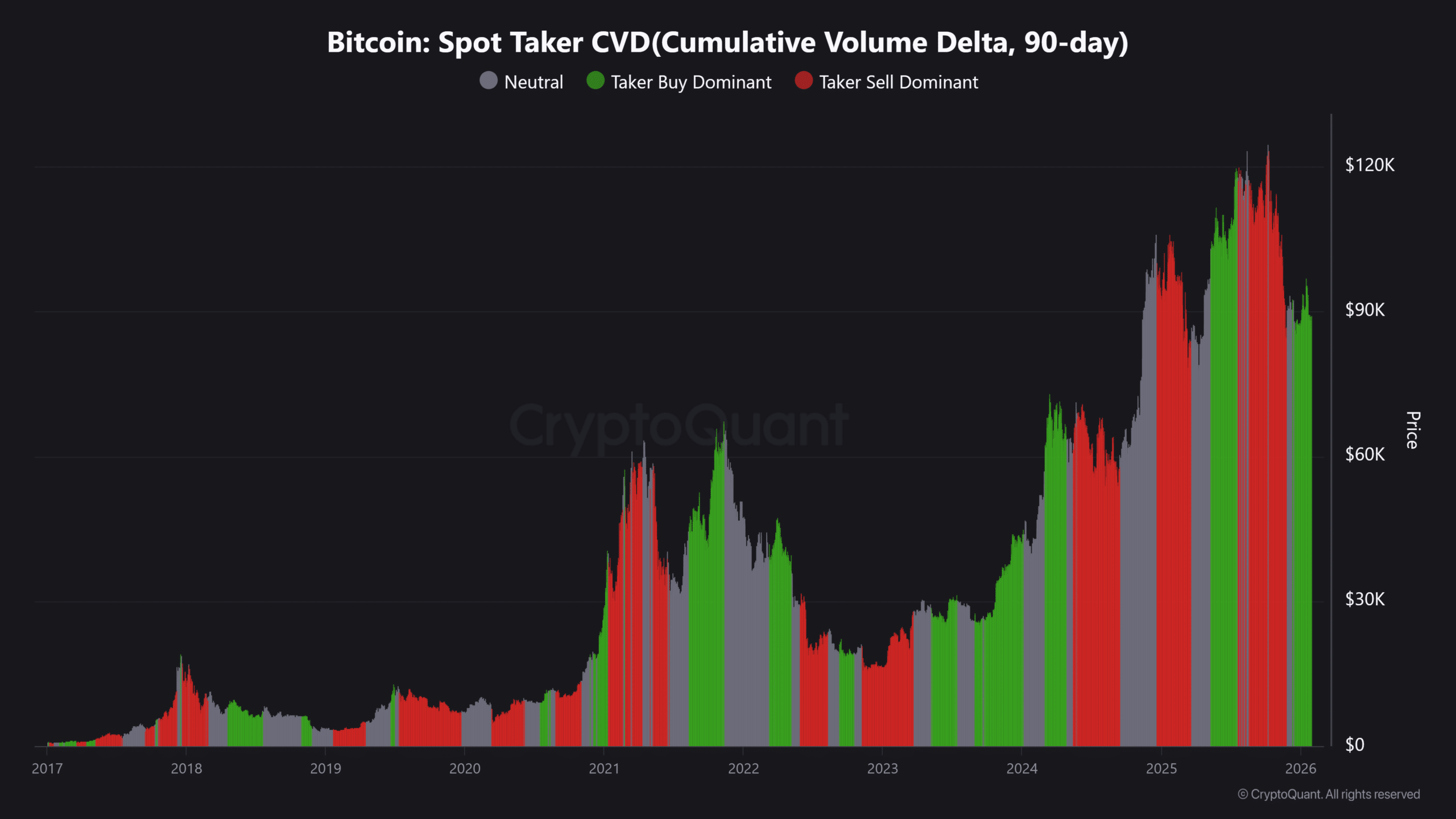

Spot taker CVD reveals buyer hesitation beneath the headline price strength. Buyers do step in, as brief green surges show, yet these impulses fail to persist.

Instead, rallies fade quickly, flipping back to neutral or sell-dominant flow. As a result, demand appears reactive rather than anticipatory.

Even during advances toward the $90,000–$120,000 zone, cumulative buying lacks follow-through.

This absence of a sustained spot bid confirms hesitation, not conviction. Meanwhile, leverage does not expand decisively.

Volatility remains episodic rather than trend-driven. This implies that risk appetite stays constrained.

Buyers defend levels when pressured, but they do not press advantage. The break fails because participation lacks aggression.

All this together, across on-chain cost bases, options positioning, and spot flow dynamics.

However, Bitcoin shows stabilization; without leadership, seller pressure has faded, risk is deferred, and demand remains reactive rather than conviction-led.

Final Thoughts

- Seller exhaustion has stabilized Bitcoin above key cost bases, but without sustained spot demand or profit expansion, conviction remains absent and consolidation dominates.

- Risk is being repriced rather than resolved, as defensive options positioning and reactive spot flows signal neutrality instead of renewed bullish leadership.

Go to Source to See Full Article

Author: Muriuki Lazaro