Key Takeaways

Why is Bitcoin struggling to find a bottom?

Traders are holding back, waiting for $17 billion Bitcoin options volatility to settle, or stocks to overheat, leaving a lot of capital on the sidelines.

What’s the near-term outlook for BTC?

Bitcoin could see further retracement and elevated volatility, especially with macro pressures and the $17 billion options expiry looming.

Investor appetite is shifting, and Bitcoin [BTC] is feeling the pressure.

On the macro side, the U.S. stock market is ripping. All three major indices [$DJI, $NASDAQ, and $SPX] have hit fresh all-time highs, signaling money chasing legacy markets post-FOMC.

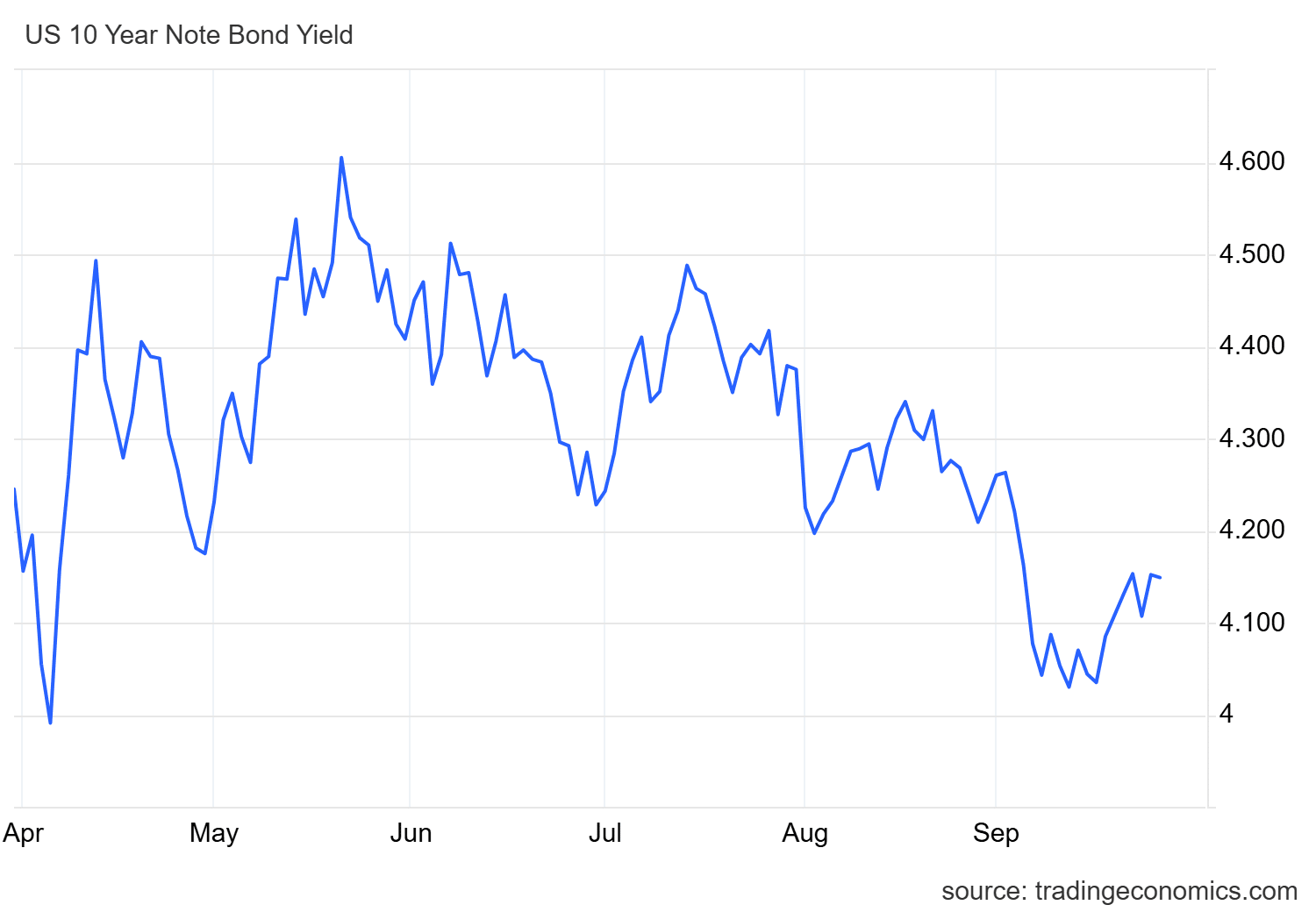

Meanwhile, the U.S. 10-year treasury yield slipped to a quarterly low of 4.01% in mid-September, hinting that money’s chasing safer bonds while risk-on bets like Bitcoin cool off. In short, BTC’s bid wall is weakening.

Despite the 25 bps rate cut, investor conviction in BTC hasn’t returned.

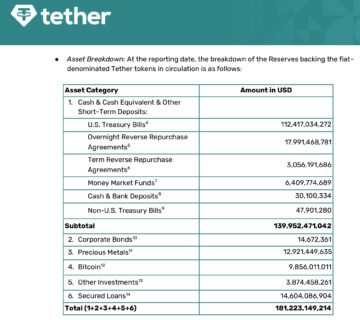

Meanwhile, stablecoin supply has exploded from $204 billion in January to $308 billion in September. That’s over $100 billion in dry powder still sitting on the sidelines, ready to rotate into BTC once risk-on flows return.

The question: When does the rotation hit? Is the market waiting on a cleaner entry, a deeper rate cut, overheated stocks, or the $17 billion BTC options expiry to clear before FOMO kicks back in?

Bitcoin eyes max pain ahead of massive options expiry

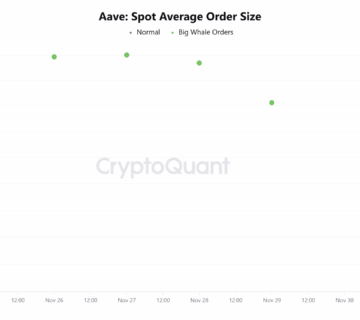

The options market is seeing heavy activity ahead of the upcoming expiry. <

Go to Source to See Full Article

Author: Ritika Gupta