This quarter, institutional appetite for digital assets took a hit.

That’s surprising given 2025 has been huge for mainstream adoption. From ETF launches, strategic partnerships, to stablecoin moves, the year has genuinely boosted crypto’s institutional credibility.

However, while altcoins rode that wave, Bitcoin [BTC] lagged. To put this into perspective, BTC ETFs have seen a $300 million net outflow in December so far, while Solana [SOL] pulled in $741 million.

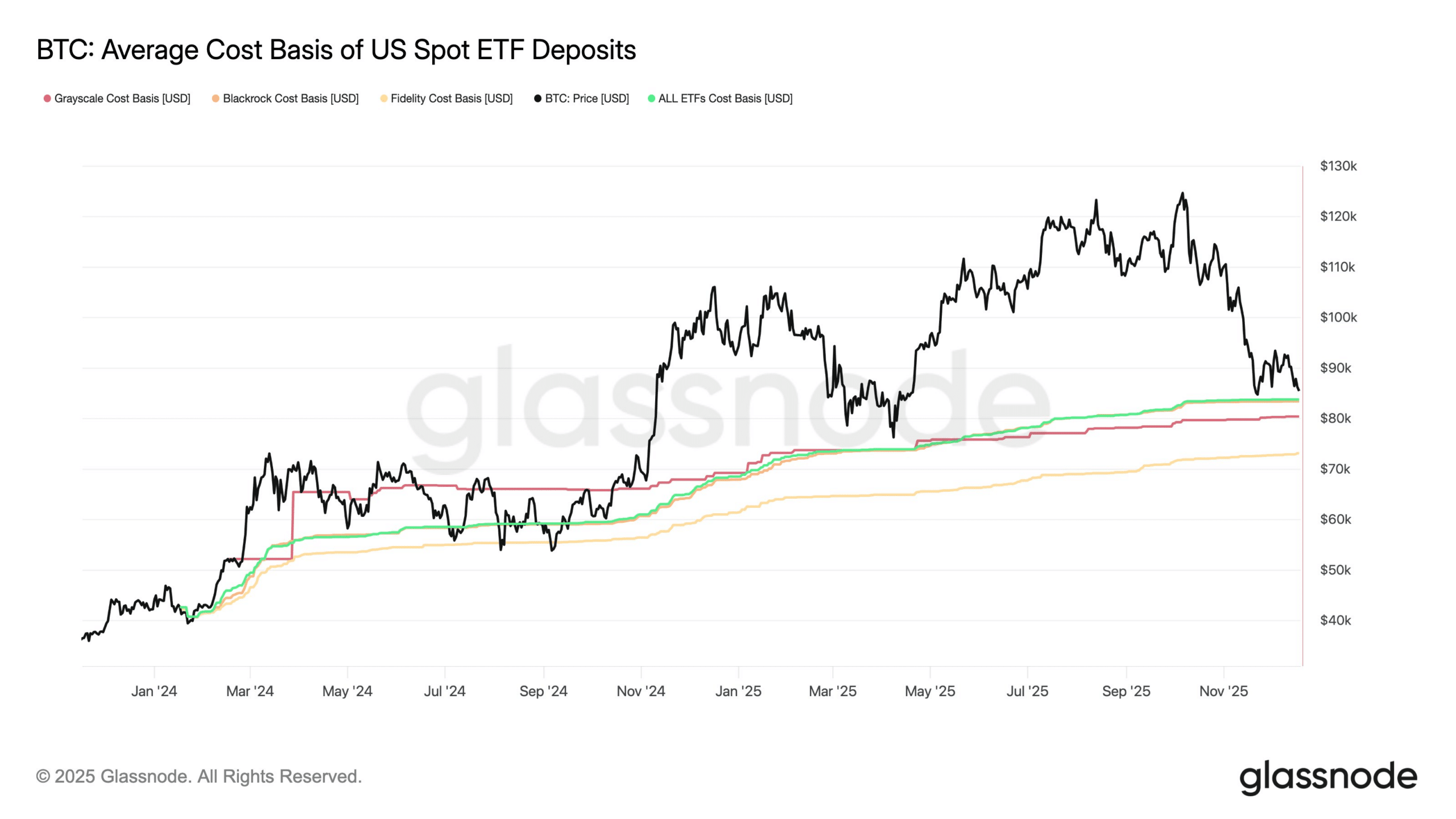

And yet, looking at the chart, this might be the start of a bigger trend.

Glassnode data shows Bitcoin has retraced toward the average cost basis of U.S. spot ETFs, hovering around $85k. Simply put, ETF BTC HODLers are at a breakeven zone, making them a key cohort to watch.

From a technical angle, this makes $85k a key support. How Bitcoin behaves around this area will indicate whether bears take control or bulls defend it to keep the FOMO alive, potentially setting up the next leg higher.

Bitcoin support zone tests market conviction

U.S. spot demand continues to act as a key catalyst for Bitcoin.

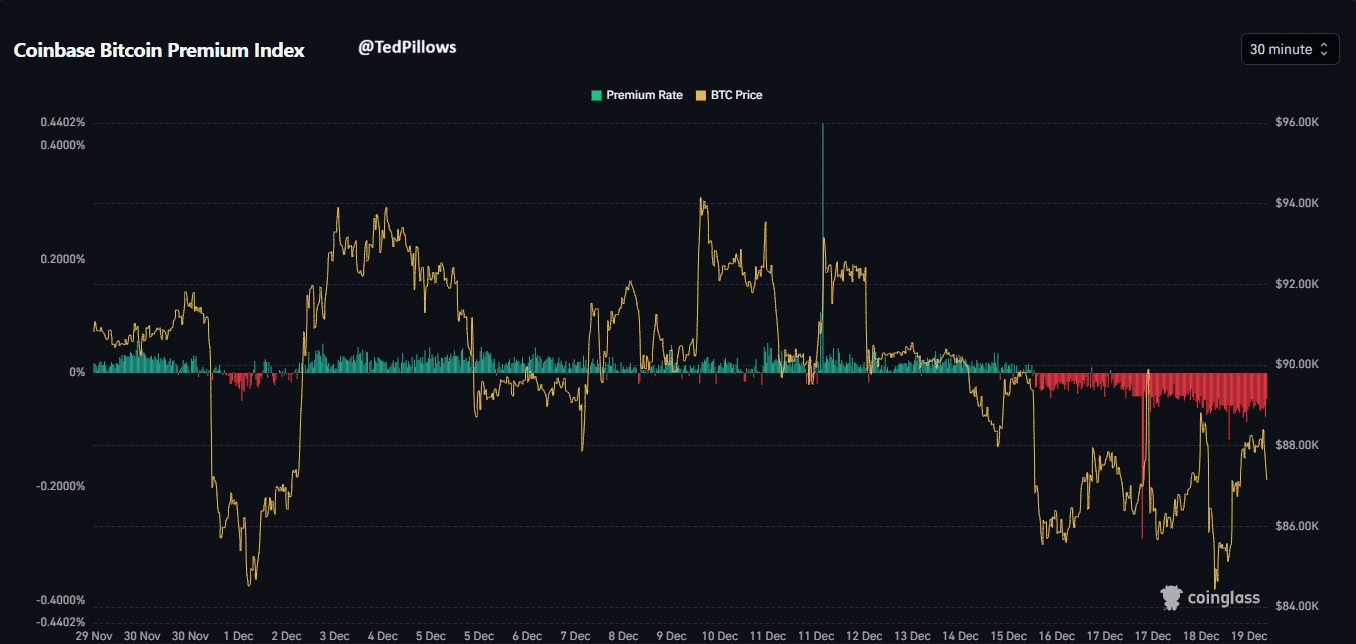

On the ETF side, conviction hasn’t really returned, leaving ETF Bitcoin holders at risk of selling as BTC nears their cost basis. At the same time, Bitcoin’s Coinbase Premium Index (CPI) shows FOMO is still muted.

As the chart shows, BTC’s CPI is sinking further into the red, suggesting U.S.-based investors are cautious about buying the “dip.” It’s a clear signal that the market’s still in a bear phase, and sentiment remains fragile.

Given this context, calling $85k a solid floor is still too premature.

On-chain data shows long-term Bitcoin holders (LTHs) are still taking profits, while short-term holders (STHs) are capitulating as BTC trades far below its $126K peak, forcing them to continue realizing losses.

In short, Bitcoin is still supply-heavy. With all this in play, the $85k level remains fragile, and with ETF holders at risk of going underwater, a deeper correction can’t be ruled out.

Final Thoughts

- Glassnode data shows Bitcoin hovering around $85k, the average cost basis of U.S. spot ETFs, putting ETF holders at a key breakeven zone.

- Weak U.S. demand and capitulation by long and short-term holders put the level at risk, with ETF holders potentially selling if underwater.

Go to Source to See Full Article

Author: Ritika Gupta