The Bitcoin futures premium reached its highest level in 18 months on July 4. But traders are now questioning whether the derivatives metrics indicate “excessive excitement” or a “return to the mean” after a prolonged bear market.

BTC price gains capped by regulators, macroeconomics

Bitcoin’s (BTC) price has been trading in a narrow 4.4% range since June 22, oscillating between $29,900 and $31,160 as measured by its daily closing prices. The lack of a clear trend might be uncomfortable to some, but that is a reflection of the opposing drivers currently in play.

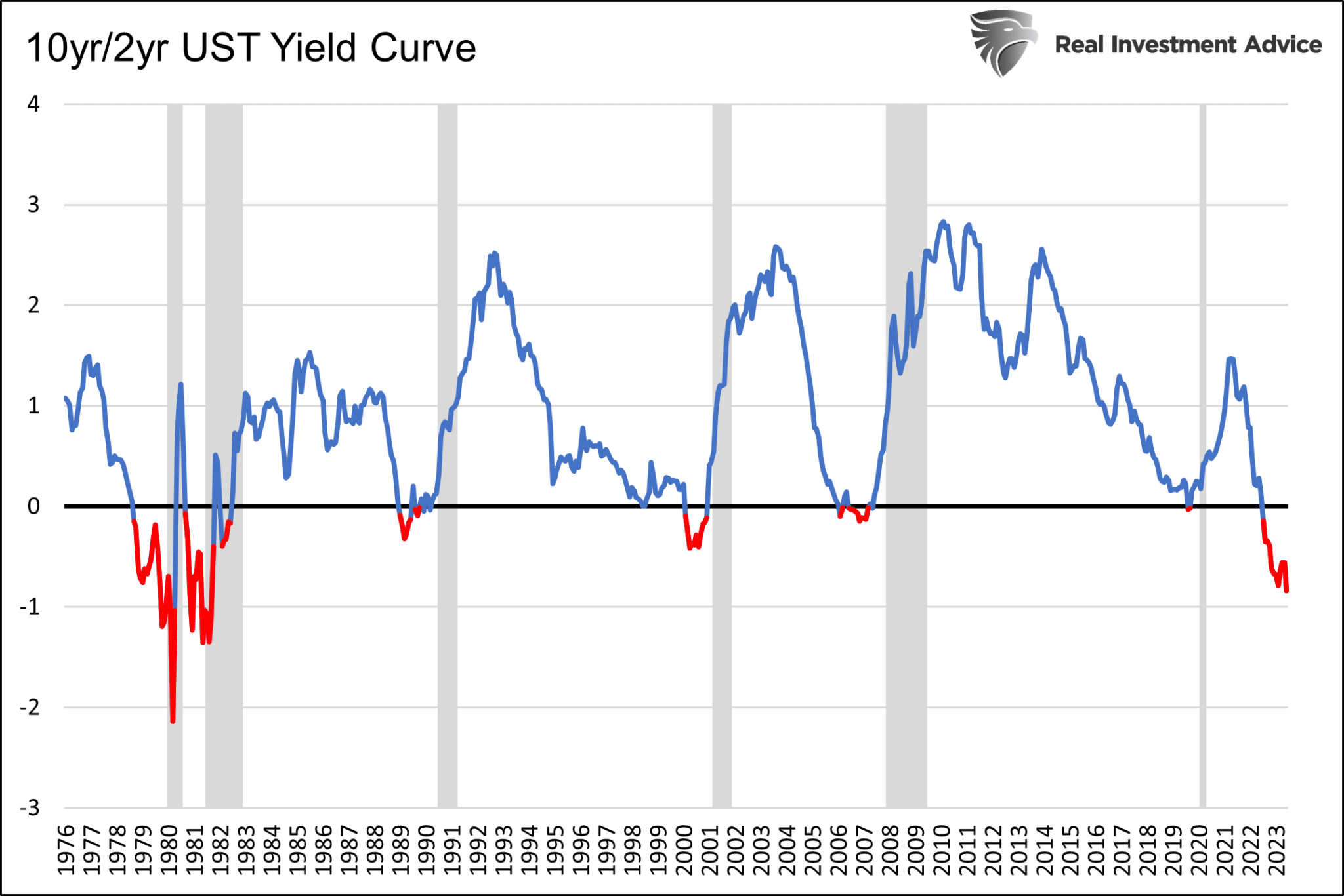

For instance, investor sentiment was negatively affected by the historic inversion of the Treasury yield curve in the United States, which reached its highest level on record.

The closely monitored inverted spread between the two-year and 10-year Treasury notes has reached its highest level since 1981, standing at 1.09%. The phenomenon known as yield curve inversion, when shorter-dated Treasury notes trade at higher yields than longer-dated notes, typically precedes economic recessions.

Related: Fed pauses interest rates, but Bitcoin options data still points to BTC price downside

On the other hand, signs of strength in the U.S. economy have reportedly driven investors to price in the possibility of further

Go to Source to See Full Article

Author: Marcel Pechman