Key Takeaways

Bitcoin’s price was just above the average short-term holder cost basis at $107.8k, which should act as a solid support level. The MVRV percentile showed no strong upward or downward signals.

Bitcoin [BTC] dropping below the $112k level meant that the short-term outlook was bearish. Bears pushed the market further down, forcing BTC below $110k.

Moreover, a spike in the Coin Days Destroyed (CDD) metric revealed that some holders were exiting the market. In fact, whale-driven Realized Profits of nearly $4 billion added to the cautious mood.

Having said that, the rotation of capital from Bitcoin to Ethereum [ETH] contributed to the cooling spot ETF flows into BTC.

An Ethereum-led rally in Q4 appears possible, but can Bitcoin keep pace?

Trading Bitcoin using on-chain metrics

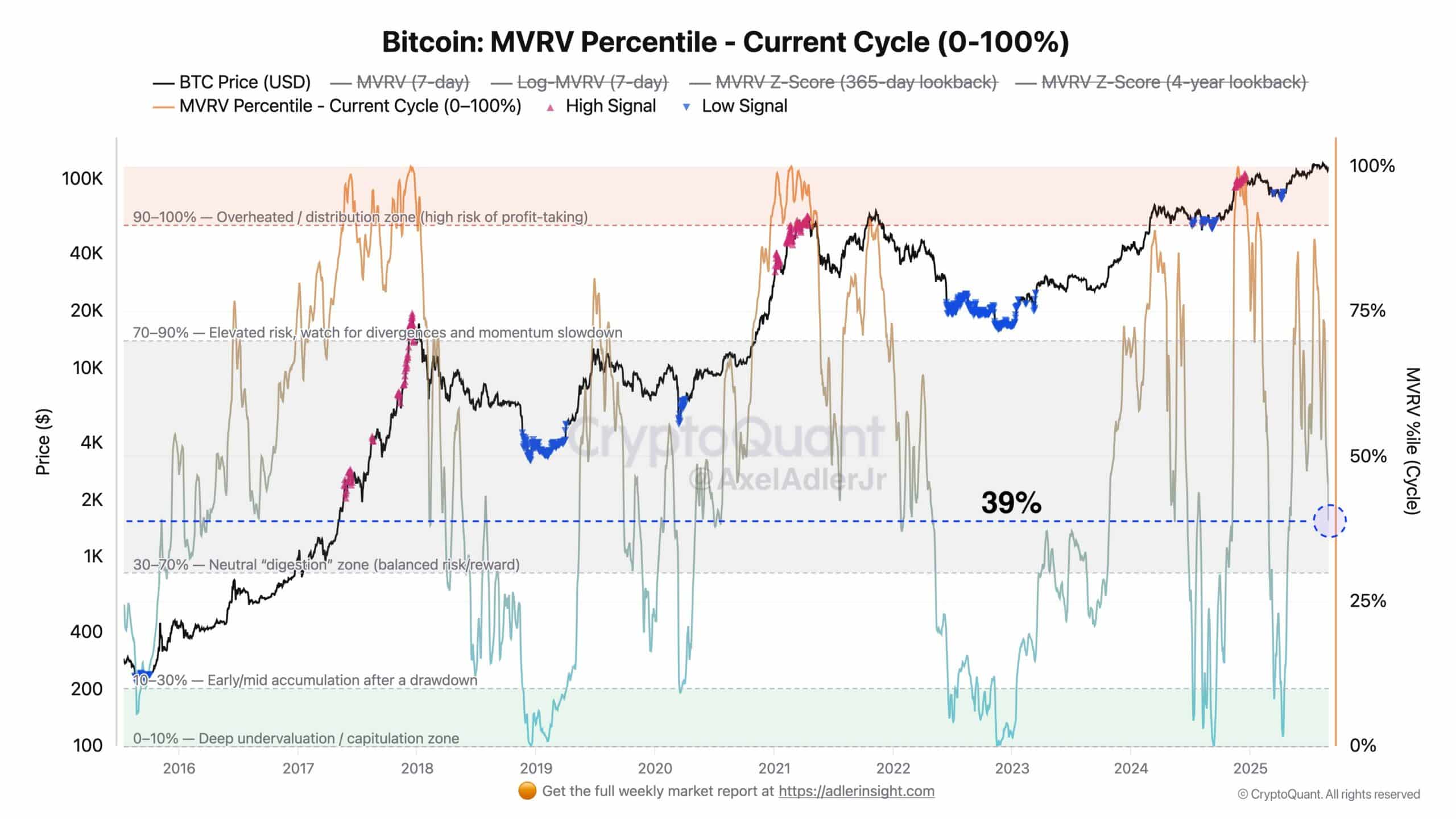

Source: Axel Adler Jr on X

In a post on X (formerly Twitter), crypto analyst Axel Adler Jr noted that the MVRV Percentile was at 39%.

This indicated a risk/reward balance at n

Go to Source to See Full Article

Author: Akashnath S