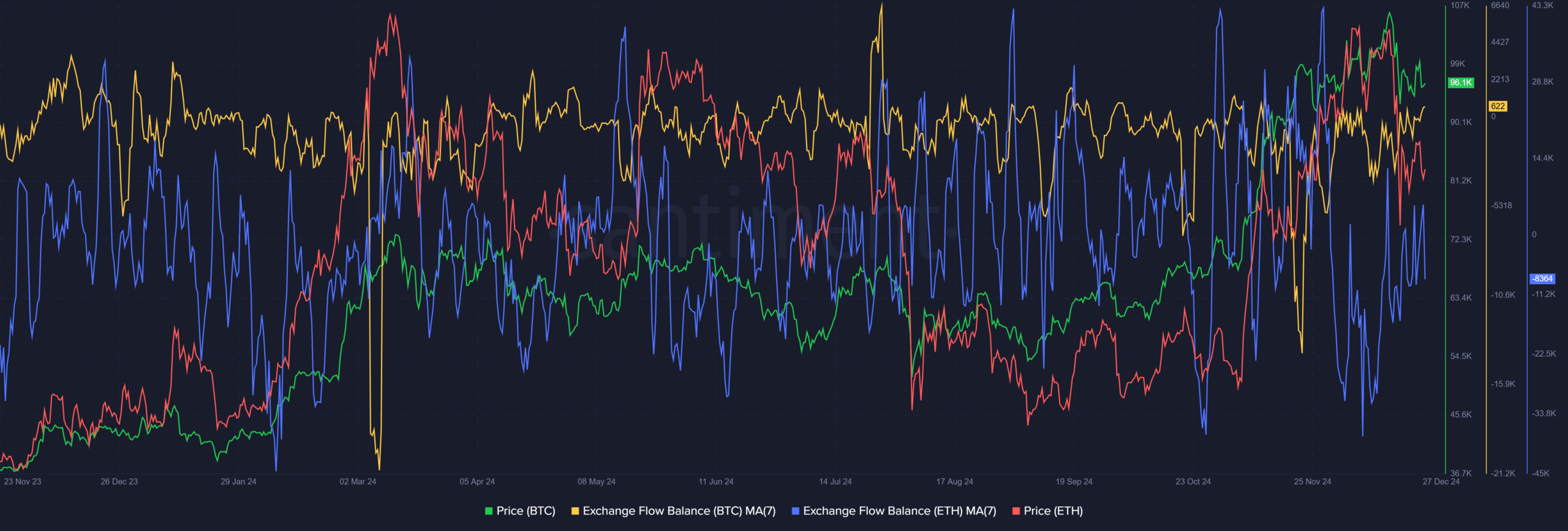

- Bitcoin and Ethereum netflows pictured similar patterns around Christmas

- Open Interest trends revealed wary sentiment among traders

Bitcoin [BTC] tends to see a Santa Claus rally in the week leading up to Christmas, before relinquishing those gains the following week. This has been the trend in recent years, starting in 2021. The year before that did not conform to this pattern.

This means that alongside Bitcoin, other major altcoins such as Ethereum [ETH] and Dogecoin [DOGE] have tended to see their prices slashed in the week following Christmas. Will this trend continue in 2024?

Major assets’ exchange flows and the price correlation

Source: Santiment

AMBCrypto examined the flow of BTC and ETH to and from exchanges around Christmas time. A 7-day moving average was used to smooth out the readings. In 2023, BTC saw the 7-day MA reach 1,481 BTC inflow on 22 December, and the 7-day ETH inflow was 32,805. A few days later, they went the opposite way.

The moving averages for exchange netflows for BTC and ETH reached -5,915 and -9,626 for BTC and ETH, respectively, on 26 and 27 December – A sign of accumulation.

Meanwhile, the price trends for the tokens were sideways for BTC and a 10% hike for ETH, leading into the final week of the year. Together, the metrics revealed that participants preferred to send tokens to exchanges to book some profits, and accumulated more the following week.

202

Go to Source to See Full Article

Author: Akashnath S