The fervor surrounding the potential approval of a United States-based spot Bitcoin ETF (exchange-traded fund) is reaching a crescendo. With Bloomberg Intelligence estimating a 90% chance of a nod from the Securities and Exchange Commission (SEC) by January 10, 2024, the crypto market’s pulses are racing.

The endorsement of such a product could spell a new dawn for Bitcoin’s price trajectory, potentially propelling it to $150,000.

Institutional Demand Grows for a Bitcoin ETF

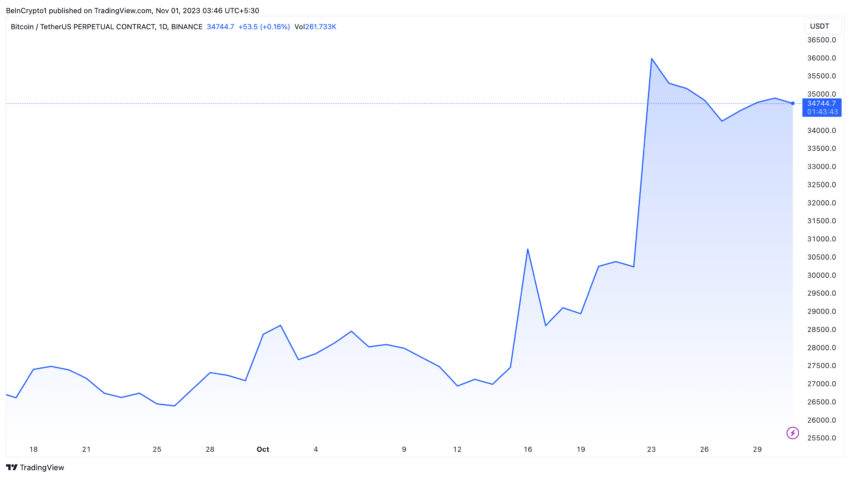

The whispers of BlackRock seeding its Bitcoin ETF have sent tremors through the crypto market. Subsequently nudging the price of Bitcoin to over $35,000. A figure unseen in nearly 18 months and a stark contrast to Ethereum’s 50% year-to-date rise.

The recent surge in Bitcoin’s price, marked by a 27% uptick in October, signals a buoyant market. Indeed, this speculation mirrors a broader sentiment that the US is on the cusp of embracing Bitcoin ETFs. This will align with the more progressive stance seen in Canada and Europe.

“Institutional demand for a spot Bitcoin ETF is stronger than ever before. For many institutions, it is a matter of when — not if — the SEC will approve a spot Bitcoin ETF,” Diogo Mónica, President of Anchorage Digital, said.

Go to Source to See Full Article

Author: Bary Rahma