The crypto market suddenly turned red on March 10 in the year’s worst sell-off. Bitcoin slipped below $20,000 for the first time in three months, and the market sentiments are bearish. The aftermath of the crash has leveraged traders reeling with millions of dollars in active trading positions liquidated during this period.

Derivative Traders Suffer Huge Losses

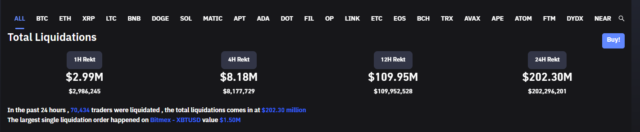

According to data from CoinGlass, derivative traders have lost about $202 million in the past 24 hours. Leveraged trading or futures market is when traders speculate using derivatives or loans from the exchange.

In this type of market, traders can either go long (speculate a rise in the coin) or go short (speculate a dip in the price). When the price reaches a certain level contrary to the trading position, the trade is liquidated and the trader loses his capital.

CoinGlass data further shows that BTC has the largest liquidation volumes of more than $60 million, with Ethereum coming a close second with $52 million. This is unsurprising as they are the two most traded tokens in the crypto market.

Related Reading: The Time to Sell Bitcoin (BTC) Is Now, Says Peter Schiff

The liquidation numbers are the highest recorded since mid-January. On that occasion, the bearish movement of the market saw more than $490 million liquidated in a single day across different exchanges.

Factors Affecting The Crypto Market Crash

The steep price dip affecting the crypto market has been coming following developments recently. Crypto bank Silvergate had reported on March 9, 2023, that it would shut down operations. This came less than a week after Silvergate Capital Corporation had indicated that it was evaluating whether it would con

Go to Source to See Full Article

Author: Olowoporoku Adeniyi