Bitcoin has been struggling to reclaim the $100K mark but remains resilient above the $96K level after a sharp market-wide selloff. Sunday night and early Monday saw a capitulation event, primarily affecting altcoins, leading to extreme volatility. BTC dropped over 9% in 24 hours, shaking investor confidence, only to recover more than 11% the same day, reinforcing its strength compared to the rest of the market.

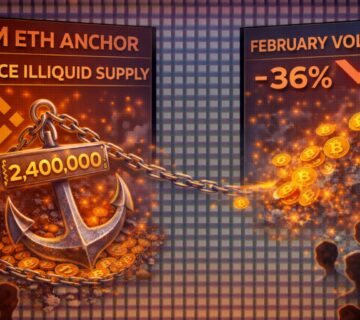

Despite the uncertainty, key metrics suggest that Bitcoin remains in a bullish phase. Top analyst Axel Adler shared insights revealing that the Bitcoin Coinbase Flow Pulse is currently signaling strong institutional interest. The absence of significant outflows typically seen in bear markets suggests that major players are still accumulating BTC rather than offloading it.

With Bitcoin stabilizing above crucial support levels, the market is now watching whether bulls can reclaim $100K and sustain momentum. If BTC continues to attract institutional demand, a breakout above all-time highs could be on the horizon. However, if BTC loses the $96K level, another wave of selling pressure could emerge. The coming days will be crucial in determining Bitcoin’s next major move as it navigates through high volatility and shifting market sentiment.

Bitcoin Consolidates As Institutional Interest Grows

Bitcoin remains in a consolidation phase, trading between crucial demand around $90K and strong supply near all-time highs. Market performance continues to be shaped by ongoing trade war fears, adding volatility to BTC’s price action. Despite this uncertainty, institutional demand remains strong, suggesting that Bitcoin’s long-term trend is still bullish.

Top analyst Axel Adler shared key on-chain data on X, highlighting the Bitcoin Coinbase Flow Pulse. This metric tracks BTC inflows and outflows to and from Coinbase across all exchanges, offering insight into supply and demand dynamics, particularly among major U.S. players. Adler’s analysis shows that Bitcoin is currently in a bullish phase, largely driven by institutional accumulation.

Go to Source to See Full Article

Author: Sebastian Villafuerte