Bitcoin is flashing strong technical signals, forming both a cup-and-handle and a bullish flag pattern that suggest a potential surge to new all-time highs.

Bitcoin (BTC) has been stuck at the significant resistance level of $107,000 for the past three days. It has jumped by nearly 10% from its lowest point this week.

What’s fueling the latest rally?

U.S. spot Bitcoin ETFs drew $2.2 billion in inflows this week alone—the third consecutive week of net additions. According to SoSoValue data, which represents a substantial increase from the $1.02 billion Wall Street investors accumulated last week.

These ETFs have had net inflows of $4.5 billion this month, down from $5.2 billion in May and $2.9 billion in April. They have had cumulative inflows of $48.87 billion, meaning that the figure could cross the $50 billion milestone in July.

With supply on exchanges at its lowest since 2017, market momentum appears to favor the bulls, setting the stage for a possible breakout above the $111,900 peak.

Bitcoin chart analysis

BlackRock’s IBIT leads the charge. The ETF added over $52 billion in assets. It now holds $74.5 billion, making it one of the biggest ETFs in the U.S. Fidelity’s FBTC has $12 billion in inflows and now has $21.5 billion in assets.

The soaring Bitcoin demand is happening at a time when the supply on exchanges has continued falling. Santiment data shows that there are 1.21 million coins on exchanges, its lowest level since December 2017.

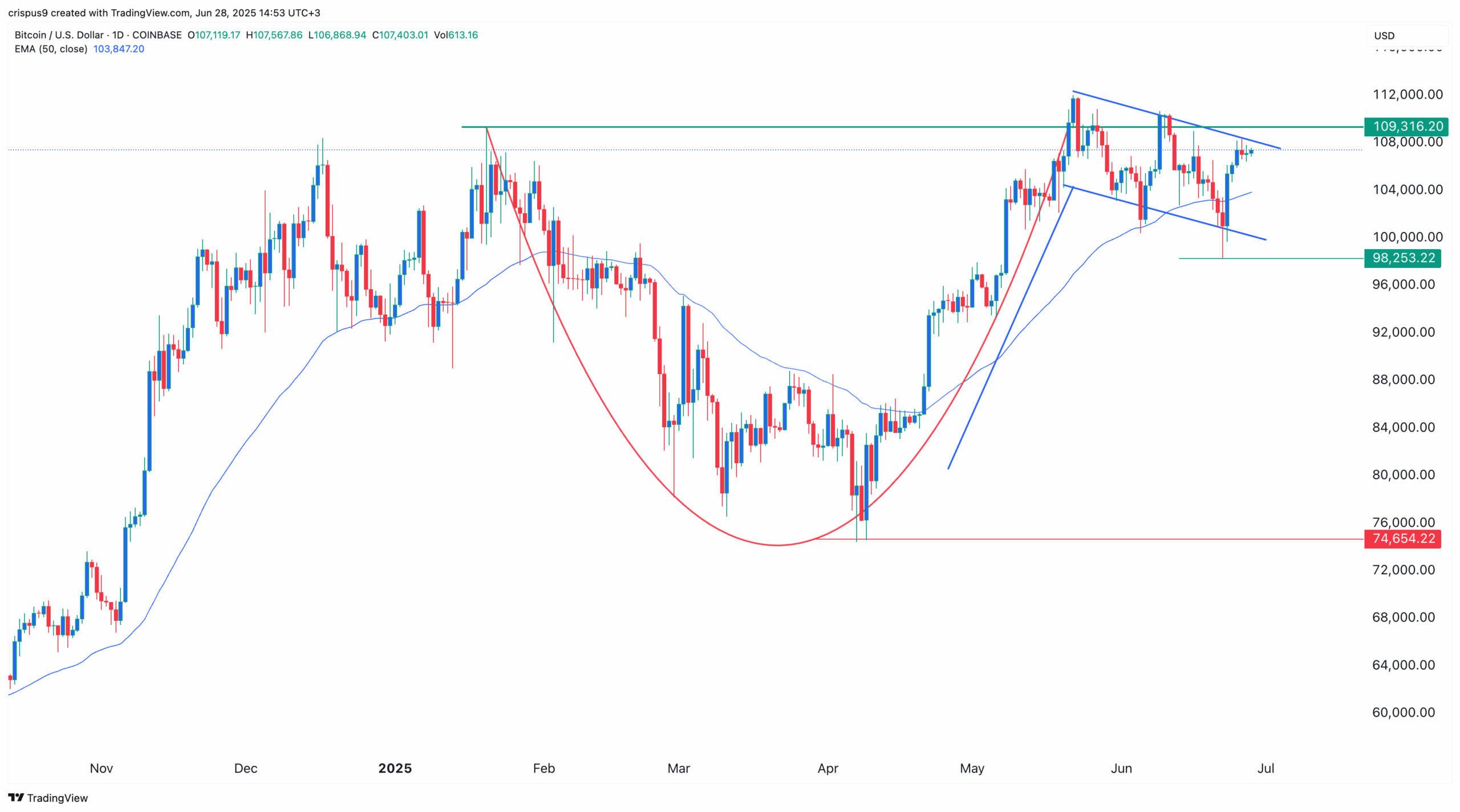

The daily chart indicates that Bitcoin has rebounded over the past few days, rising from a low of $98,253 to $107,400. It remains above the 50-day and 100-day Exponential Moving Averages, a sign that bulls are in control.

Bitcoin has formed a bullish flag pattern, one of the most positive signs in technical analysis. This pattern comprises a vertica

Go to Source to See Full Article

Author: Crispus Nyaga