Despite Bitcoin’s (BTC) price increase in the last 24 hours, key market indicators are flashing caution, suggesting that the coin may face significant hurdles in reaching the $70,000 mark. This development is contrary to the expectations investors have about the coin this month.

Though Bitcoin’s price has surpassed the $63,000 level again, this analysis discloses the reasons why investors should take these warning signs seriously.

On-Chain Metrics Flash Warning Signs for Bitcoin

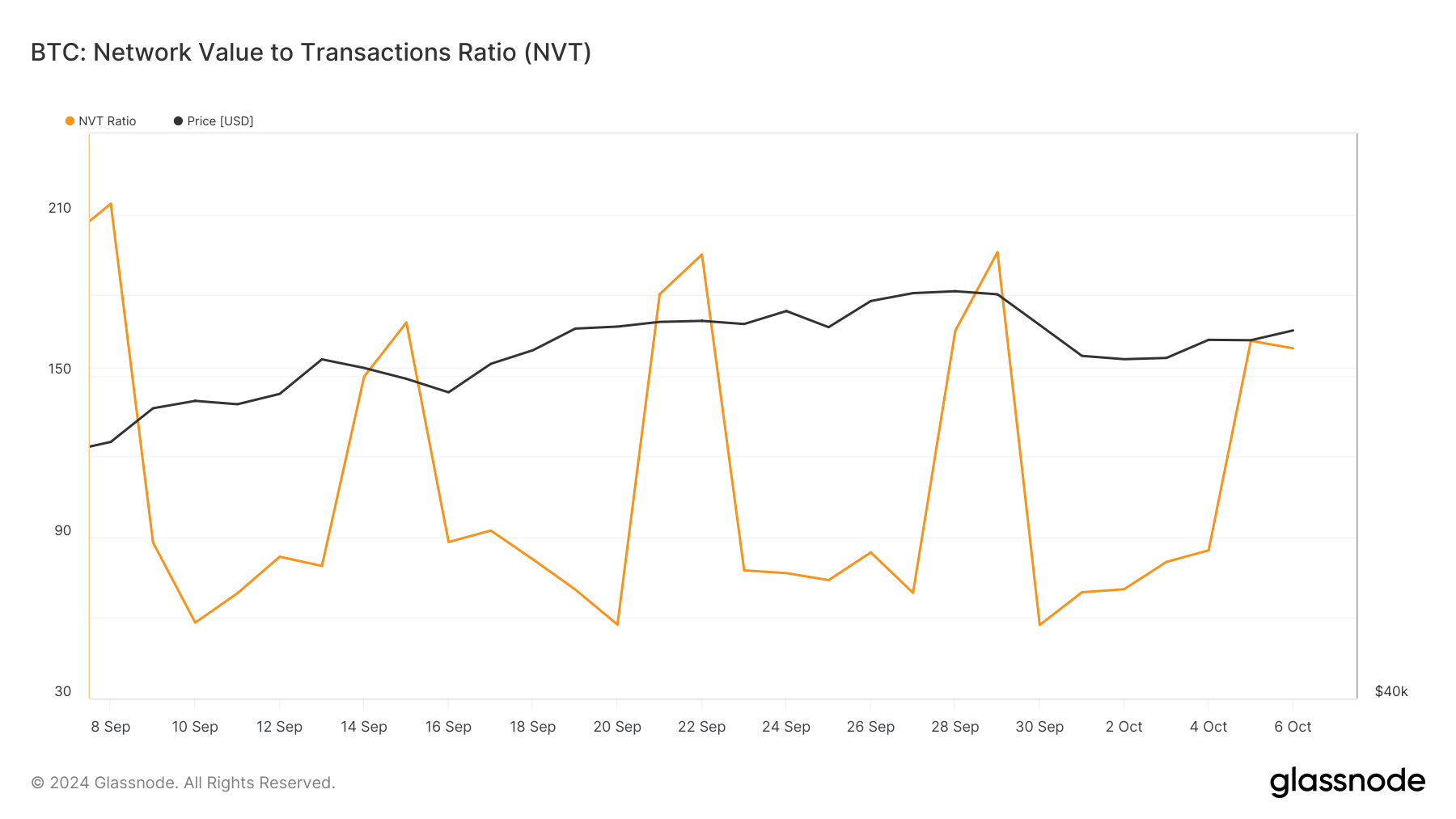

One key metric supporting a Bitcoin price retracement is the Network Value to Transactions (NVT) ratio. The NVT ratio shows if the market cap is growing faster than a cryptocurrency’s transaction volume.

When the NVT ratio decreases, transaction volume is growing higher than the market cap. In most cases, this is bullish for the price. On the other hand, a rising NVTV ratio indicates that the Bitcoin network is overhead as the market cap outpaces the volume.

As of this writing, Glassnode data shows that the ratio has increased recently. This suggests potential overvaluation, indicating a possible short-term Bitcoin price correction.

Read more: 5 Best Platforms To Buy Bitcoin Mining Stocks After 2024 Halving

Go to Source to See Full Article

Author: Victor Olanrewaju