In the last 24 hours, Bitcoin miners dumped over 1400 BTC for $41.2 million. This abrupt movement has captured the attention of market enthusiasts, who observed that the action further increased the selling pressure in the market.

Ali Martinez, BeInCrypto’s Global Head of News, citing data from CryptoQuant, confirmed the steep decline in miners’ reserves during the reporting period.

Increased Sell Pressure Keeps BTC Under $30,000

Bitcoin miners’ sudden sell-off has increased the selling pressure on the flagship digital asset that has mostly traded under $30,000 for the past 30 days.

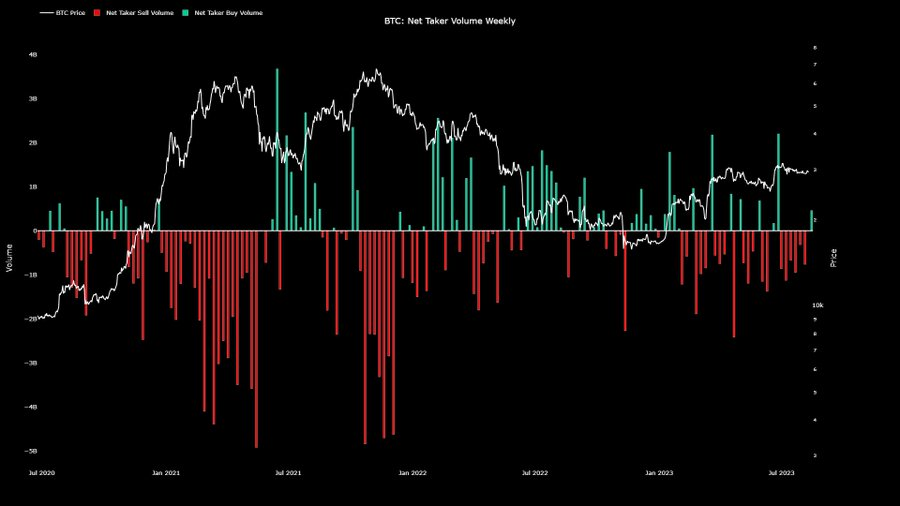

Crypto analyst Maartun validated this theory, pointing out that BTC’s sell-taker volume significantly outperformed taker buyers. He added that this was why BTC’s price was still under $30,000.

After a rapid rise at the start of the year, the Bitcoin price movement has been tepid at best recently, with the asset usually retreating anytime it crosses the $30,000 level. The asset has consolidated at around $29,000 for several weeks, barely budging despite the various events.

BeInCrypto previously reported that Bitcoin volatility is near its lowest level in the last two years. This was confirmed by prominent blockchain analytical f

Go to Source to See Full Article

Author: Oluwapelumi Adejumo