The United States arm of global crypto exchange Binance has been facing challenges in establishing a new bank partner to serve as a fiat on-ramp and off-ramps for its clients in the country, according to a Wall Street Journal report on April 8.

The recent failures of Silvergate and Signature Bank left Binance.US without banking services, depending on middleman’s banks to store funds on its behalf, according to the WSJ, citing “people familiar with the matter”.

The regulatory crackdown on banks with crypto clients is also another factor contributing to the exchange’s struggles. In March, the U.S. Commodity Futures Trading Commission (CFTC) sued Binance Holdings and its CEO Changpeng “CZ” Zhao for allegedly trading violations. The cryptocurrency exchange has been the focus of a CFTC investigation since 2021.

Related: Binance CEO CZ rejects allegations of market manipulation

Binance.US needs a bank to directly hold its client’s US dollars, but recent attempts to establish direct banking relationships with banks, such as Cross River Bank and Customers Bancorp, have failed.

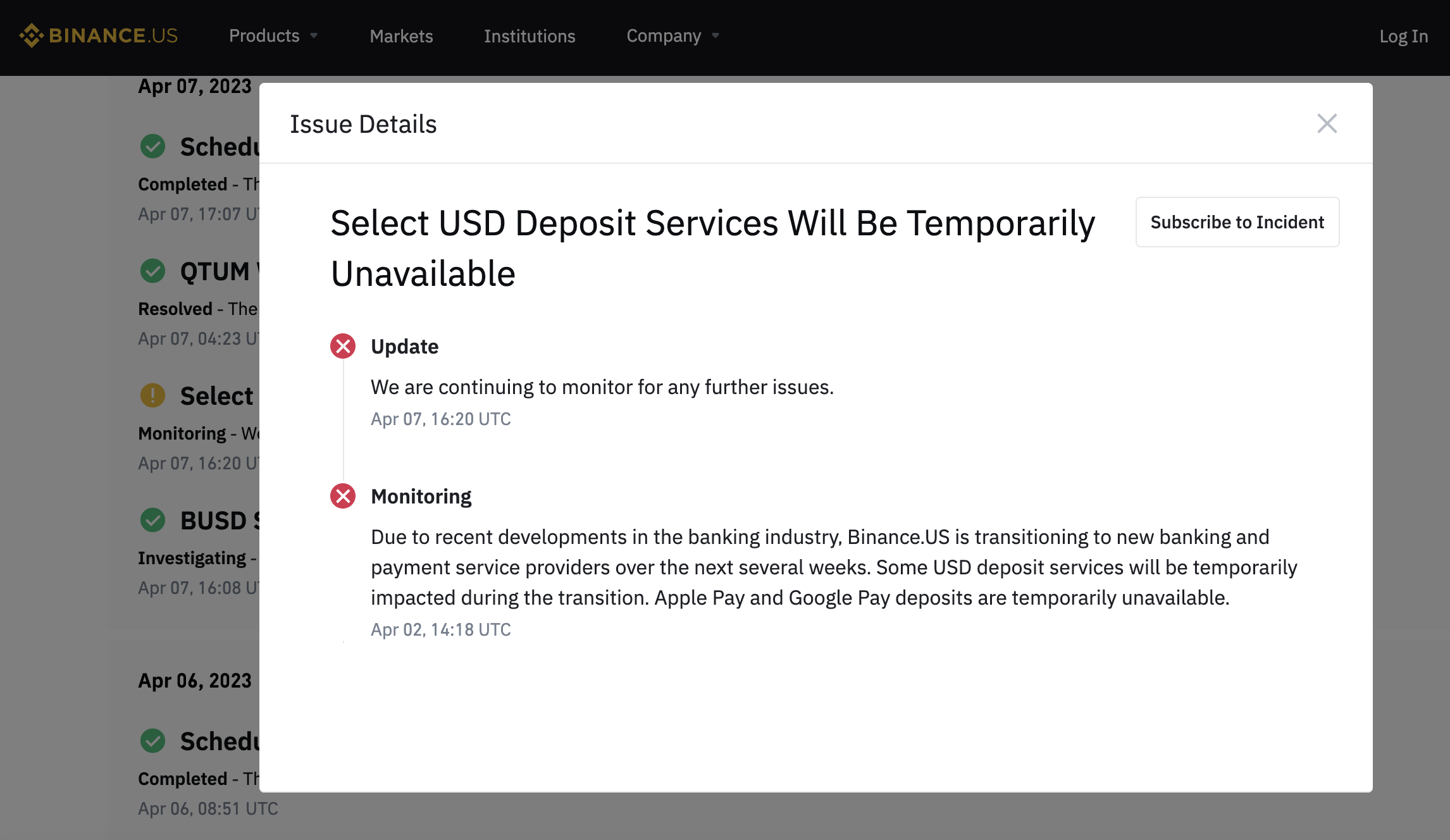

Binance.US customers have been affected by the lack of a direct bank. In a recent status update, the exchange said that it “was transitioning to new banking and payment service providers over the next several weeks,” adding that some USD deposit services would be temporarily impacted during the transition.

Go to Source to See Full Article

Author: Ana Paula Pereira