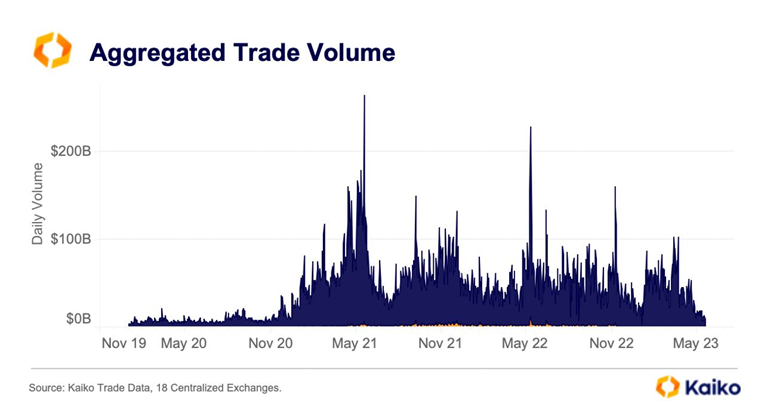

Crypto trading volume on exchanges hit a low not seen since October 2020, according to data from Kaiko. Experts point to the banking crisis and a hostile regulatory environment in the United States as key factors.

Data from Kaiko, tracking 18 centralized crypto exchanges, shows daily crypto trading volumes are at $5 billion, the lowest levels since 2020. Many view the recent crackdowns and regulatory uncertainty by the US Securities and Exchange Commission (SEC) as a driving force behind the decline.

Crypto Trading Volume Drops Significantly

Trading volume on crypto exchanges refers to the total number of digital assets bought and sold. It is the most common metric for assessing an exchange’s size and popularity.

In both cases, the general trend for this year is downward. Experts generally point to regulatory action in the US as one key explanation. However, there is no clear consensus.

Danny Oyekan, the founder and CEO of digital asset exchange Blockfinex, told BeInCrypto that this year’s banking crisis might be playing a role.

“Trading volumes are actually doing quite well in the Middle East and Asia—it’s in the US and Canada where they’re lagging. It seems as though exchanges in the US are struggling to access the banking services they need in the wake of heightened regulatory scrutiny and with virtually no progress toward clear regulation.”