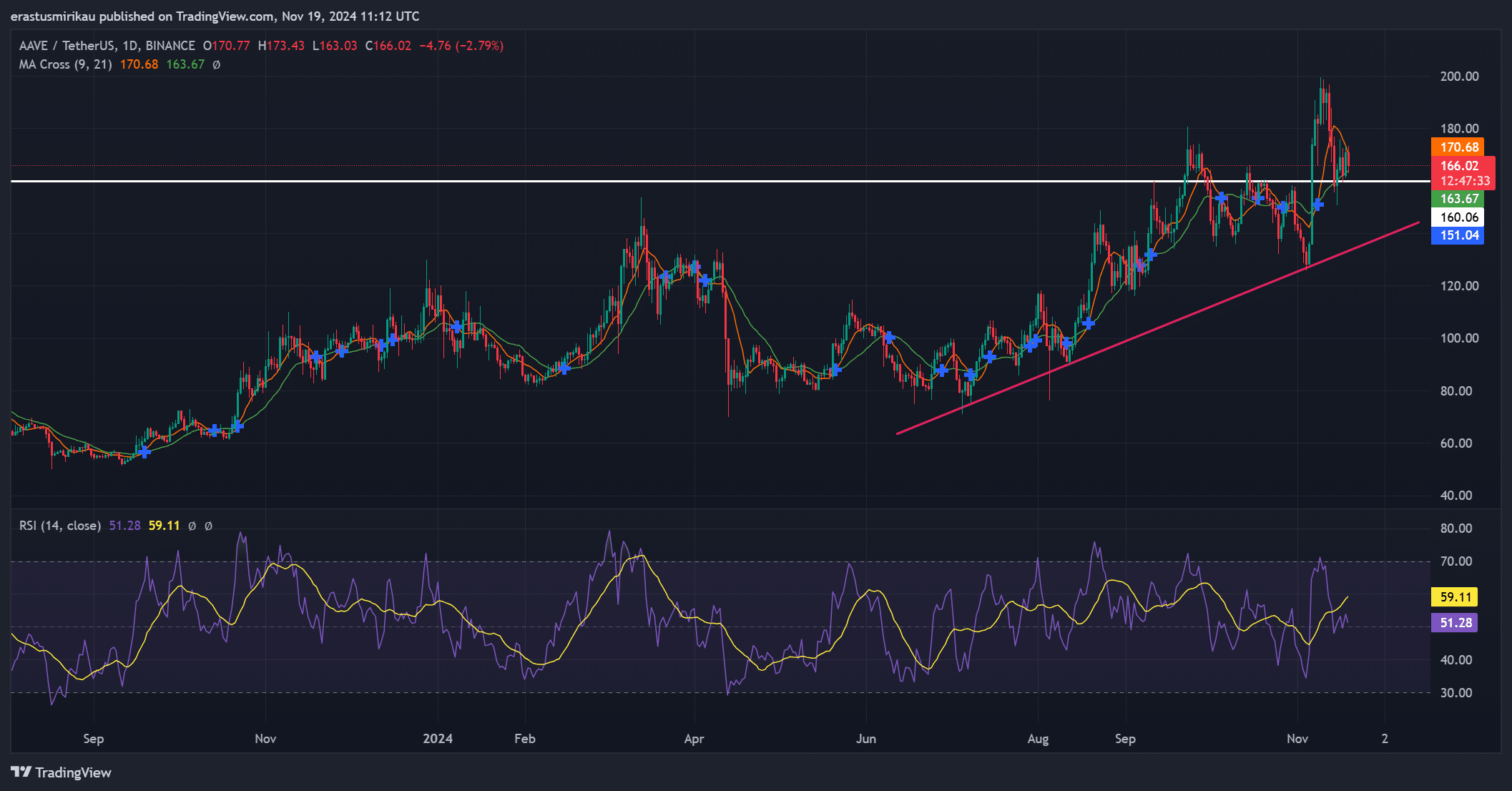

- AAVE’s retest of $170 resistance and neutral RSI signaled cautious optimism for a breakout.

- Rising transactions and dominant long liquidations reflected strong trader confidence and network growth.

Aave [AAVE] has been the talk of the DeFi sector as institutional confidence grows, highlighted by BlockTower Capital’s recent acquisition of 15,580 tokens.

At $166.09, down 2.50% at press time, AAVE’s recent correction tests whether this institutional vote of confidence can translate into sustained price growth.

With over $25 billion in deposits, the platform is increasingly solidifying its place as a DeFi leader. However, key technical and on-chain signals will determine if this momentum can push the token to new highs.

What AAVE’s resistance means

The price has consistently retested the $170.68 resistance level, closely aligning with its 9-day and 21-day moving averages.

Interestingly, a bearish crossover has formed between these moving averages, suggesting that bullish momentum has slowed. Traders are now closely watching this level to determine AAVE’s next direction.

Moreover, the Relative Strength Index (RSI) was 51.28 at press time, indicating a neutral trend. While the token is not yet in oversold territory, RSI readings closer to 60 could confirm a bullish rebound.

Until then, AAVE appeared to be trading cautiously near this critical resistance, and the next few days will likely confirm whether a breakout is imminent.

Source: TradingView

Transaction growth signals steady adoption

The on-chain activity offers more clarity on its potential. With a 1.03% increase in the transaction count over the past 24 hours, the network has reached 3,060 transactions.

This steady growth in activity reinforces the narrative of rising user engagement and adoption.

Additionally, the sustained transaction count suggests confidence in AAVE’s ecosystem, even amid market corrections. Therefore, the network a

Go to Source to See Full Article

Author: Erastus Chami